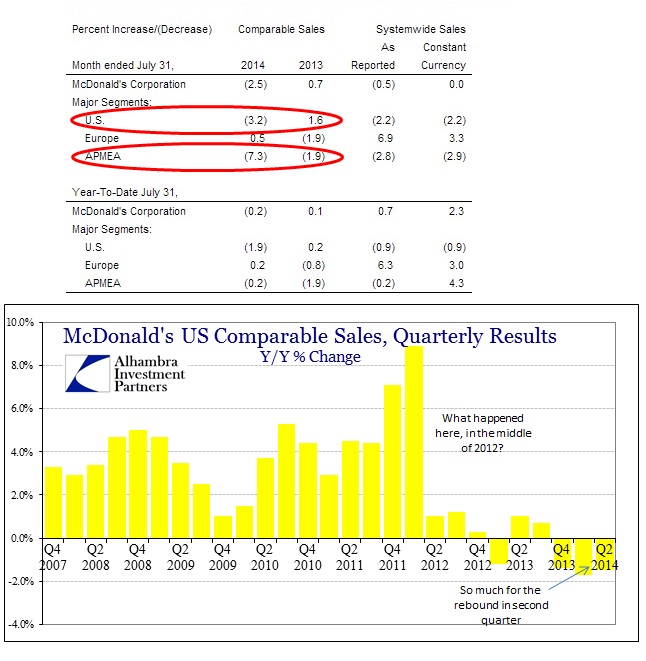

With a growing “meat” scandal in China and elsewhere in Asia, it was not unsurprising to see McDonald’s post a sizable decline in same store sales in the region. The latest figures from July show exactly that, posting a 7.3% decline over July 2013. That compared to a 1.9% decline last year from July 2012, so there is likely a lot of lost business in the company’s production problem.

But where the Asia-Pac region’s results were very much unsurprising, US comparable store sales in July fell by almost half as much as that of the Asian segment. Registering a striking -3.2% from July 2013, McDonalds American customers are either wary of similar “beef”, so flush with payroll gains as to have sworn off fast food, or can no longer marginally manage to pay for the dollar menu. The latest economic commentary would have you believe the middle option, but it’s not as if this is an outlier result – in fact, it fits almost perfectly in line with the prior trend.

I use the qualifier “almost” because in reality the trend in comparable sales is actually worsening into July, which suggests not a slow and steady erosion but a potentially renewed downward trend. Comparable sales for the entire second quarter were “only” down 1.5%, so to obtain a doubly negative rate to start the third is not a positive take on consumer spending for the vast majority of Americans.

Furthermore, despite the attribution of inventory and slowing “fiscal drag” on GDP, what McDonalds’ results show is a pretty good reflection of nondurable goods spending in the GDP accounts.

The rate of expansion in nondurable goods is about where you would expect it to be inside a recession, which would certainly describe at least what the golden arches are experiencing. That “reality” may be balanced somewhat by the further financialization of durable goods and the effect of that on the overall narrative, mostly autos, but that may not be as it seems either.

As with so many factors at this point we are left with what amounts to a binary interpretation. Again, either the economy is booming, and jobs with it, so much that people no longer “need” to eat cheaper fast food, or consumers are at the end of their tether to the point they can’t afford to.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com