While Abenomics continues to be classified as “pro-growth” rather than vilified for what it has done, that is as clear in the real economy as it is in the financial realm. Japanese experimentation with ZIRP has destroyed, effectively, any informational content from the JGB curve which contributes to continued resource waste. The Japanese just auctioned a 2-year note at a negative yield, as the nation continues to achieve these dubious milestones of global repute. Their 10-year has collapsed to barely 30 bps in yield.

These kinds of results are the death of “money” (using the term broadly here, certainly not specifically applicable as true money would prevent all of this). Is it any wonder that the one economy that has been totally disabled for a quarter of a century is ground zero for financial experimentation of the highest order? The death of money is the inevitable conclusion of this trend, and no economy will be able to survive it outside of long-term zombification dooming its people to stagnation and decay. Japanification is not a theory any longer.

Less far along on that trend are the Europeans. The economy is not as obviously in distress as it is in Japan, but it is acknowledged and nearly conventional wisdom that it is not far off from that woeful fate. And like Japan, Europe is awash in the death of money, perhaps even comically so given the state of finance there.

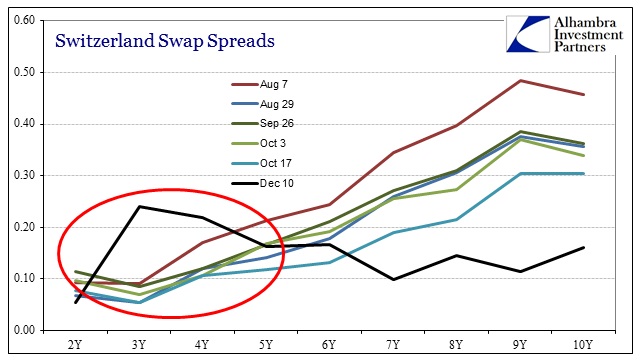

For a detached observer, there is nothing quite like the Swiss government bond “curve.” Of course, it ceased being a curve denoting anything fundamental of Swiss or even broader European economics a long time ago, but in the space of just four months it has been tortured and twisted into a thing unrecognizable to logical finance.

The latest iteration sees a bulge growing in the center while flattening out to the end and just plain disorder up front. It would be nice and neat if someone could make sense of that movement, including swap rates in the front years that are now deeply negative, but the truth is likely closer to just simple chaos. It seems pretty clear that the Swiss “markets” are just trying to deal with everything as it comes, which is accelerating in December (including, if you recall, a charge on interbank sight deposits that has had, seemingly, the opposite effect).

And to really put emphasis on the ad hoc nature of these “curves”, swap spreads in francs are so distorted now as to be conspicuously inverted in what can only be called utter confusion about what the Bank of Switzerland might do next after its latest failures to arrest contagion from European disorder.

As I said above, the Swiss curve was not one of “normalcy” even prior to the latest rebending to crisis, but this is just ridiculous in every sense and aspect of credit. It is, unfortunately, not alone in its tortured nature. Germany now sees negative yields out as far as 4-years; and with its long end threatening to join the Japanese experience.

While there remains smoothness in sharp contrast to the chaotic Swiss “curve”, the bund curve is no less dead to “normal” expressions about money and finance in Europe (and everywhere else as the global financial system is exactly that).

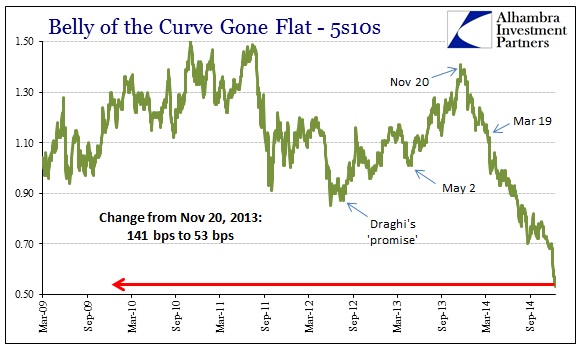

The media wants to talk about nothing but Greece, and only sheepishly since we are essentially right back to 2011 all over again. And that is precisely the problem, as in Japan. Nothing the ECB did actually worked at anything. Nothing.

There were massive LTRO’s, three separate sessions of covered bond purchases, an ABS program or two (depending on the semantics), and ceaseless intervention across interbank function. Through all of it, the European economy failed to recover and finance is a Frankenstein’s monster of almost indecipherable rabble.

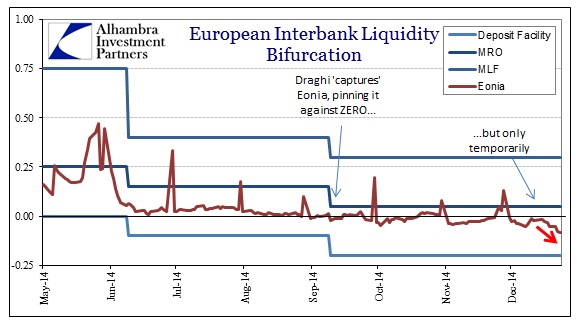

A primary case in point is the private interbank market for unsecured funding, denoted by Eonia. Since Eonia is unsecured, it should trade above the MRO midpoint (which is a repo rate) but hasn’t regularly since 2008. Instead, the ECB has shifted the entire rate corridor down toward Eonia as if to enforce “normalcy” in interbank operations (the continued negative spread to the MRO is an indication of ongoing and apparently semi-permanent fragmentation). That “required” the rate floor, the deposit rate, to achieve the world’s first nominally negative setting (beating out Japan this one time) in June.

That apparently wasn’t enough, so the ECB did it again three months later. At the time, it looked like Eonia had finally been pushed as low as it might get. Although that meant a negative nominal rate itself, it was only a few bps and trading more or less stable – which meant, in any fundamental sense, pretty much nothing but it made the ECB “feel” good about it.

The entire month of December has not seen a single Eonia fix above zero, only coming close on three occasions. Instead, like the Swiss and German curves, Eonia persists further into the death of money. Whatever Mario Draghi hoped to achieve by shifting the entire rate corridor lower has been, once more, a failure. The results of these constant interventions and countermeasures are financial indications that are no longer identifiable as anything other than obvious signs of malfunction.

The more “they” kill normal finance the more likely they will kill “their” own economy. While US economists dawdle about in undeserved confidence, that applies just as much to US credit. Substitute an effective repo rate (effective as in broadly applicable to capture as much unseen activity) and it will look worse than Eonia. And it’s not like US credit markets are showing robust expectations either.

No, there is a connectivity that escapes convention. The global credit markets are unified in their total revulsion of current conditions, a proper reflection of monetarism as a theory and how its distortions create the circumstances for nothing but continued and worsening function thereafter. The preponderance of screwed up finance and curves tells you everything you need to know about “unexpected” economic retrenching. Unfortunately, there is proportionality here as well, since the more screwed up these financial indications become the more we can expect the same about the economy.