Earlier this month I reported on how the much ballyhooed European economic recovery wasn’t showing up in the bank asset data. Virtually all of the growth in bank assets, such as there was, was a result of the direct transfer of cash from the ECB via its recent massive loan operation called the TLTRO. That means Targeted Long Term Lending Operation.

The ECB lent €245 billion to the banks in March. It pays them a bonus on any new loans that the banks make that are related to those funds. The banks quickly figured out that they could lend the money to each other to earn the bonus interest.

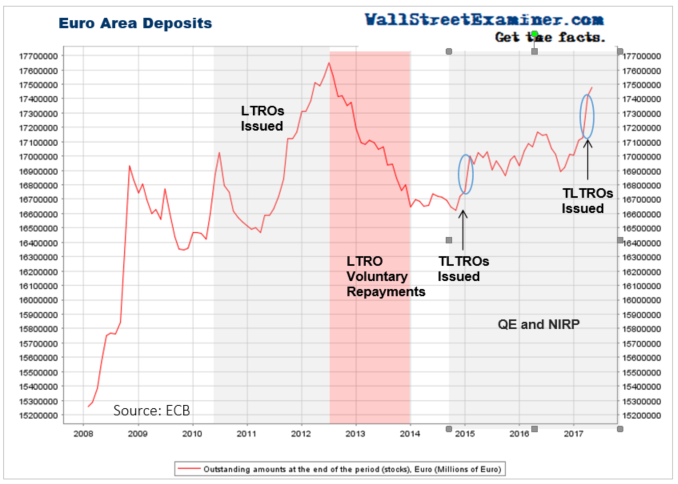

Now we turn to the liability side of the aggregate balance sheet of the European banking system. The ECB publishes this data about a month after the close of the reported month. Current data is for April. That was one month after the last TLTRO operation.

Deposits in Europe edged higher in April, gaining 0.3%. That followed an increase of a whopping €290 billion (1.7%) in March. That’s the amount of the TLTRO plus another 45 billion. That’s about the amount of the ECBs bond purchases that month under its QE program.

Every time the ECB has done a slug of LTRO or TLTRO, deposits surge. Then most of it is reversed in a few months as the useless loans, for which there is no real demand, are quickly repaid. Measuring deposit growth without the recent TLTRO and the first one in January 2015, the banks’ total deposits have grown by a total of 0.7% in 2½ years.

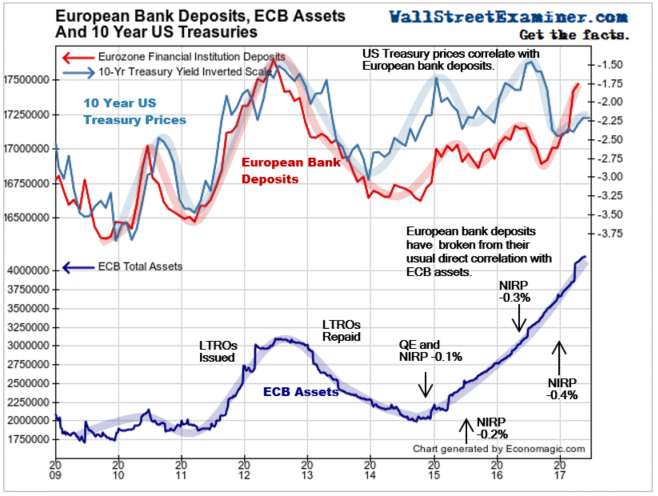

Even as the LTROs are repaid, some of the deposits created when the ECB buys bonds outright should stick around. But even that’s not happening. Since the ECB started QE and NIRP in Q4 of 2014, it has managed to goose deposits in Europe’s banks by a total of 4.8%, or an average of 1.9% per year. That includes the period of the additions from the TLTROs. Outright QE has done virtually nothing to boost growth. The money is literally disappearing from the system as fast as the ECB prints and injects it.

The total increase in deposits since the inception of NIRP/QE is now €830 billion. It sounds impressive. But it’s pathetic, considering that the ECB has pumped €2.2 trillion into the banks over that time. Most of it has disappeared. Depositors have used much of it to buy assets in the US and elsewhere. Much of the rest has gone toward paying down debt, thereby getting rid of the cost of holding deposits or European sovereign paper with negative yields.

Surging deposits in Europe have in the past been a bullish sign for US markets. The correlation is strongest with Treasuries as Europeans with cash tend to buy US Treasuries. But some of the deposits created when the ECB prints money are also used to buy stocks. And domestically in Europe, some of it is used to pay down debt and thereby extinguish deposits.

Another word for it is “deleveraging.” While that may be a good thing for Europe in the long run, in the short run it’s usually bearish for the markets. But the ECB is papering it over, taking the risk upon itself. Ultimately that will be transferred to the taxpayers and bank depositors when the next collapse comes around.

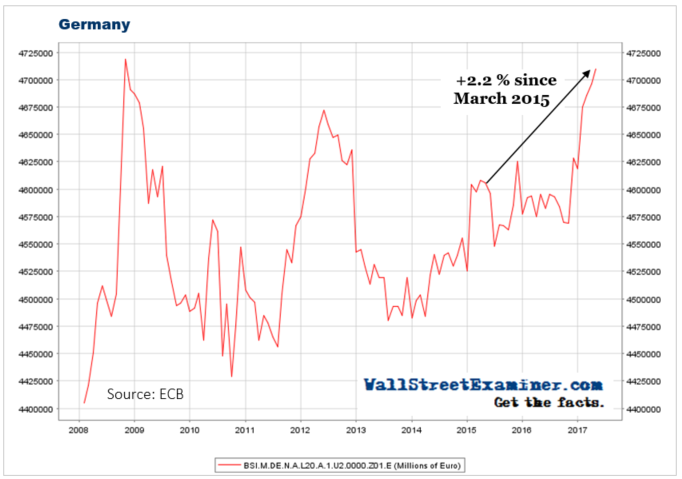

Germany

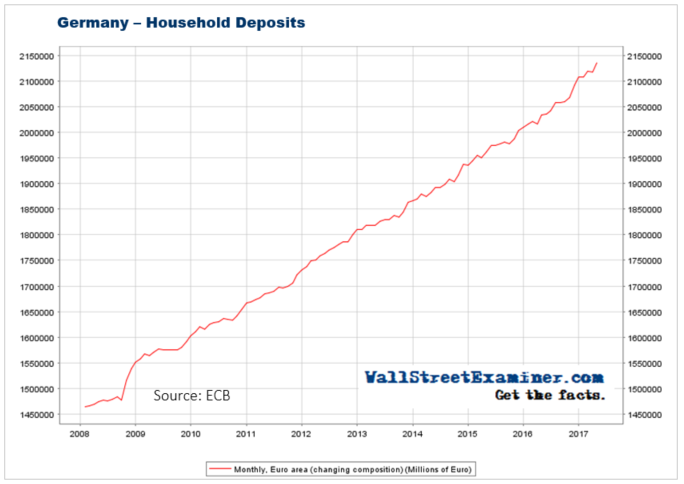

Deposits in Germany rose in April. They were up by €13.3 billion or 0.3%. Year to year they’re now up 2.5%. German bank deposits have seen a massive spike since Brexit. I suspect that repatriation was the driver. But there’s less here than meets the eye. Deposits have grown by a total of just 2.2% since March 2015.

We have seen these spikes before in Germany. They’ve never stick. The German banks are still sick and German institutions and businesses don’t trust them. Without massive ECB monthly cash infusions deposits in German banks would be shrinking.

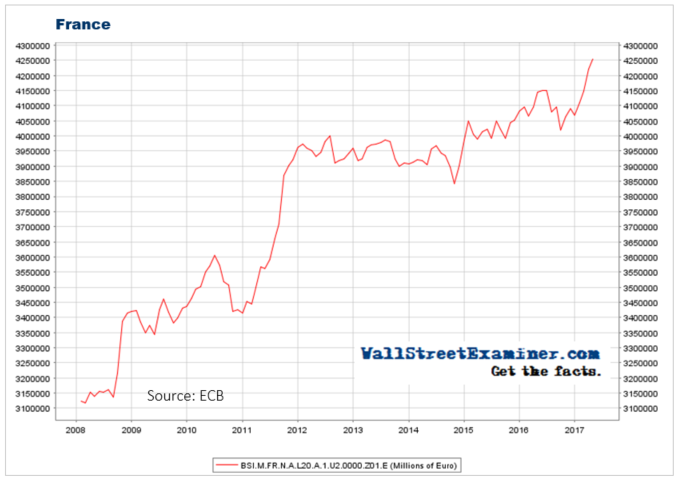

France

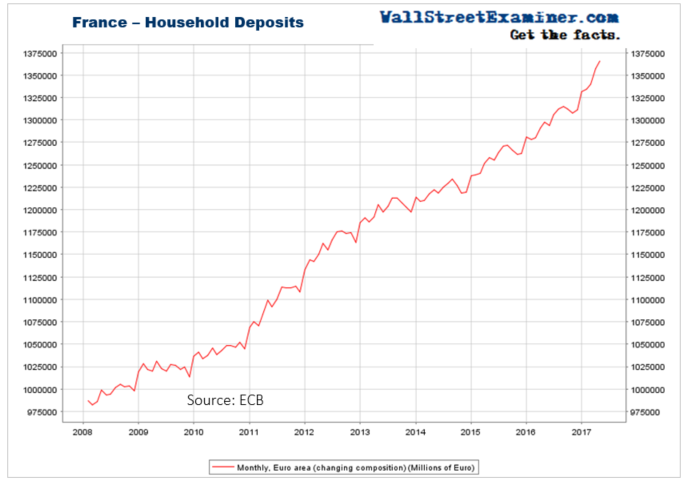

French bank deposits also rose in April, increasing by 0.7%. That brought the annual growth rate to 2.5%. Unlike Germany, French deposits are forging new highs. In March, French deposits rose by a massive €70 billion or 1.7%. The ECB’s TLTRO appears to have been the driver of that increase. The stop start path of deposits in both France and Germany is a sign of central bank interventions, not intrinsic economic growth.

Household Deposits

Household deposits rose in Germany in April. Deposits rose by 0.8% and are up 4.9% year over year. The monthly increase of €17.7 billion was larger than the 13 billion euro increase in total deposits. So while households were adding to deposits, businesses were withdrawing them or using them to pay down debt. Households typically do not have the ability to move their money out of the country. German households are increasing their holdings of cash despite the lousy, or even negative returns.

We see the same dynamic in France. Household deposits rose 7.6 billion or 0.6% in April, driving the annual growth rate to 5.2%. Unlike Germany, deposits other than household deposits are also growing.

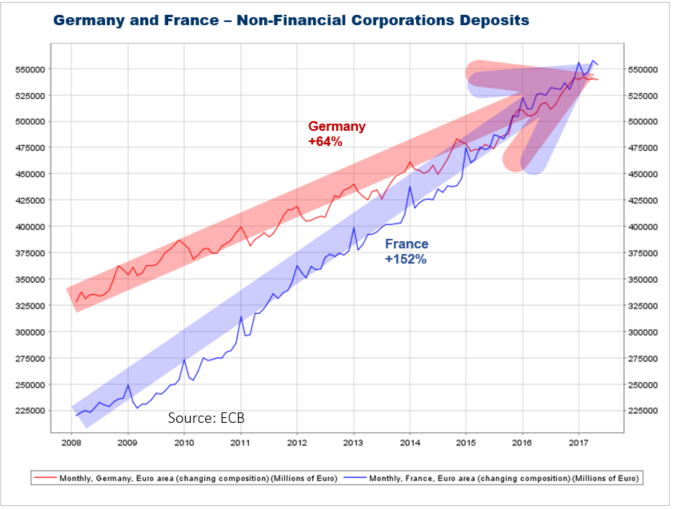

Commercial Deposits

Non financial corporate deposits declined slightly in both France and Germany in April. France continues to outpace Germany in growth of business deposits. Big companies have their choice of where to deposit their cash. Last month they again chose France over Germany. That has been the trend for the past 7 years.

Interbank Deposits

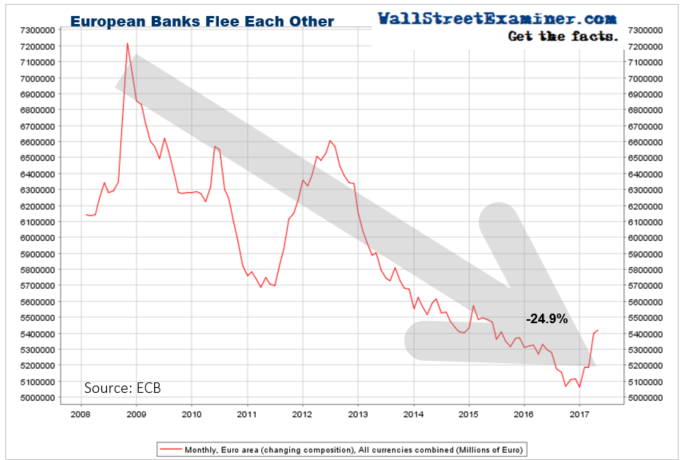

The downtrend in total interbank deposits—deposits of Europe’s banks in other European banks—was interrupted in March thanks to the ECBs TLTRO program that month. We see the ECBs fingerprints all over this. Interbank deposits rose by €204 billion. Not coincidentally that was the bulk of the €245 billion TLTRO. April followed with an uptick of 23.8 billion or 0.4%. Even with this bounce, interbank deposits remain down by €1.8 trillion, or 24.9%, since 2008.

While the ECB plays games to boost deposit levels in Europe’s biggest banks, European households have no choice but to keep their money in Europe. If you have no options and you are worried about the future, you increase your holdings of cash. But business deposits haven’t grown at all this year in Europe’s 2 biggest economies. And interbank deposits have only recently bounced because of the ECB’s money games. There’s just no sign of intrinsic growth.

And we haven’t even gotten to The Continent’s problem children yet. They are still collapsing. The rot doesn’t show up in the topline numbers or in the big country systems only because the ECB continues papering them over, transferring the risk on to its own books and ultimately to all European taxpayers and depositors. We’ll have a look at those countries in a subsequent report.

This report is derived from Lee Adler’s Wall Street Examiner Pro Trader Monthly report on the European banking system.

Lee first reported in 2002 that Fed actions were driving US stock prices. He has tracked and reported on that relationship for his subscribers ever since. Try Lee’s groundbreaking reports on the Fed and the Monetary forces that drive market trends for 3 months risk free, with a full money back guarantee. Be in the know. Subscribe now, risk free!