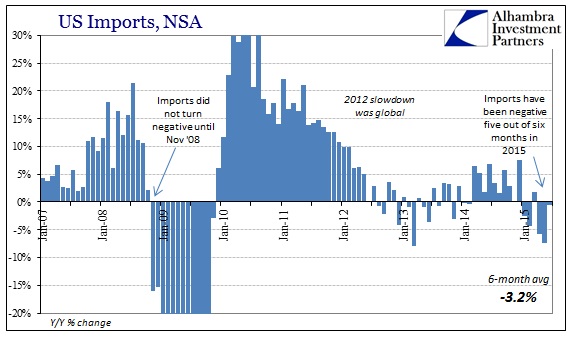

There was absolutely nothing good about the most recent trade data for June. Even what looked like an improvement really wasn’t, suggesting, strongly, that conditions in the global economy are still declining. With Canada falling to recession, blaming a “puzzling” and sharp decline in non-petroleum exports (the US as that nation’s biggest customer), the decline in US import “demand” completing now a full half year is simply confirming.

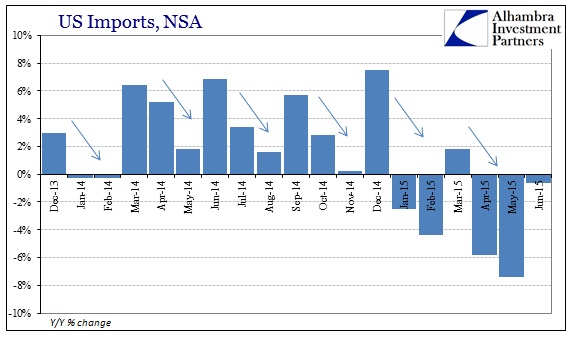

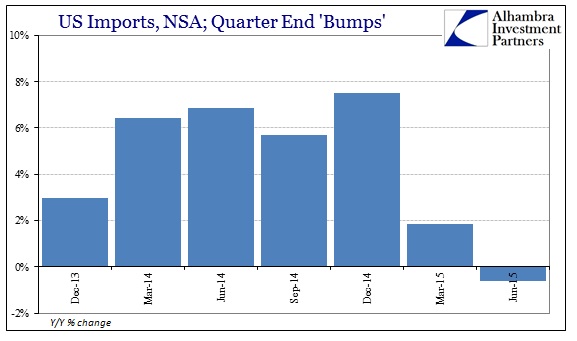

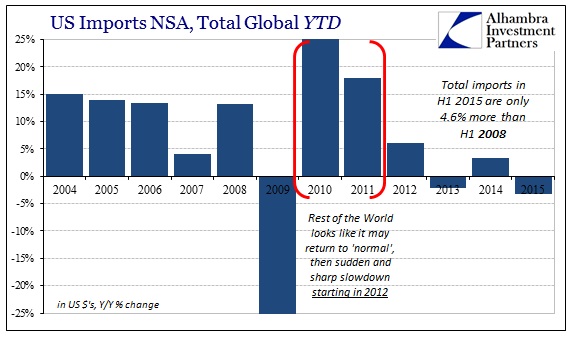

At first glance, imports fell “only” -0.6% in June year-over-year which seems to be a vast improvement over the alarming -7.4% in May. However, since late 2013, US import activity (much like inventory activity) has fallen into a quarterly pattern (first distinguished via imports from China). The last month in each quarter has been inordinately superior to the other months within it, meaning the relevant comparison for June 2015 is not May 2015 but rather March 2015.

When March’s imports were up 1.8% that was believed to be consistent with the mainstream, orthodox expected rebound since it was seemingly better than February’s -4.4%; however, that +1.8% was appreciably worse than the far more relevant +7.5% from December 2014. In sequence, then, these quarter end “bumps” show the same disquieting downward trend.

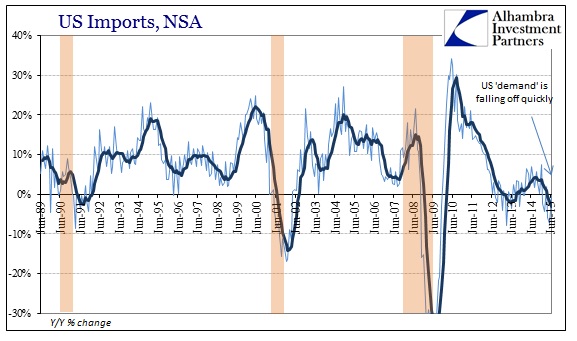

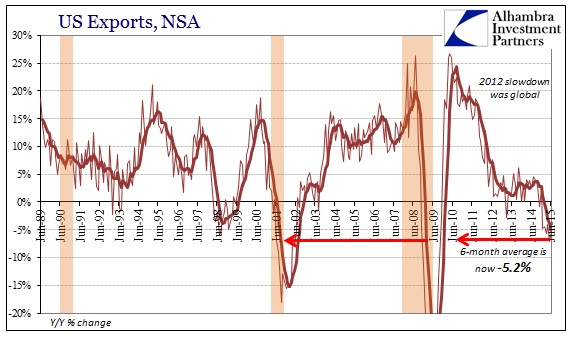

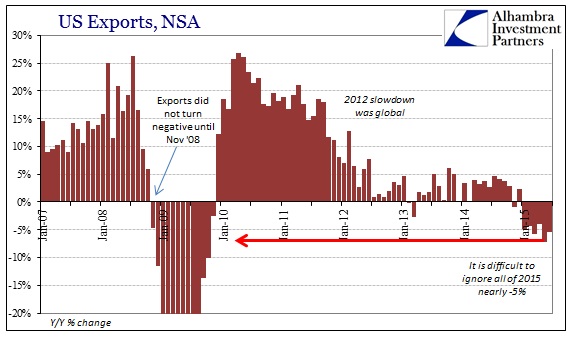

The raw decline by itself is concerning, of course, but the fact that this is occurring in imports to the US is totally opposite orthodox ideas about currency and economy. The “rising dollar” was supposed to make imports “cheaper” relative to the pre-dollar exercise, which should have produced an immoderate and significant increase in import activity had domestic demand simply stayed constant. Not only that, the timing of this decline is a dead giveaway as fully coincident to the same troubling experience with exports.

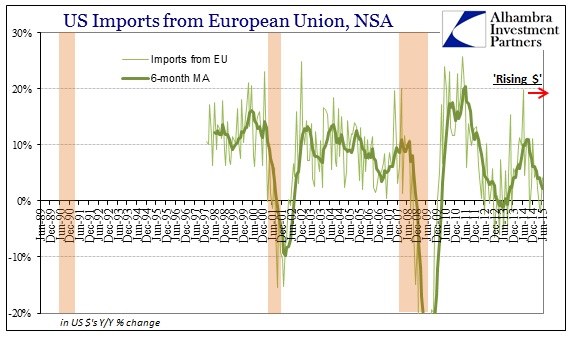

To emphasize that currency point further, the dollar has been, arguably, most diminished among major trade partners against the euro. That would, in a ceteris paribus world that doesn’t actually exist, propose a much more robust trade going from Europe to the United States. That actually was the case (for reasons that appear now wholly unrelated), until June 2014 when the “dollar” (not dollar) circumstances changed. Ever since, import growth from the EU has been sinking and sinking quickly.

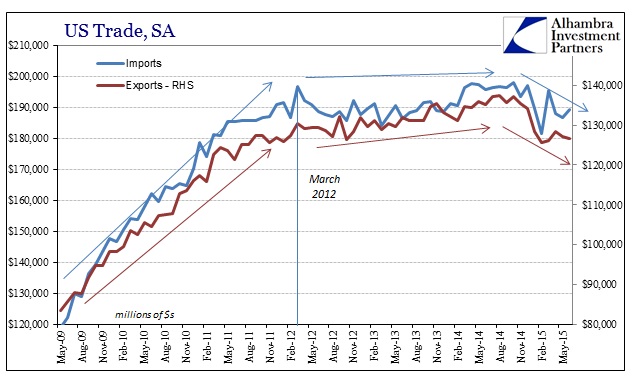

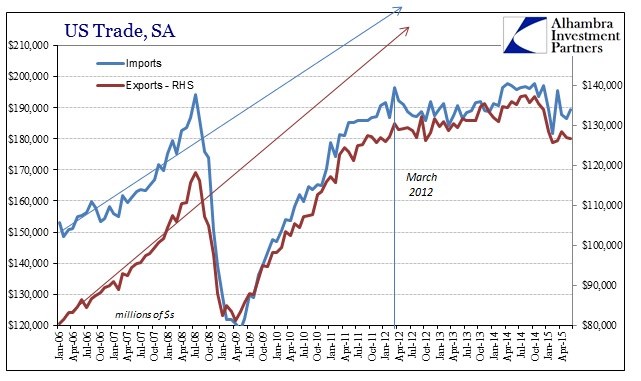

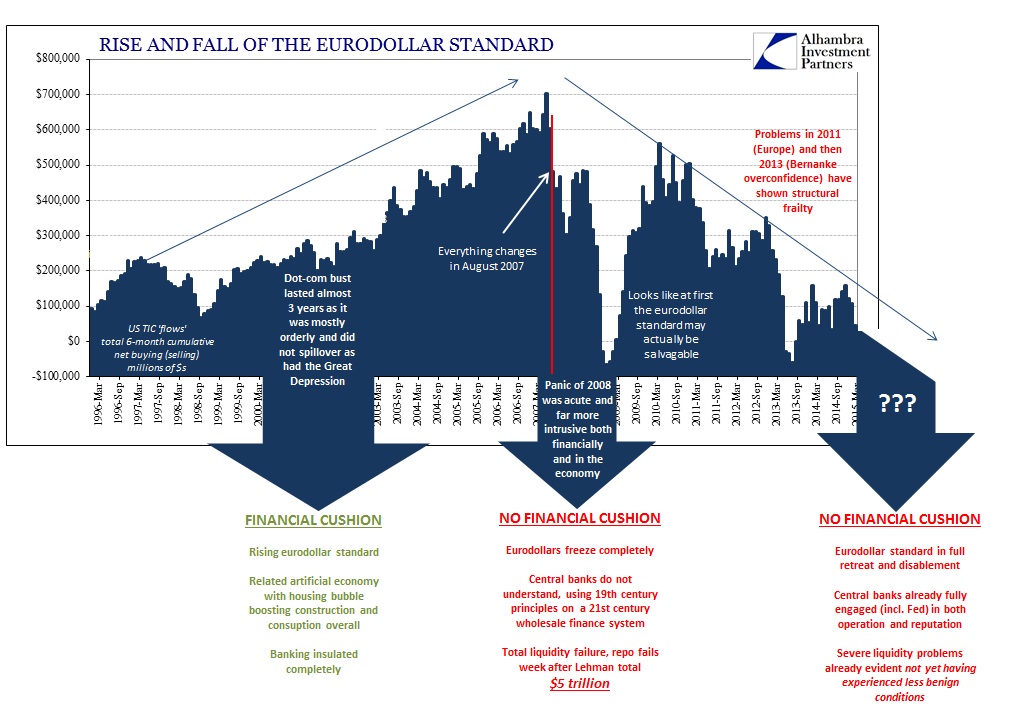

There can be no other explanation than global economy which certainly incorporates, at its apex, US “demand.” As noted yesterday, this is a problem that dates back to the second eurodollar eruption in 2011, “enabling” the 2012 global slowdown that began in March of that year.

The figures for US trade in June simply confirm that a second, downward inflection seems to have been reached in late 2014. The fact that it has lasted now more than a half year reduces the chances (to nearly zero) of “anomalies” or whatever inanities (summer storms now) orthodox economists might cook up to try to preserve the idea that monetarism works, has worked and all is still well.

While those processes speak about the more immediate “cycle” impacts, elongated as it clearly is now, there is a related and larger issue that makes these inflections that much more dangerous and pressing. A deficient recovery is already a problem, but coming immediately after a massive “recession” or economic hole is exponentially more awkward. Monetary “stimulus” itself, being of generic transactions for the sake of transactions-type redistribution, is premised in the real world as creating momentum in absence of organic momentum but still relying on organic momentum to in the end carry the load.

Instead, what we see increasingly with time is not just an odd cyclical occurrence but really how that relates to an economy, in the US and globally, that seems to have permanently shrunk (depression not recession). There are various expressions of this observation, especially labor utilization, but it appears here in US trade figures as well.

Both import and export levels in 2015 are not appreciably larger than those of 2008 despite the span of seven years and thus great population expansion alone. You might be inclined to list crude oil as primary causation on the import side, but the timing of these changes, their “elasticity” with regard to economic and financial factors more so would argue, in my view, as if there is a smaller economy on the other side of the Great Recession – a permanent alteration in economic “potential” owing not to the economy itself, as secular stagnation would have it, but to the reasons of global financial experience and how that related(s) to economic modality under financialism and soft central planning (IOW, serial asset bubbles as monetary “tools”). That is as much the case in raw, absolute numbers but even more so when figuring per capita.

I think that is the answer to the elongated cycle and the second inflection in 2015, as much as anything might be more comprehensive. In other words, there has been an absence of pure economic “shock” but a clear “slump” if not already recession forming. The case of attrition relates to both the cycle and the shrinkage, combining as innumerable problems about real economy activity that cannot and no longer be penetrated by policy promises that are clearly unable to deliver much beyond temporary bursts of more harmful redistribution.

Stringing together, in rough words, cycles dating back to the rise of the eurodollar and the serial asset bubbles in tandem, you see mild recession (dot-com), unusually mild recovery, huge recession (Great Recession), no recovery and now potentially recession again. As much, that may be a singular supercycle, which would explain why the “recovery” as it has been is nothing more than statistical positive numbers while close personal experience, all around the world, isn’t at all relating.