By now most people have given up on IBM. I don’t mean that they have dismissed the company as a dinosaur on its way to extinction but rather it has been pulled down from the Pantheon of bellwethers, no longer important in helping us determine the actual state of the US and global economy derived from actual results (rather than stochastic calculations of survey results). Revenue and profits have been sinking for so long now that it is easy to just see cloud computing and move on to something seemingly more relevant.

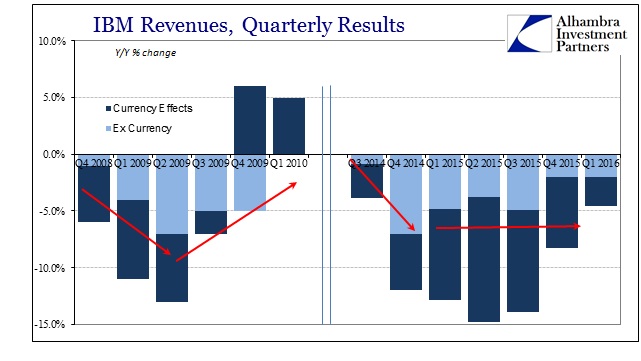

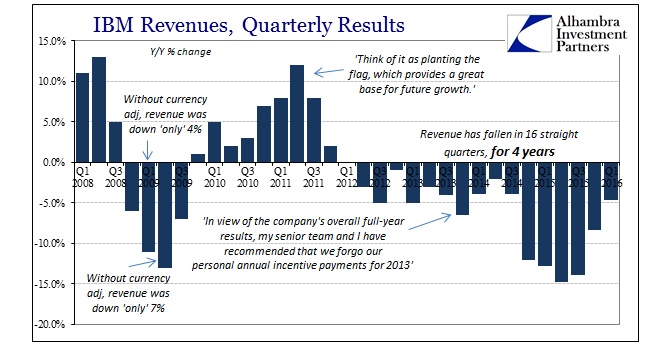

There is, of course, a great deal of truth in the accusation. The computing world has shifted and IBM was caught far out of alignment. The scale of that drift is simply astonishing; though the company reported revenue declined “only” 4.6% in Q1 2016, which was actually the best topline result in a year and a half, it doesn’t actually do the descent justice. Revenue in Q1 was 5% lower than Q1 2015, which was 13% below Q1 2014, which was 4% less than Q1 2013, which was 5% lower than Q1 2012. Sales have been contracting for a solid 16 straight quarters, four full years, which leaves the $18.7 billion in Q1 revenue as just about 25% less than Q1 2012. The firm has lost a quarter of its revenue.

Everyone will claim in 2016 that it was easy to see the cloud and software-as-a-service (SaaS) coming, but IBM’s posture in the middle of the recovery (so-called) in 2010 and 2011 belies that post hoc revision. In July 2011, reporting on a quarter in which IBM delivered 12% sales growth (with a good part of it due to the “falling dollar”), CFO Mark Loughridge confidently declared that there was only good fortune ahead – good fortune being delivered mainly through its traditional business lines (hardware/mainframes) as if the post-crisis era would be largely the same as the pre-crisis.

Our growth is broad based from a segment perspective as well. This quarter we had 24% growth in hardware with great performance in all system brands. These are high value offerings, not low in content. For example, we have 24 new mainframe customers in growth market countries, just since the introduction of the Z enterprise last year. Think of it as planting the flag which provides a great base for future growth.

What changed? There is a base alloy of sudden frugality in SaaS and business in general moving away from IBM’s bread and butter, and the timing of the switch just cannot be ignored. In other words, why was it in late 2011 and early 2012 that IBM’s customers suddenly lost so much interest in the more costly IBM solutions? That they turned toward cloud and SaaS is inarguable; there is still great relevance, I believe, in why that started when it started.

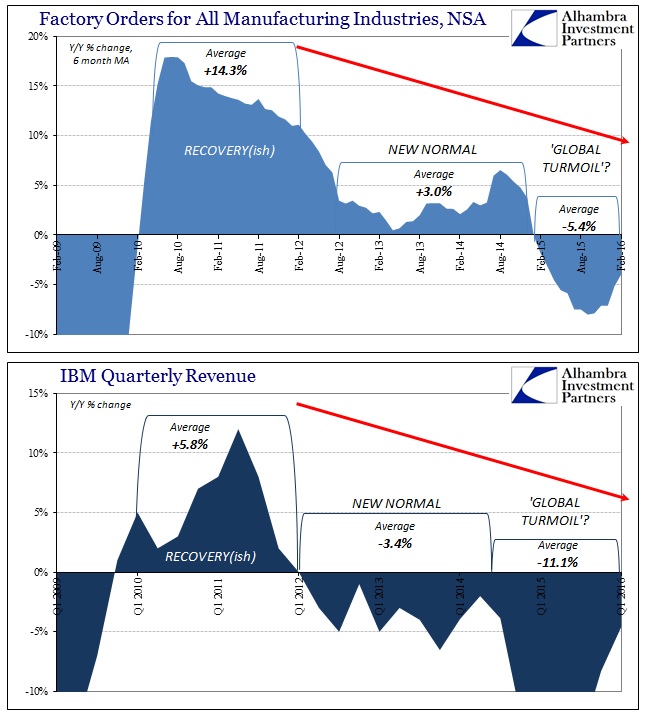

It cannot be mere coincidence that IBM’s quarter revenue exactly matches the same economic slowdown pattern that we find time and again in the full domestic manufacturing recession as well as all over the world. In fact, IBM’s misfortune during this forever stretching slowdown or cycle is very much consistent with its global action, as the company is as much multinational capex proxy. Revenue, for example, from its “growth markets” improved in Q1 to -3% which is actually a better result from the -4% taken from US sales.

This is a constant refrain in anything that suggests dire economic existence. Intel, for instance, just announced that it would layoff 12,000 workers, 11% of its entire workforce. It is not the global economy that is blamed but rather the shift to mobile computing. As IBM, there is undeniable truth in the charge, but then how do we explain Apple, who should be the main beneficiary of Intel’s stumble (and IBM’s to some degree), suddenly and sharply cutting back its own production in January?

Shares of Apple Inc. extended their descent on Wednesday [Jan 5], amid news that the company is scaling back orders for its iPhones…

A Chinese provincial capital promised Foxconn Technology Group—which assembles iPhones—more than $12 million in subsidies to minimize layoffs at its operations there, according to a government document.

China’s subsidies came after Foxconn began dismissing some workers there earlier than usual for the Chinese Lunar New Year break, according to people familiar with the manufacturer.

Component suppliers that rode the iPhone’s boom are now bracing for lower sales. Apple has cut its order forecasts to iPhone suppliers in the past several months, according to three people familiar with the company’s supply chain.

As if that weren’t enough to spoil the pretext, just last week it was reported that Apple intended to maintain its reduced production schedule for the April to June period, as well, citing “sluggish sales.” I fully realize that all of these are anecdotes and are thus wrapped in their own idiosyncrasies but at some point the common thread through all of it stands out. Yes, their industries are undergoing transformations but that doesn’t preclude the possibility of macro considerations playing a significant role. It is the same thing in retail, as analysts rush to explain away weak retailer results and forecasts as if online sales and that industry’s transformation were the sole factor in them, when instead we find that retail sales overall are still atrocious even when considering retail activity no matter where or how it occurs.

It is the weirdly shallow slope of this slowdown that has allowed these excuses to linger, but in each we find that as the baseline matter. IBM has shrunk for four years, an astounding achievement no matter how hard the company’s management has tried to dodge that fate. It only goes to show that this continuously dreadful economy is beyond most if not all capacity to avoid it. For Big Blue, the Great Recession was harsh but over with in a comparative flash of just four quarters; this is something altogether different and potentially far, far worse if I am right that IBM is a weakened, reduced but still relevant and global bellwether.