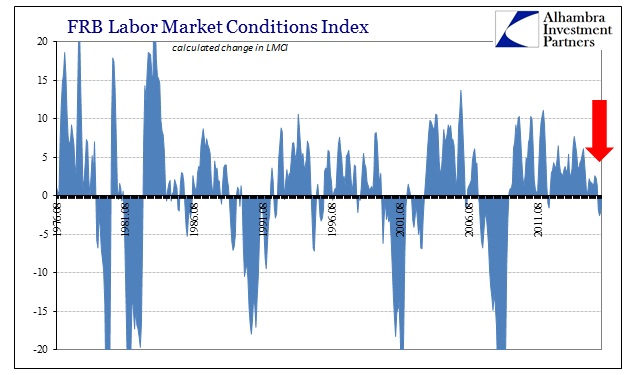

If the Fed is data dependent in its monetary policy setting, then the current update for the labor market should keep them still inactive (or at least not raising the federal funds rate that nobody uses). While the main payroll report last Friday was disappointing, it remains largely irrelevant as does the unemployment rate in determining FOMC tendencies. We are told that the Committee has committed itself to a broader survey or measure of the labor market and it even came up with its own index to accomplish the task.

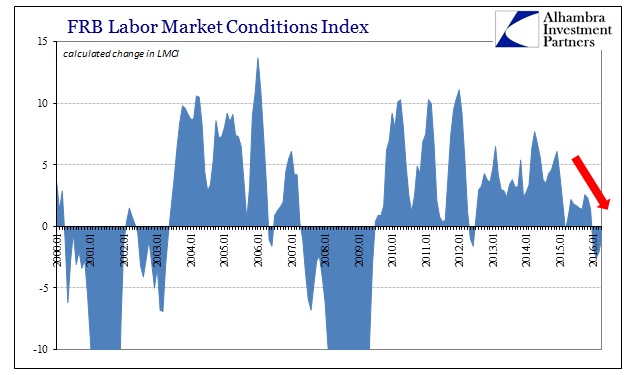

If they remain true to that word, then there is no way there will be rate hikes soon. The Fed’s Labor Market Conditions Index was negative for the fourth straight month in April. Though the change was only -0.9, slightly better than February and March, the index has not seen four consecutive contractions since 2009. Worse, the 6-month average turned negative for the first time this “cycle.”

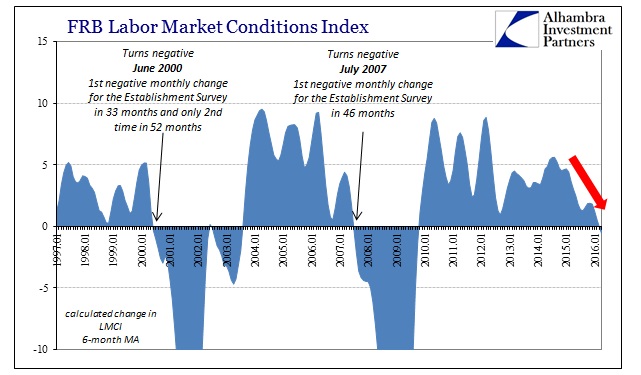

The six-month average may be most significant, however, as the last two times that this has occurred with respect to the downswing in each cycle turned out to be actual labor inflections. The prior shift in the 6-month LMCI average was July 2007. As of current Establishment Survey estimates, that was the first monthly decline in payrolls of what would become shortly thereafter the Great Recession. You have to go back forty-seven months before that, to the “jobless recovery” of 2003, to find a negative month in the Establishment Survey.

More importantly, after July 2007 there were only five more months of weakly positive estimates before giving way into full-blown and nasty recession.

The pattern is repeated in the dot-com cycle, as the 6-month average for the LMCI turned negative starting June 2000. That was also the first negative payroll print in almost three years before it, and only the second time that happened dating back to 1995. As 2007, there were only five more positive months before the Establishment Survey shows the full weight of the dot-com recession into 2001.

I want to be careful as to not make too much of this one index, especially since it isn’t that old and it is a rather considerable agglomeration of various inputs (and a factor model of them at that). Just as there is the possibility of heavy cyclical implications in comparison to the two months I highlighted, there are also numerous false positives where the 6-month average turned negative but without recession immediately following (they did cluster around obvious periods of weakness).

My point in comparing to those cyclical peaks is to only further erode any sympathy for the possibility that the Establishment Survey in 2016 is even close to recognizing just how precarious the real state of employment might be in this slowdown economy. Even though the headline figure for April was weaker than many would like it to have been, the LMCI adds weight to the idea that it perhaps should have been much weaker still. I think that might be the pertinent point in considering monetary policy for those that still do so, though like the unemployment rate I find the FOMC just as irrelevant. The LMCI is another addition to the growing catalog declaring it both in terms of what policymakers might do and more importantly how nothing they did do made any difference.