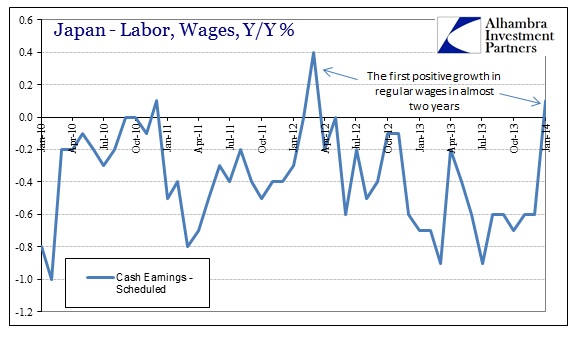

I suppose there is some cosmic and ultimately cruel irony to the fact that the new release of wage data in Japan happened today, April Fool’s Day. All the hopes that were pinned on last month’s positive reading in scheduled wages, the permanent income component, were flushed down the memory hole of statistical revisions. For a fleeting moment, Abenomics had something concrete, if incomplete, to add to its ledger.

This is not the first false alarm on the wage front. There was much rejoicing in December when the first release of scheduled wages for November showed zero. It may seem strange to celebrate nothing, but the soft bigotry of low expectations is ubiquitous under these economic conditions. As the Financial Times reported then:

Regular wages in Japan have halted a 17-month run of declines, in a sign that the private sector is beginning to heed the prime minister’s calls to pay staff more…

In November, however, scheduled earnings per worker were flat from a year earlier, according to government data released on Friday. Excluding the effects of the March 2011 earthquake, that matched the best result since April 2008.

That renowned zero has since been revised down to -0.6%, meaning the string of declines remained deeply unbroken. In its wake, however, the initial projections from January were a positively giddy +0.1%; an actual positive number.

When the Japanese government revised the figure for the February release, it had to have been a very tough pill to swallow for an economic program that will live or die based on exactly this factor.

And there is good reason to suspect that February’s estimate, already worse than January, will itself be revised lower due to a time imbalance in figuring wages for part time jobs (the culprit for these downward revisions). That can only add further unease to an already unsettled situation – though financial “markets” seem particularly poised for more QE.

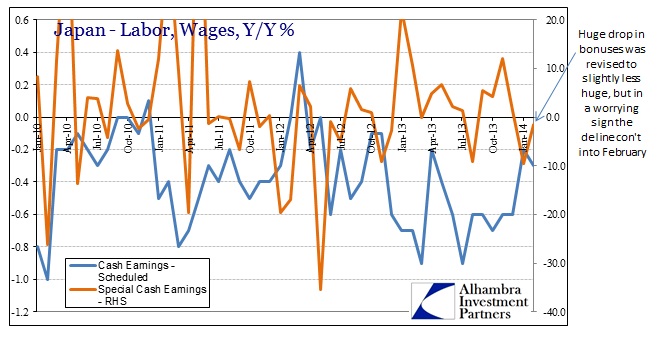

In addition to scheduled earnings, cash bonuses, the one segment of earned income which has kept Japan from being totally obliterated by “inflation” appeals, declined again in February after collapsing in January. Perhaps the silver lining here was that January’s drop in bonuses was revised from -14.5% to only -9.6%. Given that, however, it has to be further disheartening to see cash bonuses decline for a second month in a row (the first time that has happened since November-December 2012).

As we approach the tax increase, these figures more than suggest a deeper apprehension about economic affairs. As the FT pointed out back in December, wages are by and large paid through smaller businesses that aren’t subject to the “benefits” of yen devaluation.

But three-quarters of total salaries in Japan are paid by small and medium-sized businesses, which are mostly not unionised and where the recovery in profits has not been as strong. In particular, surveys of business sentiment at small non-manufacturers, heavily dependent on household spending, suggest a lot of nervousness over the tax hike.

I think the phrase “not been as strong” understates the point by more than a little, but it is made nonetheless. So we find, once again, commonality amongst the various and sundry versions of central bank interventions, whether QE or something different. Monetarism has a unique ability to concentrate any and all welfares into the largest participants. The redistribution of inflation, however defined, spins in only that direction. The big Japanese corporations are reveling in the yen devaluation of profits, responding by shipping jobs overseas and turning(ed) Japan proper into a corporatist vassal.

That has always been the cost of monetary intervention; it was simply hidden in previous versions and other geographies by the distillation of asset inflation and credit “booms.” Rarely is it laid so bare as it has been in Japan in the last year or eighteen months.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com