Most of what accounts for GDP is nothing but noise, leaving only a few major indications about what the economy is doing (or not doing). Prior to 2008, that wasn’t much of a problem as GDP by and large seemed to correlate well with other estimations of economic progress, and even our own intuitive perceptions.

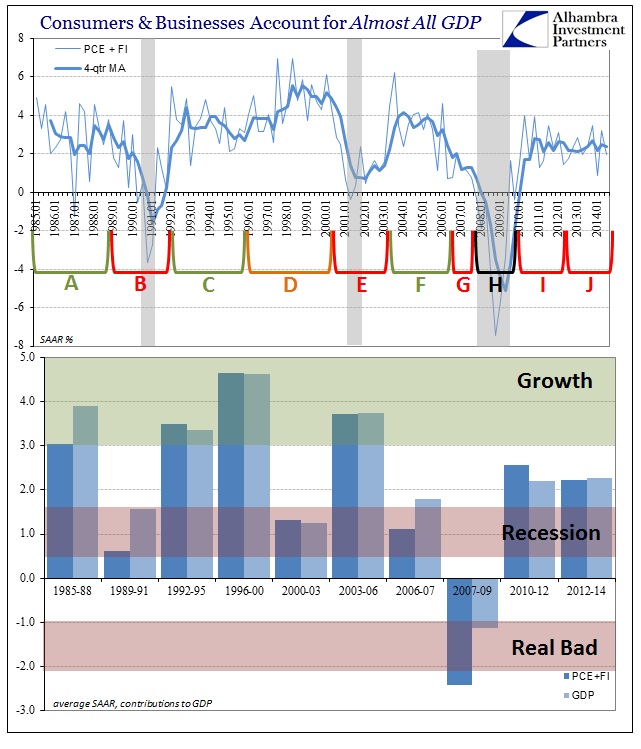

If you go back historically, almost all of GDP, on average, comes down to two components – Personal Consumption Expenditures (PCE) and Fixed Investment (FI). That makes a great deal of sense given that consumers and businesses are really what the economy is supposed to be about. What that means is that changes in inventory, exports (net) and especially government “spending” are largely transitory and likely account really to back changes in PCE and FI (over time). In fact, this relationship between GDP and those two components has actually strengthened in the past few decades as inventory cycles recede in terms of lingering economic impacts.

From 1947 until this last GDP report, PCE plus FI contributed, on average, 82.4% toward total “growth” (so far as the “dollar” value of all goods and services traded represents actual economic progress) The proportion increased to 88.4% since 1970, and 94.1% since 1990 (just-in-time inventory systems and a more permanent drag of imports canceling exports and government). In terms of specific cycles, the relationship is even closer in all parts except the recessions themselves (which accounts for much of the variation away from PCE and FI in the historical comparison).

That, too, makes intuitive sense given that inventory and government spending (the Keynesian idea of the “automatic stabilizer” that does nothing of the sort) increase variability of GDP during recession – but remain tied closely to the longer-term trends in PCE and FI.

That makes GDP in 2014 rather surreptitious like so many economic accounts of the past six or seven years. Temporarily, at least, in the quarterly figures GDP has diverged from PCE and FI meaning that it is likely at some point to converge toward that long-term average.

In the latest quarter, PCE and FI accounted for only 1.96% growth, for an average of just 2.0% in 2014. Over those same three quarters, GDP has averaged just 2.34% meaning that the more volatile swings, especially from Q1 to Q2, have largely been meaningless. What is left is an economic foundation stuck somewhere between recession and growth, but never achieving fully either one or the other (yet).

So the economic foundation, which will likely account for GDP trajectory at some point, remains in a state of deficiency. That is quite clear in the historical context going back to 1947.

GDP has been far more stable in this age of interest rate targeting, which was the intended trade-off of monetarism, “fill in troughs without shaving off peaks.” So orthodox economists expected that getting rid or 7-8% growth with more frequent recessions would be better under a regime of a more stable 4-5% range. That seemed to be what was taking place in the later 1980’s and throughout the 1990’s, except that those periods were marked by asset bubbles (and the foundation for true “secular stagnation”) meaning that growth was not at all stable, only artificially so.

Instead of that 4-5% range, we now see in the 2000’s a 2-4% range giving way to a truly bad recession and now only a 1.5-2.5% range. That is not stability in any way except the narrowest definition – instead, coming off such a huge and widespread downturn, 1.5-2.5% “stability” is the very definition of failure (violation of symmetry).

That explains a lot as to why GDP has diverged from intuitive expectations and perceptions, even in 2014. The longer-term basis for growth is severely curtailed, so either there is about to be a robust period of consumer spending and business capex or overall GDP will have to converge downward to PCE and FI. To that end, there isn’t much about PCE that suggests a coming boost (which we know from so many other and unrelated data points on retail sales and retailer revenues).

When you consider a drop in imports and inventory levels in Q3 compared to Q2 (the latter “contributing” to GDP), those are rather concerning signs about the state of “demand” domestically (no need to tell China, they already know). Then there is the actual trends in spending, especially this curious rut in nondurable goods (which usually precedes recessions).

Over on the capex side, there has been a clear slowdown in trend post-2012. Given that pre-2012 trajectory was insufficient on its own, that cements the idea that most businesses are still turning toward financial “investment” rather than productive capacity; perhaps doing so to even a greater degree now that the economy has been stuck at this low level.

As long as asset bubbles remain, especially in stocks, I highly doubt we will ever see a return to more historical levels of Fixed Investment.

The foundation for sustained economic growth, even as represented by GDP and its components, continues to underperform severely. As I have said on many occasions, this appearance of really low but steady growth is simply the new “cycle” pattern that is elongated as compared to prior growth/recession cycles. The longer this goes on the more likely of reaching the ultimate peak. That is why, I believe, there is a growing and palpable sense of urgency with monetary policy, in particular, to “get it right” and place all emphasis on recovery narratives (which ending Bernanke-isms counterintuitively accomplishes) deserved or not.