In the 18th century, Swiss mathematician Daniel Bernoulli modeled dynamics of pressure in the motion of fluids. His work would form the basis of how we understand flight, particularly the motion of air across a wing surface. The curve of the wing produces different pressures above and below, providing lift. That places a great deal of importance upon more than just speed to determine lift, as any pilot has to be very aware of the angle of attack.

It is the angle of attack where stalling occurs, and most crashes. If the angle is not properly maintained, in any maneuver, the airflow behind the wing will excessively “burble.” The increase of burbling reduces the Bernoulli-effect and a plane will stall (having nothing to do with the engine or thrust; this why most airplanes can’t ascend at more than a shallow angle). Proper airflow is the primary function of the pilot, and that is why there is more than just a throttle in the cockpit.

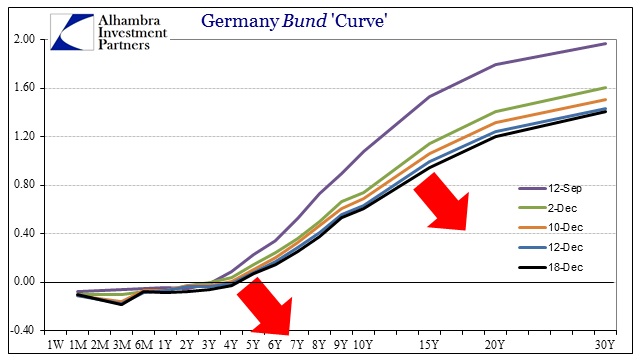

I am reminded of the complexities of modern flight in the case of European reality this morning. The Swiss National Bank is countering what they see as disruptive “flow” caused by, among other things, the “thrust” action of the ECB. Of course, the ECB has been providing additional “thrust” for a year and a half to no avail. That seems to provide the basis for this aeronautic analogy, as bond curves, swap spreads, currency movements and central bank counteractions are nothing more than the financial equivalent of excessive “burbling.”

The odd appearances presented here may make some sense to a central banker dealing with only short-run deficiencies as he sees them, but in the relevant wider context these are indications of a severe stall. The European economy is not oriented to the proper angle of attack in which to provide lift (recognizing the danger of using physics and actual and applicable mathematic precision to the very qualitative art of economics).

The primary presence of financial burbling of this kind is, of course, the “dollar.” Central bankers and economists talk about headwinds, but I think this is a far more accurate description of to the situation. It’s as if they don’t realize they have no idea how to fly “the plane” other than just running at “full power.” Pilot error is the leading cause of crashes, in both aeronautics and economics.

In the case of the real economy, the controls are far too complex and numerous to really have any kind of pilot in the first place.