We got a small and unexpected uptick in the number of unemployment insurance claims this week—so naturally the Wall Street gamblers have been piling into the “risk-on” bandwagon. In the great scheme of things with respect to the actual main street economy, of course, Thursday’s figure at 231,000 initial claims was pure noise, and if anything should have been a slight discouragement to stock buying.

But not in Fed World. A tiny trace indication of labor market weakening was taken as a sign that the long-delayed Fed pivot to rate cutting is finally going to materialize!

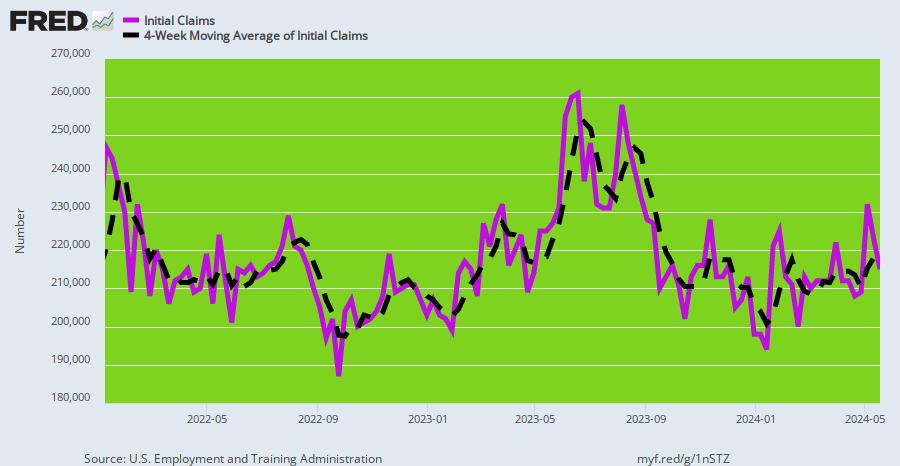

And we do mean “trace”. The dotted black line indicates the four-week moving average of new claims, which has been oscillating tightly around 215,000 for the last two and one-half years. And it hasn’t moved at all in recent months. Yet the slight spurt in the weekly figure (purple line) for the first week of May was all it took for the entitled gamblers down in the canyons of Wall Street to conclude that once again they have the denizens of the Eccles Building by the short hairs.

Stated differently, the stock market is so house-trained to drool over any and all Fed actions that even the slightest hint of economic weakness becomes a trigger for the fast money to start front-running the Fed’s next capitulation to the Wall Street gamblers. So if any proof is needed that honest price discovery is dead, this week’s action surely fills the bill.

Initial Unemployment Insurance Claims, Weekly and Four-Week Moving Average, January 2022 to May 2024

Needless to say, what passes for central banking today is really a perverse form of Wall Street-pleasing monetary manipulation. It employs the vocabulary of central banking, but in practice it fundamentally undermines main street prosperity, even as it showers the 1% with unspeakable financial windfalls.

Stated differently, virtually everything the Fed does for the alleged benefit of the American economy is both unnecessary and a ruse. The Fed has actually become a captive of the Wall Street traders, gamblers and high rollers, and functions mainly at their behest. Not surprisingly, therefore, today’s Federal Reserve is a huge roadblock to restoring fiscal sanity, financial sustainability and middle-class prosperity in America.

The proof of this proposition starts with startling historical fact that the post-war US economy did just fine without any interest rate targeting, heavy-duty bond-buying or general macroeconomic management help from the Fed at all. For all practical purposes today’s omnipresent Fed domination of the financial and economic system was non-existent at that point in time.

We are referring to the full decade between Q4 1951 and Q3 1962 when the balance sheet of the Fed remained flat as a board at just $51 billion (black line). Yet the US economy did not gasp for lack of monetary oxygen. GDP grew from $356 billion to $609 billion or by 71% (purple line) during the period. That’s nominal growth of 5.1% per annum, and the majority of it represented real output gains, not inflation.