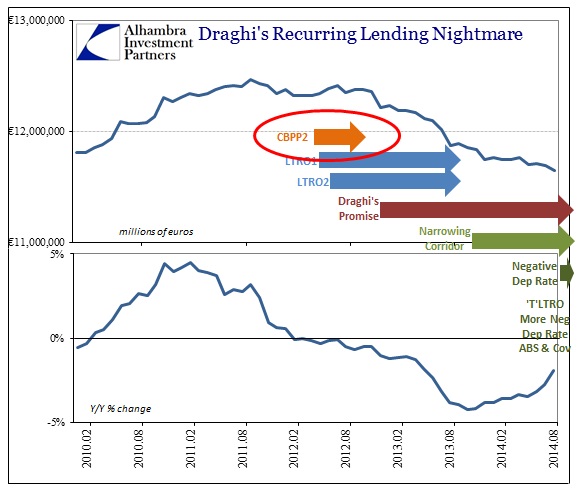

The reason I have been characterizing the ECB’s actions since this summer as “desperate” is entirely due to the fact they are simply redoing things and expecting everyone to simply assume they are acting anew. That may not be entirely the case with their obsession with Eonia (more on that below), but narrowing the corridor has been the active policy “stimulus” position since May 2013 – to no apparent imprint. That counts sadly of the latest scheme which is, again, a rerun.

Much excitement has been conjured over the covered bond purchase program, though we will see how much has been actually limited to just economists’ excitement, as this morning it was announced that the ECB had “injected” monetary something or other in two Spanish issues, one German and one French. The idea of covered bonds is to, as the Financial Times puts it, “revive lending in the eurozone and stave off a vicious bout of economic stagnation.”

As the quoted credentialed economist in that story makes plain, the threat of buying covered bonds has already narrowed spreads making it seem as if it were already working. However, if narrowed spreads were all that it took to engineer inflation and then a recovery from scratch, then Europe should have been swimming in more economy than it could actually handle by now. The entire period since late 2011 has been one giant spread compression regime, and it also corresponds to the largest, deepest and most sustained retrenchment in lending ever seen on that scale.

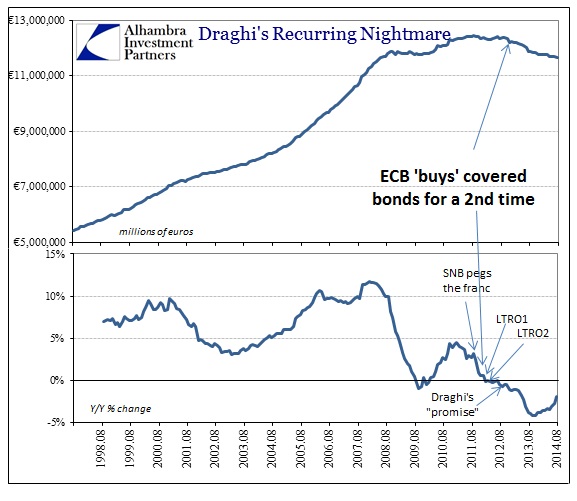

If you actually take the time to notice, at the beginning of all that spread management sits the CBPP2, undertaken in November 2011 during the worst days of the euro crisis. As the numerical qualifier at the end of that acronym signifies, that 2011 initiation was actually the second time the ECB had “bought” covered bonds, the first being started in 2009. So in the space of two covered bond “programs” lending has sunk to a state that looks like a depression.

In ending the CBPP2 on October 31, 2012, the ECB mentioned its expectations:

Today, the CBPP2 ends as scheduled. On 6 October 2011, the Governing Council of the European Central Bank (ECB) had decided on the CBPP2, the technical modalities of which were published on 3 November 2011. The purchases of covered bonds commenced in November 2011. The aim of the programme was to contribute (a) to easing funding conditions for credit institutions and enterprises and (b) to encouraging credit institutions to maintain and expand their lending to customers.

According to Eonia, the covered bond purchase did nothing of the sort in (a), and as you can see above lending has been shrinking without stop, meaning that (b) hasn’t been anywhere near implemented.

The full failure is more complicated than the simple world inhabited by orthodox economists that care only about the numerical value, in this case the spread of covered bond rates to some benchmark. The fact that a spread narrows may be comforting to the ECB, but what it might actually accomplish is something altogether more complex, and often quite contrary to that simplistic assessment. In 2012, all these liquidity and “stimulus” programs “freed” bank “capital” to be expended on PIIGS bonds rather than lending, a result that was never part of the monte carlo simulations run at the ECB (or at least far, far away from the “central tendency” of the modeled anticipations as to be ignored as “trivial”).

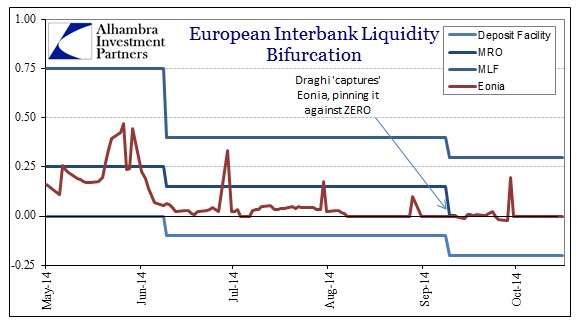

Indeed, as the Financial Times makes plain, two of the “beneficiaries” of the ECB’s renewed interest in covered bonds were the French bank behemoths BNP Paribas and Société Générale. Unless the European banking condition is in near-crisis pitch, I highly doubt selling covered bonds to the ECB is going to make any difference in those banks’ lending decisions. After all, judging by a persistently negative Eonia (stuck at right around -1bp) funding is not anywhere near the top concerns of the biggest banks.

What the ECB is left with are those nefarious “portfolio effects” on those banks, hoping against already-rendered empirical judgment that BNP Paribas and Société Générale will be “forced” to lend to some French business (or, don’t laugh, Spanish mortgages) because the ECB has given them an artificial profit on past lending (covered bonds are essentially bank liabilities with a recourse to a pool of mortgage loans still on-balance sheet; so BNP Paribas and Société Générale, if they are actually two of the counterparties, sold the ECB their own bonds collateralized by their own loans, a joy to be comprehended of the mockery of modern bank “capital”).

This is to say nothing about liquidity further down the line, though fingers are crossed in Brussels that something like that will take place. Again, as Eonia demonstrates, the largest banks have no problem in funding themselves, which includes any additional lending they may make. That is a condition that has been evident since 2012, yet lending has been eroding rather than expanding. So the covered bond purchase, in its third go around, makes no difference to ending the liquidity bifurcation that set in around 2008 nor does it change the balance of risk factors that these banks will lend into.

What we are left with is pure psychology, namely that the ECB simply hopes nobody will remember past attempts and simply “believe” in that it doing something for the sake of doing something is “stimulutive” – just as chasing Eonia to ZERO might offer some appearance of success in that the spread is forced to something more like “normal.” They probably should have just saved themselves the trouble and simply changed their webpage to include nothing but the statement “we have stimulated banks and the economy”, because for all that matters these latest maneuvers are exactly the same thing, spreads notwithstanding for a third time.

Like Janet Yellen has urged on several occasions, the implicit result is that private “markets” should not fret themselves over the details and simply embrace the ignorance. Judging by what has taken place just in the past four months, they hope everyone just goes quietly back to it once more.