Herb Stein was an economist that drew the unenviable task (though I don’t think he saw it as such) of being chair of the Council of Economic Advisors under Presidents Nixon and Ford. He was a man who knew imbalance up close and personal. To that end, he once quipped, “Economists are very good at saying that something cannot go on forever, but not so good at saying when it will stop.” The quote stuck and has been used and varied in the past several decades because there is so much simple truth contained in it.

Even in November 2003, the estimable Paul Krugman argued that “Steinism” applied in whole to the budget deficit “crisis” that he was railing against at that time.

Such explosive growth in debt can’t go on forever, and it won’t. Yet our current leaders and their apologists insist that the problem will magically solve itself. Last year’s deficit came in slightly below forecasts, and we’ve had one quarter of good economic growth — see, we’ll grow out of the deficit!

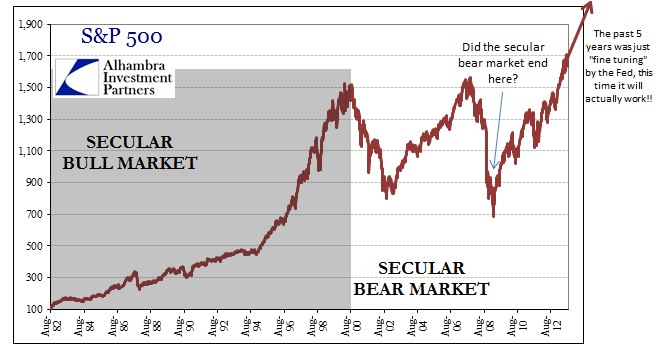

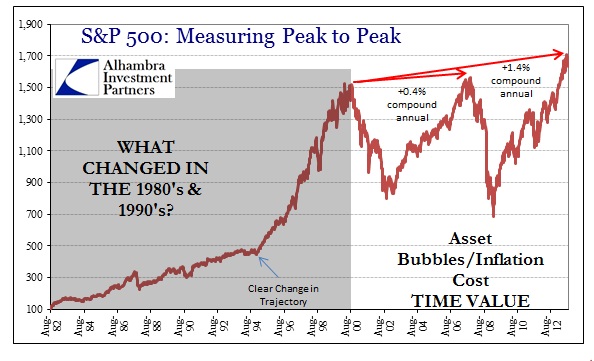

We never quite got that explosive growth, rather only the economic veneer of asset bubblation. They figuratively papered over the whole massive imbalance – literally they (monetarists) courted a new kind of fungibility of money never before seen in such huge and radical quantities. That opened a corollary to Steinism, namely that asset inflation cannot go on forever, and so it doesn’t. That became very evident in housing in the latter months of 2006, as a complete shock to nearly every participant, regulator and credentialed economist, only catching up to stock investors in October 2007 (and not really in scale until May or June 2008).

Krugman’s clumsy (and contradictory given his current position) formulation is very much applicable to stocks. The bullish answer to the stock bubble question now, as in 2003, is to grow our way into it. Explosive economic growth renders the fundamental imbalance moot, as that is the whole of the question. Robust conditions invalidate Stein’s basic premise, because under such circumstances stock prices can (and do) go on and on. That is the basis of a secular bull market.

So the argument about bull or bear as it exists in April 2014 itself pivots on the question of economic condition.

The bull case rests gently and infirmly on the idea that the extreme low of March 2009 marked the point at which the next great secular bull market was launched. If that was indeed the case, then there is no end in sight for stock prices beyond April 2014; just as the secular bull market that formed in 1982 set the stage for a nearly 18 year run of epic proportions.

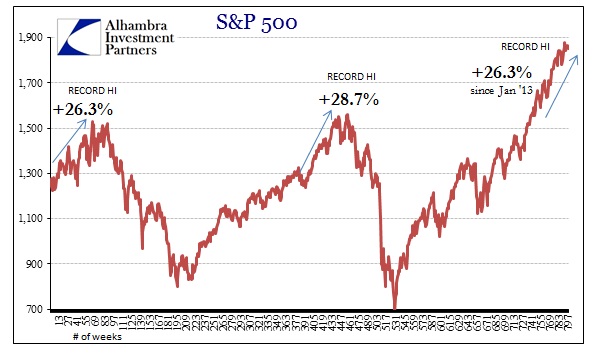

If we believe history offers us some kind of a guide, and I certainly do given the cyclicality of pretty much everything in human existence, then we should be able to discern not just the faint hint of similarities between then and now, it should be something far closer to a mirrored reflection. In other words, the past five years should look very close to the years from 1982-87.

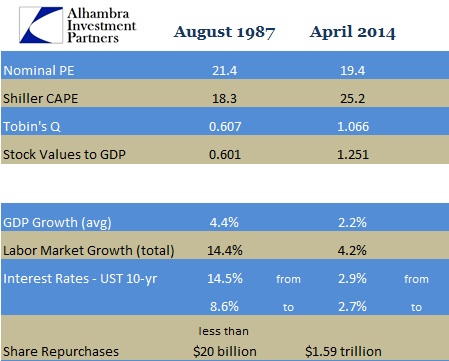

At first glance, that does appear to be the case. There exists remarkable symmetry in the 267 weeks between July 1982 and August 1987 and the 267 weeks between March 2009 and today. In fact, in raw terms, the current market (as defined by the S&P 500) has actually underperformed its 1980’s cousin. As such, the nominal PE of the S&P 500 in August 1987 was 21.4 (and itself headed for a revaluation only three months hence), more than a little above the 19.4 we see now.

It should be no surprise, however, that the similarities end there. Apart from nominal valuation, other means of valuing bubble”ness” show stark contrast. Valuations are exceedingly important as (common sense) a condition far higher in valuation is axiomatically closer to the end of a cycle than the beginning. Again, the argument here is to whether economic conditions will catch up to current bloated valuations, thus reducing them as the denominator (earnings).

Economic growth, on average, was slightly more than twice the rate in the mid-1980’s as in the past five years or so since March 2009. And the average in the previous period includes one negative quarter (from the last vestige of the 1981-82 double dip recession) which matches the comparison with 2009-14 (includes the final quarter of the Great Recession). Since these are compounding numbers, a growth rate twice as fast will add “success” geometrically greater than its slower comparison. If the 2.2% growth rate had existed in July 1982 forward, the economy by summer 1987 would have been 11% smaller, for example.

By every other major economic standard the current period fails by a huge margin. Overall payroll and labor growth in the mid-1980’s surged by over 14% compared to 4.2%. That statistic matters not just in terms of economic proficiency, but as a means by which to foment an actual secular bull market. Bull markets are not just rising prices, but more importantly relate to depth and wide participation. The economic advance in the 1980’s allowed far more of that “deepening” because living standards were actually increasing very broadly.

The current “recovery” period to this point is a sugar-coated stasis. A full part of the “sugar” has been the injection of financialism into the core of the American system – share repurchases (along with M&A infatuation). While there was significant growth in M&A in the 1980’s, particularly under the junk bond euphoria, it was only a singular outlet for expansion. In other words, there was room for that imbalance, whereas today saturation is evident.

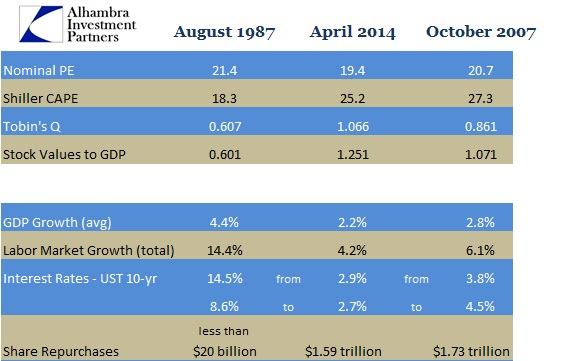

This becomes even more plain if we use a more fitting comparison. In fact, it is very clear that the current conditions, including market valuations, look similar enough to that of October 2007 to divert discussion in that direction. I already examined the curious manner in which the labor market of this “recovery” reflects far too closely that of the housing bubble period. It would certainly stand to reason that such similarities would depart and extend to other economic and financial factors.

In other words, if it floats like a bubble and shimmers like a bubble…

That, then, attempts a compelling explanation as to why the “grow our way out of the bubble” is likely to fail. As with the 2000’s, and in sharp contrast to the mid-1980’s, there is yet any growth to buttress that expectation. The entire premise rests upon the idea that Fed will somehow get it right – all of a sudden. That would entail overcoming both increasing cyclical degradation as well as the malignant impaling of economic trend (potential). After failing for nearly two decades, the recipe has suddenly been discovered?

The penalty for getting this wrong is severe. Though stocks are at or near an all-time high, given the time value of the trajectory the “market” took to achieve it renders that beyond insignificant; the downside of bubble imbalances reveal the costs to rationalizing the illusions. This time really is different, but only if you are talking about a new secular bull market. If instead your gaze falls upon 2007 and the housing bubble, there doesn’t appear any difference at all (there’s even a convenient housing bust forming just to cement the comparison and to direct effect to cause).

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com