By Mark St. Cyr

Over the years since what is now known as “The Great Recession.” There has been one dominant factor that pushed most – if not all – collective business reasoning and acumen aside, while simultaneously, allowing even the most rudimentary “investor” to believe they were a genius. That factor was: The Federal Reserve and its iterations of one QE (quantitative easing) initiative after another.

If you were a public entity for instance (e.g., shares listed on the various stock exchanges) financial engineering tools once inconceivable were now, at-the-ready in both availability and acceptance via the Fed. e.g., Low interest financing for stock buy backs, etc., etc. Along with the rampant acceptance of adulterating true earnings and more by employing Non-GAAP financial measures as one laid off, fired, downsized whatever to give a favorable Wall Street appearance so that the “hot money” being facilitated by the Fed. would find its way into your company lifting shares based solely on “momentum” strategies, rather, than anything resembling true business fundamentals. (Do I need to also point out “loan loss reserve” games?)

However, there was also an overarching meme held by far too many. That meme was: It was all dismissed by most as some sort of “Well that pertains to them – and not me” reason or argument. i.e., It’s about Wall Street and such – not about me and my business, or interests. I argued (and continue to) against that premise.

I have stated too numerous to count that everyone from the solo-practitioner, business executive, Mom and Pop operation, and more needed to understand the bigger picture in far more detail. Along with, at the least, a commonsense (working) overall understanding of not only Wall Street and the global markets, but also the political manifestations inherent within both as it pertains to business.

No one else was doing it. I know this because when I was looking for it myself back in ’07/’08 during the crisis, I could not find it either. So, I took to the task.

My readership back then? I think my mother visited my site once and that was my highest ranking day, if you get the hint. Yet, this was where and when I began trying to articulate my arguments based on my prior business acumen.

So much of what was transpiring at this time was absolutely confusing to many a business person, big and small. They would hear this, that, and the other thing from not only the financial media at large, but also, from the main stream media peppered with touted spokespersons or well-known figure heads in the field of Business/motivation, finance, and the whole Silicon Valley/VC/social everything set.

I’m not picking on, nor do I have anything against these people, so let that point stand and remain straight forward here and now. I only bring this up because they were some within my own genre of business/motivation seeming to be gaining further notoriety or influence near daily on what I felt were flawed assumptions and/or conclusions. Again, I felt their argued positions or interpretations were flawed. Nothing to do with them personally. So with that said…

Whether or not anyone agreed with me was irrelevant. The point was – no one, and I do mean – no one – seemed either willing or understood the complexities as to point these flaws out. I truly believed then, as I do today: not understanding the intricacies, as well as, the true implications, along with, blindly following much of the recommended advice that I saw coming out from many of the popular talking heads was not only going to come back and haunt them. It may be down right horrifying.

For others, it might also lead to finding out not only might their business life may be upended, but also, their personal life with no understanding of why it happened. And worse – why it might or keeps happening.

This is where Einstein’s argument for insanity shows true. For the issue for many would soon be: They keep doing the same thing – and keep getting the same results. And worse: Not knowing or understanding why because – they’re doing precisely what the so-called “experts” are telling them to.

A classic example of this which had the same characteristics, as well as, being just as prevalent (and in some HR circles still is) is where people heard or “learned” from “experts” why they could, or could not, do something because: they were either “left brain or right brain thinkers.”

This lame brained drivel has since been disproved by science itself as garbage. Yet, that hasn’t stopped many a speaker, or HR department to dispense another version of this trite as “new and improved!” Why? The “answers” sounds so easy. The “assumptions” made and the remedy to “fix” sounds so simple. Problem was, as long as the underlying issues remained simple – even simply wrong advice can take on the appearance of maybe right.

On the surface it did seem to be some magic bullet for insight and remedy. So people walked away believing they now had the answers to workout their “issues” in the future. i.e., “Oh, I didn’t understand that because I’m left brained and that pertains to right brain thinking. So I’ll just disregard it.” Till all of a sudden those “issues” move from the surface level to having far more reaching consequences. These insights could have been as easily explained away with the same averages as reading and applying one’s horoscope found on some generic web site.

The problem as always is, inevitably, when the real “issues” of the day do in fact show up. They suddenly find themselves in far worse shape. Again why?

Because they “believed” they were prepared in the first place based on flawed thinking and/or assumptions. Whether thought through the left or right side.

Now, not only might they have done the wrong things, at the wrong times, applying the wrong tools as to deal with an “issue.” Depending on the circumstance – it may be too late to salvage anything going forward – for the damage might be too far along.

All of the above is a direct, applicable analogy, if one wants to extrapolate its underlying message to fully understand what myself, and very few others, have warned about: e.g. The Just Buy The F’n Dip mentality crowd. aka BTFD.

Here is the one function not only enabled by the Fed. But was also: rewarded and back stopped ever since the financial crisis.

For the last 7+ years, no matter what investing strategy you were told or sold, as long as there was QE running down the “drip tube?” Those investment “strategies” that you were either told (via the financial media at large) or sold (you bought the book, attended the seminar to hear this weeks version of a speaker just killing it etc., etc.) it was hard to argue against what had all the appearances of pragmatic insights. After all: BTFD and you too were in the same boat were you not?

And yes you were – then suddenly the boat begins leaking, then splitting, and now even the people who seemed to have all the answers on how you needed to get in the boat are now appearing to have that same blank stare you are beginning to have. Reason? The BTFD mentality allowed one to think there was no need for life preservers on the boat. And now, you find out rather inconveniently – there aren’t any.

This is the reason why I have made such an adamant stand against anything rewarding BTFD behaviors, as well as, the assumptions that it is was something other than what it truly was – a Fed. supplied addicting monetary drug enabling mind altering suggestions that people were smarter than they thought. The drug of QE enabled BTFD genius and paradise.

However, once, and now since, the I.V. drip did in fact close – it was inevitable there was going to be a lot of withdrawal and hurt to go around for far too many people who bought in not only to the hype, but also, to the hype promoted by those whom dispensed financial and or business advice based on BTFD reasoning during this period.

This problem has not been exclusive to just the business/motivation, finance, Silicon Valley, social marketing, or VC, field. It’s been rampant everywhere. It’s even in the world of consulting and other venues as well. At all levels. Trust me – it’s rampant.

Just to give an example, I know one of the most highly respected consultants in the U.S. He consults and advises businesses, CEO’s, at the Fortune 50™ level and mentors many more around the world.

Personally I have great admiration for him for he truly is a one of true thought leaders on the world stage today when it comes to consulting. Yet, when it comes to the financial markets, their global impact, and just how precarious a knifes edge and the possible resulting disruption that may manifest at any given time? Circumstances which I believe to be far more devastating or consequential than possibly the original ’08 crisis? Absolutely numb to the whole idea or premise. Furthermore – dismisses the whole premise as “nonsense.”

And why not I suppose? After all, as the counter argument goes: “Things always bounce back. Just look at where we are today! It’s not ’07/’08 all over again. That’s preposterous. We’re in far better shape to handle another such crisis today than then. After all, look what we’ve learned and done from the past. Banks are better capitalized, Unemployment is at great levels, GDP is low but getting strong, etc., etc., etc.” You would think you were listening to a recording from some next in rotation fund manager or economist. Oh wait – that’s who he is listening to. So, I guess it should come as no surprise then.

Suffice to say, that’s the argument and viewpoint a great many currently hold today. And the BTFD manifestations that have taken place over these subsequent years have allowed that viewpoint to be held even tighter. After all – that’s what they hear, see, and read from the many a mainstream media source. And more importantly – see in their current 401K monthly statements. And so, ergo, it must be true.

Problem is, as I always try to emphasize: “We’re here only via the effects of QE. And, not only has that stopped, even if it comes back – it may not work this time. It’s all now a crap shoot. And if you don’t have a working understanding of that, along with the ability or foreknowledge as to pragmatically make adjustments, as well as, preparations to either hunker down if needed. Or, better yet – effectively take decisive actions as to leapfrog your competitors as they become frightful and frozen with indecision in what may be another monumental business upheaval. You are going to find yourself not only behind-the-8-ball, but maybe, something far worse. Period.

A few cases in point:

Back in November 2014 Tony Robbins released his first new book in some two decades. What was it about? Stocks. In it he argued (just like many) the way to make money and other things was to do what he outlined in his book. I totally disagreed and argued on more than one occasion (here and a year later here) why I felt it was flawed. I stated my reasons and stood by them. And then was besieged from people making statements like “What do you know?” and “Who are you too say?” While others for the sake of decency I won’t express, but you get the idea.

I don’t shun from criticism, and like I’ve always said when I feel there is “a fair point” I’ll then articulated why not only did I have a right to argue (vis-à-vis in the same business) but also I showed de facto I had more published writings about the financial markets than even he did.

However, that mattered about as much as a ticket to one of his seminars the day after a great many found out via a trip to the emergency room that fire can indeed burn no matter how much you tell yourself it wont. (That’s not me trying to take a cheap shot though many will have that first reaction. I believe it’s a fair point when looked at in this context. For remember, as I’ve stated numerous times, I like Tony. I just don’t agree on every point.)

So let’s take Tony’s book since it validates my point. If you followed the advise of that book it is in my humble opinion and estimation that you are currently – very uncomfortable. Or, worse.

As I stated then: “Anything less than under-the-mattress styled thinking for safety and/or actions or, as close as one can feasibly come to it, is all that one should currently be focusing on. For it’s now all about the old adage ‘the return of one’s money as opposed to a return on.’”

After that argument which took place in Nov. ’14 when the book came out. The subsequent year (being 2015) was the first year in 87 years – Cash (i.e., the holding of no other asset stocks, bonds, diversification this or that) outperformed every other asset plan. Period.

And, as of this writing? How’s any “diversification” of asset plans currently working out? Hint: Even for the biggest names in finance itself like Hedge Fund managers, some are not only bleeding assets under management, others like Carl Icahn’s own firm was downgraded to “watch negative” from “stable” on declining portfolio values and higher leverage implying a cut to junk may be possible.

Then there was tweet-storm between the self-described “America’s Most Trusted Personal Finance Expert” Suze Orman pleading with non other than CNBC™ fame Jim Cramer on what the Fed. should or should not do.

I argued then, as I do now, if this is how two of television’s “experts” are handing out advice. Then there really is something wrong with this whole business/motivational genre. And as of today? I’m becoming more right with every passing day. For if you’ve listened and taken any of Mr. Cramer’s since that time – you are far, far, from happy. And as for Ms. Orman? The silence on what people should be doing as of today has been deafening. But hey, “What do I know about such things?” And, “Who am I too say?” otherwise.

Then there was the whole social media, Silicon Valley, VC narrative. I personally argued against many of the “insights” as well as “must do’s” articulated by many of the aficionados. When it came to “everything social” not only did I articulate ideas of why many a business should not focus on this medium as some “holy grail” business modifier which far too many were proposing, But rather: I showed using myself as the example of how not using it as prescribed and focusing on other business principles and ideas could be far more meaningful, as well as, beneficial. (Need I remind anyone how many suddenly found “their audience” was no longer their audience when many of these platforms overnight, and without notice, changed their rules?)

Where applicable I openly demonstrated using actual provable stats and metrics (not pie in the sky based on magical thinking) my reach dwarfed in both readership and/or potential audience many who not only relied solely on these platforms, but also, sold others that they in fact needed to be on these platforms almost to the exclusion of anything else.

As I’m quoted, and still stand by, “The only people making money from social media – are the people selling you social media.”

So with that in mind: If you don’t think there’s a sea change currently taking place in Silicon Valley since the ramifications of the Fed’s QE no longer fueling the brilliance is starting to take hold. (One that I have argued, argued, and argued some more where I was told by many of “The Valley” itself insisted I had no clue) I’ll use this screenshot of an article that was posted at Pando™ dot com a few weeks ago. (you have to be a member to read the articles) To wit:

For those who argued “I just don’t get both “The Valley” or the whole meme of “social” and/or “VC” as it pertains to it.” Let me remind some of a few facts…

2015 was an absolute bloodbath for IPO’d unicorns with many losing some 90% of their once lofty highs. While a preponderance still remain under their initial IPO price debut. And, as of this writing? Where it will be March in mere days. There has not been one, that’s zip, zero, nada “Unicorn” IPO’d so far this year.

I thought it was always a great time to IPO thise unicorn dreams to riches? At least that’s what everyone was saying back then. Oh right – back then. I guess “it’s different this time,” right? Funny how all the “genius” stuff along with portfolio swagger seems missing since QE has stopped, no? But hey, “What do I know.”

And just when (if ever) another Unicorn does bear fruit and IPO this year? Again, no one, and I do mean zilch, just like the IPO’s of late, knows. Yep, it sure is a different time – isn’t it.

Again, as long as the Fed’s QE faucet remained open financial, VC, social advice, and a whole lot more seemed hard to argue against. However, now that the faucet has closed? Just read that screenshot again and see if that once tightly held meme started, as well as, articulated in the past is still the viewpoint to have today? It’s for you to be the judge – not me – as it should be.

The only reason why I detailed the above (and that is the condensed version) is that I believe: it is important to both the discussions at hand, as well as, future discussions.

For it’s one thing for people to make arguments, or try to espouse ideas others should take. It’s far different on whether one should heed or act on those the contemplations or insights when it comes to formulating what actions one should take, or more importantly, what actions to avoid in both tough times as well as good.

For if you can navigate the bad, taking advantage during the “easy” makes it even all the more profitable and palatable. Both for one’s bank account, as well as, one’s sanity. And I believe one’s sanity is far more important than wealth. For one you can always recover from losing wealth. When it comes to one’s sanity? Sometimes – not so much.

So now with that all said (and I know it’s been a read-full) let me share with you what many have been asking me about as of late and where I see things going. e.g. The financial markets in general.

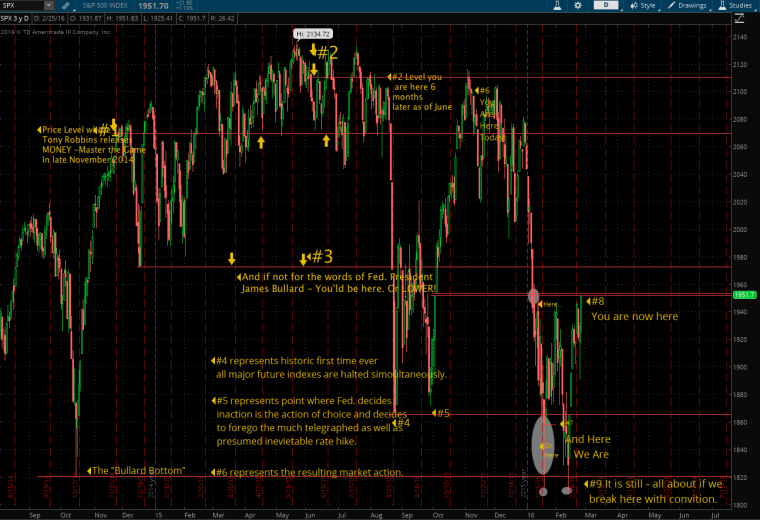

Below is an updated version of the chart I began posting well near a year ago, and have updated it when I felt we were at critical, or at the least, significantly important times in its evolution. Today is another one of those times. To wit:

As one can see, we have pretty much done precisely what I speculated previously followed by nothing more than returning to the area which started the previous down-run in earnest. In particular where I placed that lower oval, then implied “needed to hold” has indeed not only happened, but was once again tested as I’ve denoted with the smaller ovals just below that demarcation line. Why is this important you might ask? Fair question, and here’s my best assessment for those who may want to know…

The implications from a purely technical viewpoint, as opposed to anything fundamental is this: The fact that a major support level held (that level is also referred to as the “Bullard Bottom”) but (and it’s a very big but) the subsequent bounce only brought it back as far as the original level e.g., a gap that could have been also acted as support if filled. Was filled – yet – did not hold.

Then (once again) convincingly turned around and retested that lower level within days. Then (once again) returned to that area to (once again) fall right back down, only to be saved from an out right panic selloff going even lower by (once again – are you seeing a pattern here?) Fed. officials (such as Mr. Bullard himself – once again) jawboning reasons why they may or may not do this, that, or the other thing.

And where has all that “once again” repeating action stalled? Look at that #8 position “once again” for clues.

It is in my estimation: if we are to fall “once again” (I’m not trying to be coy or funny, the reference is actually quite relevant and important) over the coming days or weeks to test that “Bullard Bottom.” I am of the mindset: it does not hold. And, there very well could be a panic induced selloff too much, much lower levels. Quickly.

Just how far and how deep is anyone’s guess. However, from what I’ve concluded from the ways in which these markets have been acting, along with many of the other concerns mounting outside of the U.S. It could very well rival similar episodes witnessed in ’07/’08.

Remember: No one knows for sure. Yet, that doesn’t mean there aren’t, nor hasn’t been enough clues to look to as to speculate just what is possible under the prevailing circumstances. And, the reason for my concerns, and why I’m even saying what I have is – all I’m currently hearing from the so-called “smart crowd” is the resulting market actions over the past week and a half has been indicative of “a bottom” where the next moves will undoubtedly be higher – much higher.

I believe those assumptions are wrong. And quite possibly – dead wrong.

Again: all I’m saying is – be prepared for what everyone else has said is “long since passed and won’t be seen again in our lifetimes.” Because, in my estimation: It’s very possible what we were told “we’ll never see again in our time” just might be over the horizon waiting to make shore.

Take it for what ever it’s worth. I just thought it was important to point out for I feel we could be at another of those critical junctures.

And for those who may be new and are thinking “Why or, on what basis should I take his argument as to contemplate what I might or might not happen?” All I’ll use as evidence is that above chart. For I started it, and began annotating it, where you see the #2. All that has happened after is what I argued was more probable or likely – as many of the so-called “experts” argued it would not. And as readers who’ve been here for a while will attest – I’ve made my arguments and stated observations before they occurred. Not after. Just as I’m doing now.

I might be just as wrong this time, as I’ve been right on all the previous. Again, no one knows. However, what you do from here can only be done by you. No one else.

Just make sure you can handle the consequences no matter how they play out. Whether for gain or, the prevention of loss.

Source: A Few Points for the Record, and a Few F.W.I.W. Points – Mark St. Cyr