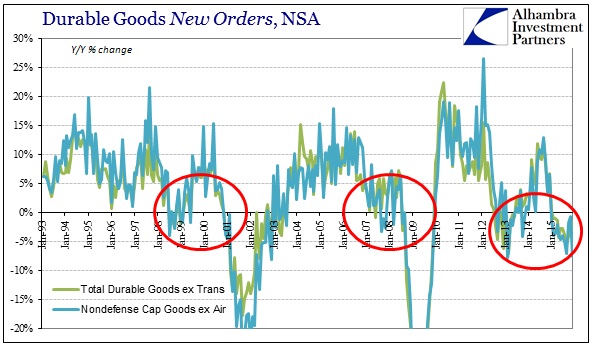

Durable goods orders and shipments declined much worse in December than November, ending any hope that November’s variation was anything other than simply that. Across-the-board, capital goods as well as durable goods, the numbers year-over-year were nearly flat for November, thus suggesting just how bad 2015 was overall when slightly negative seems like a huge improvement. So where capital goods orders had been -7.15% in September, but -1.8% and then -0.8% in October and November, respectively, December thumped everything back to recessionary reality; -7.69%. In durable goods orders (ex trans), what was -5.42% in September and -4.14% in October briefly turned to -0.91% in November before back down to -3.09% in December.

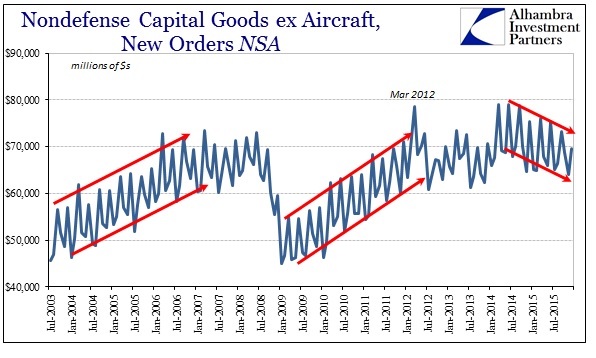

What is more troubling is that shipments though now persistently contracting, too, are doing so still at a noticeably lesser pace than orders; the 6-month average for capital goods orders is -4.41% vs. -1.75% for shipments. Forward-looking, then, this suggests only more cuts in production and activity to come.

The longer this contraction goes, the more it looks like slow recession even without any widespread or large-scale cutbacks as yet. Even in energy and oil production, the full fury of the oil crash is nowhere to be found; meaning it can only be lurking ahead. If durable goods already suggest recession tendencies without all that, it focuses attention on what the downside might be with all that. In other words, more still the adjustment phase than yet the cutback phase.

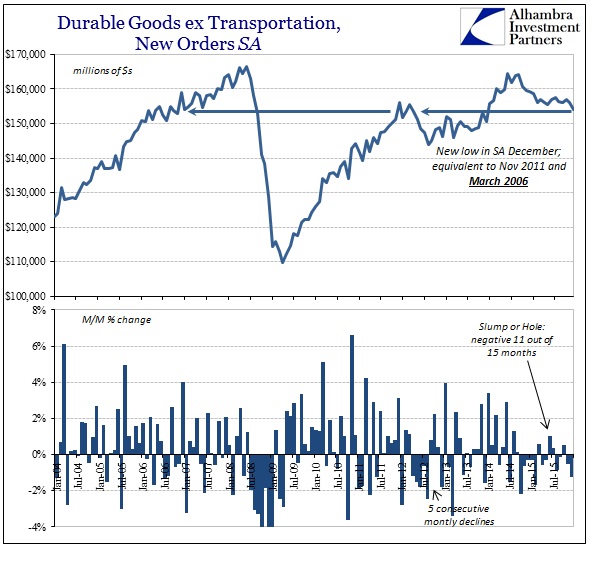

In seasonally-adjusted terms, durable goods fell a rather significant 1.2% month-over-month, the worst decline since February and confirming the negative interpretations for December. With seasonally-adjusted figures leaving little doubt as to the economic hole, too, we actually gain a better sense of where the economy is at this point. That includes the observation that this recovery never was anything close to that, as durable goods orders in December 2015 were equivalent with not just November 2011 but also March 2006! Almost ten years later and durable goods remain the same level? There is no way that can be anything other than structurally rotten economic support.

That decrepit and pitiful economic state, I believe, begins to answer why we could have recession-like conditions in 2015 without all the full and heavy recession tendencies that usually make it. This is attrition, pure and simple; a highly fragile state that is as much a factor of time as forward momentum. The longer the dead recovery strung out, the more likely it would simply start to reverse of its own kind of inertia. Economists surmise that recessions are caused by exogenous “shocks”, but under these circumstances such a negative impulse may not have been needed; or if it was, it needn’t have been very large.

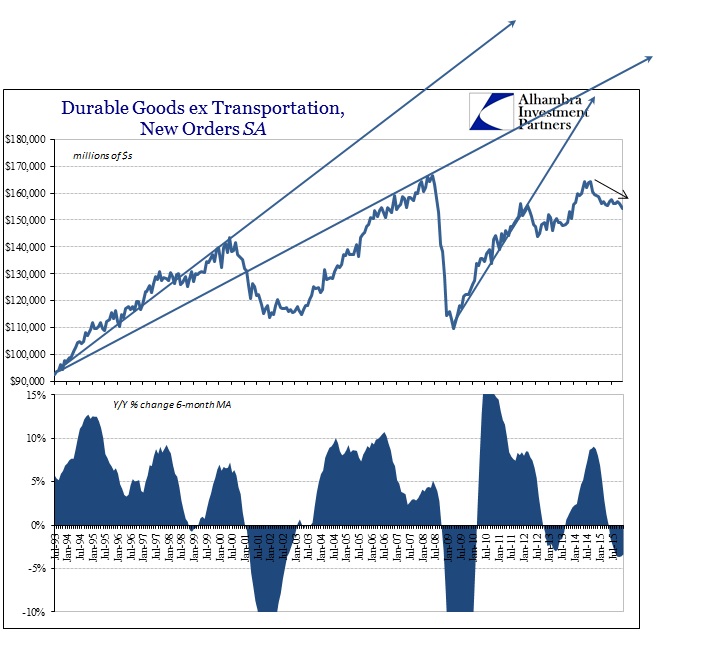

The timing clearly suggests the “rising dollar” which matches perceptions of this reversal. It makes sense within the context of attrition, too, as the “dollar” exchange rate holds little direct effect over US consumers but acts as at least a depressant in parts of the economy that would matter over time. Again, if the highly fragile economy needed only a small push to start its downslope, you can easily imagine the “dollar” providing it even if not in the most visible and direct fashion (such as firms more exposed to the “dollar’s” ill effects simply altering and adjusting a little their hiring rates or resource utilizations; especially if those were glossed over by overoptimistic employment statistics, for example).

Whatever ultimately the cause, the effects are again clear. The slope remains downward though not yet fully so. That is, however, still suggested.