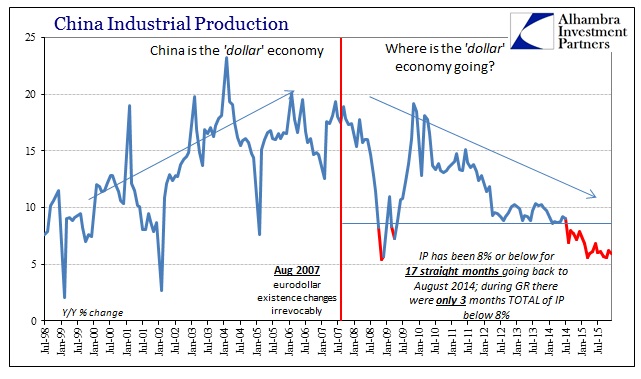

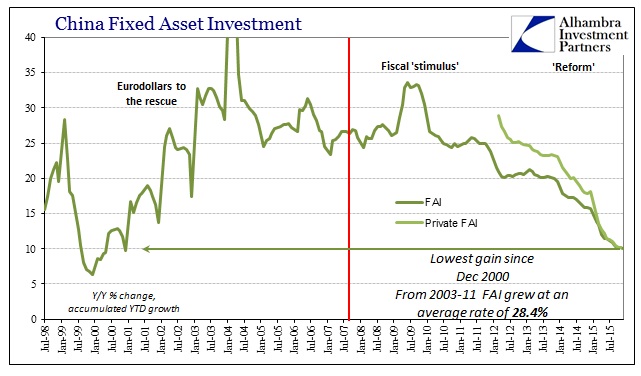

China’s economic update for December and Q4 were uniformly ugly. GDP fell to 6.8% and 6.9% for the full year. Industrial production was back below 6%, estimated at just 5.9% and once more denying all those that claimed November’s slight uptick was the start of renewal. Retail sales disappointed at 11.1%, down from 11.2% in November (no difference) while Fixed Asset Investment for the year was just 10%. There is nothing positive about any of these numbers because they signal, inarguably, that the same trend in place for four years now is still the dominant baseline.

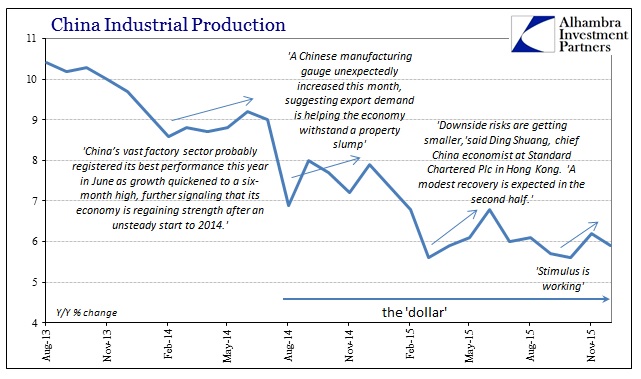

That point is remarkably clear, but no matter. Economists, in particular, have already started explaining why what you can plainly see of China’s economy isn’t. This comes about after having said, year after year, that there was no danger of a slowdown in the first place. Now, however, with China’s industry an admitted mess such is a good and positive factor. China is, supposedly, becoming a modern consumer economy, so, by extension, industry suddenly doesn’t matter as much.

The government released other economic metrics today that illustrate the split in China’s economy. Consumers keep rising as old industry declines. Retail sales and industrial production are heading in opposite directions. Retail sales growth reached 11.1% year over year in December, a tick less than last December, but sales continued rising faster than most of last year.

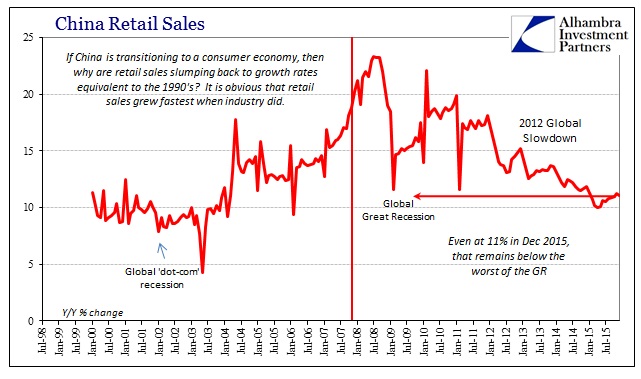

That entire passage is misleading, and obviously so. Retail sales in 2014 averaged just less than 12%, so 11.1% in December 2015 means nothing. For all of 2015, retail sales averaged just 10.6%, clearly slowing from 2014’s pace. But that wasn’t, again, anything surprising. Retail sales have been decelerating for years just as industrial production has. To say that “retail sales and industrial production are heading in opposite directions” just isn’t true in any meaningful sense.

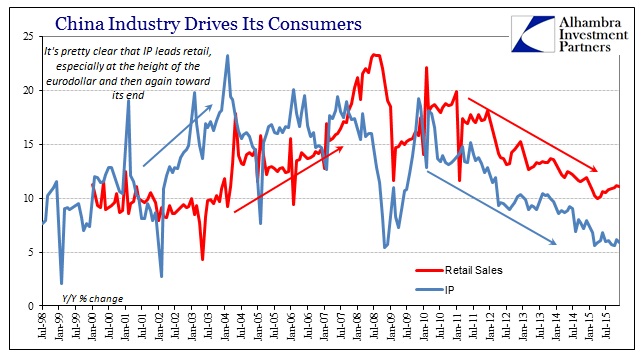

Retail sales in December 2015 were less than the worst of the Great Recession. After averaging 18.4% in 2010, Chinese retail sales averaged 17.1% in 2011 and then 14.2% in 2012. In other words, Chinese consumers are not diverging from China’s industrial track, they are all moving in the same direction if not exactly at the same time. Worse, for those who think China is transitioning to a consumer economy, industrial production clearly leads retail sales in this systemic baseline – both up and down. Even in the Great Recession itself, IP began collapsing in July 2008 while retail sales would not similarly adjust until that November (with the same lag in the recovery where IP started up months before retail and consumers).

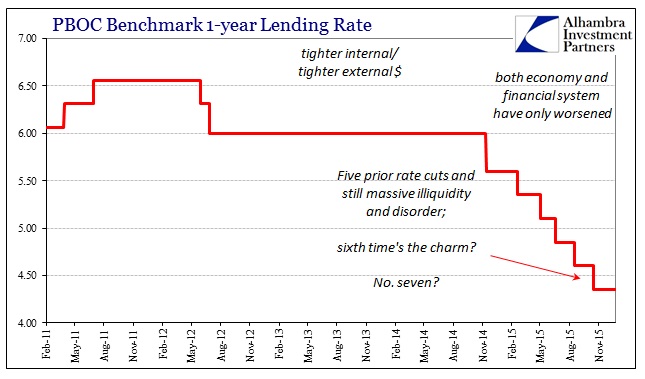

If there has been any divergence, it has been the past few months where retail sales have yet to get much worse while industrial production has. If that is the effect of monetary “stimulus” then it shows, once more, just how little effect “stimulus” has; it isn’t even noticeable in the chart above. Instead, no matter what the PBOC has done, the Chinese financial system has only worsened right alongside the country’s industry. It has been the case that China’s industrial capacity and activity are the driving force for the rest, and that clearly hasn’t changed at all in 2015 beginning to end.

All of which leaves but the central banks as a sort of last resort because the worse it gets the more new “stimulus” hope apparently matters. It’s an idea and correlation that makes absolutely no sense, but it is prevalent:

“While headline growth looks fine, the breakdown of the figures points to overall weakness in the economy,” said Zhou Hao, senior emerging markets economist for Asia at Commerzbank Singapore.

“All in all, we believe that China will experience a ‘bumpy landing’ in the coming year,” he said.

There was relief in the markets, however, that growth at least matched forecasts, and a growing expectation that more monetary easing measures were imminent, possibly before Lunar New Year holidays in early February.

The PBOC started its supposed rate cuts in November 2014, six of them so far to now, to no prevailing effect. Yet, more “stimulus” will suddenly make the difference? What has changed about “stimulus” in 2016 that will make it potent (after much damage, mind you) where all prior versions were not? The only way that sentiment makes any sense is if you simply wipe the slate clean after each monetary program fails to have any effect; starting over in expectations each time, forgetting or ignoring that there were any others. The world doesn’t work that way, but apparently enough people think it does so that they are continually surprised by these results.

In addition, the PBOC has written an unknown number of swaps and forwards in exchange markets, stamped out all volatility (maybe redundant) in CNY exchange for five months during 2015, rigged SHIBOR since September, required increasingly stringent “capital” flow mitigations, including the imposition of a dollar reserve on Chinese banks, tasked China’s banks to seriously blunt “speculators” offshore, all while dramatically adding to internal reverse repos and yuan liquidity offsets. Such “stimulus” has also produced nothing of the intended results, yielding only increasing disruption (economically as well as financially) and disorder. From an unbiased perspective, one that doesn’t just assume automatically that monetary “stimulus” is that, it might seem the correlation is at best slightly negative (the more the PBOC does, the worse it gets) for “stimulus.”

After four years of all that in enlarging doses, you might also get the sense that China’s problems are, indeed, intractable; bigger than China, and much more than the PBOC can ever truly handle. That point is all the more compelling after noting that this persistent downward trend in retail sales and industry together emerged after enormous, even biblical, “stimulus” that raged during and after the Great Recession. It, too, failed to stimulate except in the most fleeting and long-term destructive of fashions. In short, China’s downtrend now is the product of past stimulus failing, leaving any new “stimulus” as exclusively an attempt to try managing the decay.

The reason none of it works is enlighteningly simple – the global economy never recovered and increasingly it is being realized that it never will. The global economy that built China over the past few decades was in many ways a monetary illusion of the eurodollar system. That system became inoperable in August 2007 and apart from the short burst of hope in late 2009/early 2010 it has largely remained that way. That has had the effect of locking the global economy on a slow, at first, downward spiral toward achieving an inevitable systemic reset. It is in that context that “stimulus”, monetary or fiscal, is fully appreciated for what it truly is. There aren’t any surprises here except the increasingly distressed methods of coping and denial.