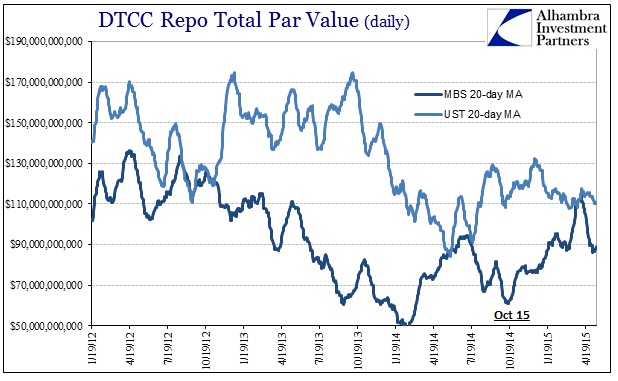

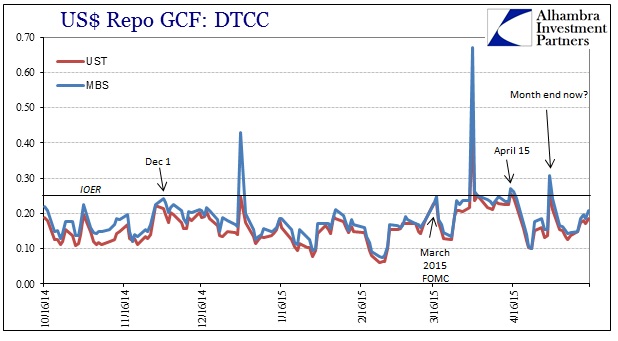

Repo rates ticked up again today as both agency and MBS GC rates remain over 20 bps. Volume has picked up also more recently, which may suggest more benign conditions overall the past almost two months are running their full course. Ever since May 1, volume in all three classes has been significantly greater than their drawn out averages, with MBS volume alone at or nearly at $100 billion three of the last four days.

It bears repeating that these rates and figures are provided by DTCC in what is actually reported, there is much of repo markets that remains one-off, bespoke that escapes all observation except by the bilateral parties engaged directly. Even with that deficiency in mind, I still think there is a direct link to repo of what we can see (and other funding indications) and more outward price projections including and especially UST – and specifically this last week or so.

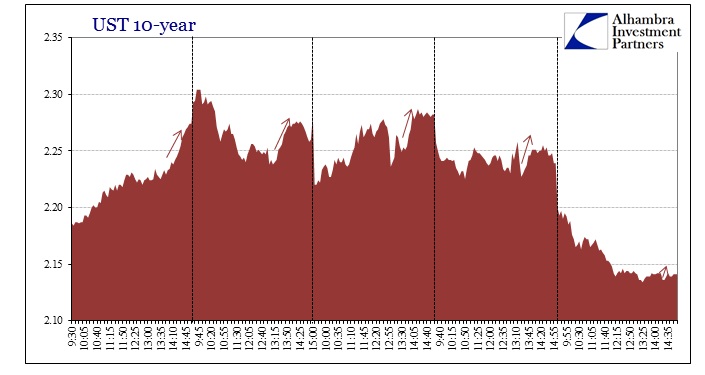

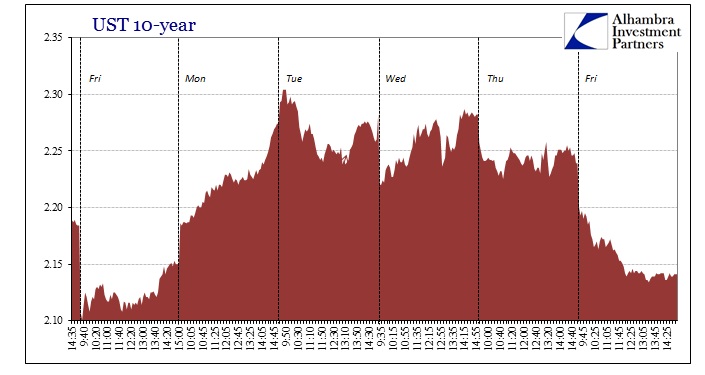

UST trading has been seriously volatile all week, some of which related to a curious repeat of a 13:30 selloff (or thereabouts). Even the more placid trading yesterday was still kind enough to project that regularity, though today’s version, amidst a far more sustained bid, was only a few pips in scale.

For all the trouble here, the treasury market essentially just round-tripped from last Friday. That is, I believe, the significance of the volatility as it was almost volatility for the sake of it – there is no clear direction or defined regimen detectable in any of this. I mentioned earlier that there are surely some German bund nerves working their way through here, but overall this smells of funding markets.

This lack of determined conviction itself seems more of an intermediate concern coupled with that short-term funding condition. In other words, I think the credit markets are pretty well resigned that the FOMC has been pushed off their intentions of raising rates by a serious economic interruption. At least that seems to be the initial hopes as for what is taking place; that it may only be a temporary, if still large and deep, dislocation that may yet avoid full recession. The response may or may not be for QE5, but clearly credit participants are at least thinking (hedging) in that direction (both TIPS and swaps, especially longer and benchmark).

So there is a tug between two polar positions, the urge for liquidity (buying UST) and the hope that brings another QE and one that might work (along with time). The latter position may be more meaningful especially among those that still view QE somewhat favorably, as there is likely to be speculation that the economic predicament itself is timed to the end of the last QE (and therefore returning to another one might “right the ship”). While there is a mountain of evidence that says this “slump” is of its own accord, QE or not, in terms of credit market hope and perception that positive belief may hold until conclusively and excruciatingly disproven on all accounts; thus the urge to sell and steepen.

I think that shapes the credit markets that are in this sort of limbo, not sure what to do or to make a trade with full conviction until pressed toward one side or the other. Of course, all of this is made that much more difficult by the policy environment itself which has pushed interest rates everywhere so low as to be fundamentally revolting. Buying UST’s right now is not an investment but rather a trade on relative conditions which are now more difficult than ever to project as a cohesive trend.

Given the shape of wholesale liquidity, I tend to still believe that side “wins” out and that rates will go lower before they ever get higher. That is not a posture based on denying any bond bubble, only recognition that certain bubble and economic dangers elsewhere may at times take precedence. In other words, liquidity is still the primary factor, a frustrating and damning condition almost eight years on, and that will tend to heavily favor financial factors on UST buying, again unanchored by fundamental value. And, if repo volumes arise once again, there is that always-present collateral imbalance to factor.

In any case, it’s all quite the mess without much prospect for clean resolution. These kinds of binary outcomes are entirely too dangerous for what these “markets” are supposed to represent. No wonder the economy doesn’t recover, it’s as if money decisions, of which benchmark risk pricing should be stable and involved, are being soured and spoiled by the still-persistent domination of pure finance.