The fact that these deficient economic estimates continue in April instead of the forecasted and pleaded rebound has raised more serious concerns even among those most loyal to the mainline tendencies. It is getting more difficult to deny that there is a major economic problem brewing, one which may already be rather severe despite the fact that the heaviest pressures associated with recession itself are still absent. The changing perception about the economy, with that 5% GDP talk now dead and buried, is itself one of those factors as there are enormous downstream implications from such a potential reset.

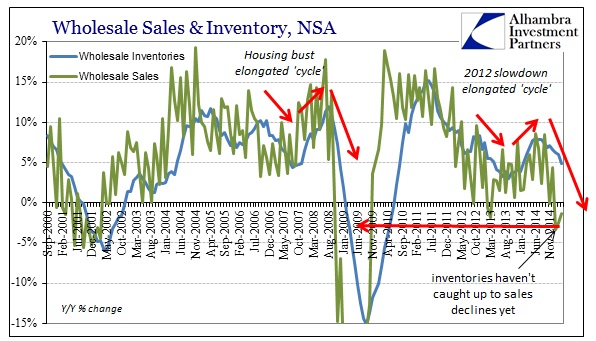

It probably has always been that way to some degree, and there is no doubt that there is at least a small basis in monetary theory about recession being not much more than pessimism. But the QE-world seems to have run massive interference in the ability of business, in my opinion, to operate with some sense. Take the case of inventory, as there has been a massive buildup in the past year without the salving and saving grace of actual sales growth up and down the supply chain. That has left wholesalers and retailers full of “stuff” and not much sign that it will eventually and easily move in the near term.

The question is why businesses, service businesses as they are classified, would befoul their own circumstances to such a high degree. The only answer I can come up with is the Blue Chip Economic Survey and all its kin. After the polar vortex setback last year, it was proclaimed by every economists and policymaker all over the world that that was an aberration, an anomaly to ignore as the economic sun was finally about to rise. So certain were they that it was unceasing and relentless. Without much by way of alternative, what were businesses going to do? Many of them, undoubtedly, are full of recession fatigue and surely longed for that satiation of economic hope. Why not 2014 since “everyone” was so sure?

It certainly would not be the first time that business, in the aggregate, misjudged the economic circumstances, and surely not the first instance where monetary interference aided in the error. In fact, again, recessions used to be almost entirely made up of just this sort of inventory imbalance, a fact that traces back to that risk the supply chain must take in order to deliver economic flow. Business activity, for all the statistics and minutiae, is rather lumpy; retailers and wholesalers are quite used to the high degree of variation in sales and together smooth out the process by an almost constant flow of inventory.

You can see that quite clearly in the raw figures; sales are all over the place while inventory is almost unbroken:

What that means in practical terms is that the supply chain itself absorbs that variation and takes on a high degree of cyclical risk at times. It is not linear, however, as the selling process does not possess a static relationship to volatility. In other words, businesses will tolerate, as best they can, a temporary slump, smoothing it out with a constant flow of inventory even when sales fall away. Recession is the process whereby that patience becomes exhausted; the very point where tolerance for passing slump is replaced by changing perception toward recognition of something much worse and more sustained.

At that point, inventory on hand needs to be liquidated and orders for new inventory scaled back – slowly at first and then all at once. Again, this is not a linear process and is itself uneven, full of fits and starts – declines and false dawns.

In the case of 2014, you can begin to appreciate the danger as that hopeful optimism about the dawn of the actual recovery at long last gives way to something far darker. While economists might be excused for missing Q1 yet again, and thus business might retain at least some hope for 2015, even that has seriously faded as economists now turn themselves inside out, revealing the rotten intellectual foundation for their forecasts, to maintain that hopeful line.

The disappointing [retail sales] report prompted Michael Feroli of JPMorgan Chase to revise his estimate of second-quarter economic growth to 2% at an annual rate from 2.5%.

Americans were expected to finally splurge in April after harsh winter weather and stagnant wages were blamed for crimping their purchases since December. A closely watched Labor Department report early this month showed private wages rising at the fastest pace in seven years in the first quarter.

Other factors also have fattened consumers’ wallets, including strong job growth, high consumer confidence, lofty stocks and low gasoline prices.

“The disappearance of consumer spending in early 2015 has now become even more mysterious,” Feroli says.

The more “mysterious” this is to economists, the more businesses are going to lose that faith and head to that final break, and not just in inventory.

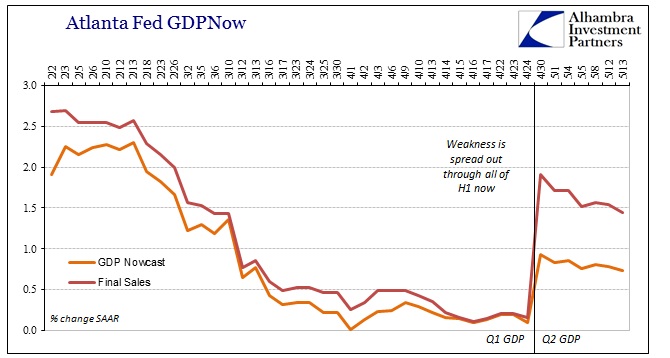

The fact is that even 2% GDP for Q2 is highly optimistic, though par for the course from the mainstream. The Atlanta Fed’s GDPNow tracking model, which was almost exact on Q1, is at just +0.7% for Q2. With revisions set to take Q1 likely to somewhere between -0.5% and -1.5% (depending on a few factors deep in the BEA’s models), that would mean the entire first half of 2015 is in very good danger of being negative on GDP; and I happen to believe +0.7% in Q2 is being charitable (PCE at 2.6%, with the worst retail sales figures of the recovery and some of the worst in the entire series in April? Imputations and Obamacare spending aren’t going to be that “good”).

In that case, it would be less likely that businesses would retain the inventory or any of the other plans they have based solely on economists getting it right this time. A negative H1 2015 would all but end any thoughts of a “transitory” “anomaly” no matter how much Janet Yellen will plead and obfuscate. Instead, thoughts will likely turn back to 2008 when we saw exactly this same process play out, with economists taking investors and a good many businesses over the cliff with them.

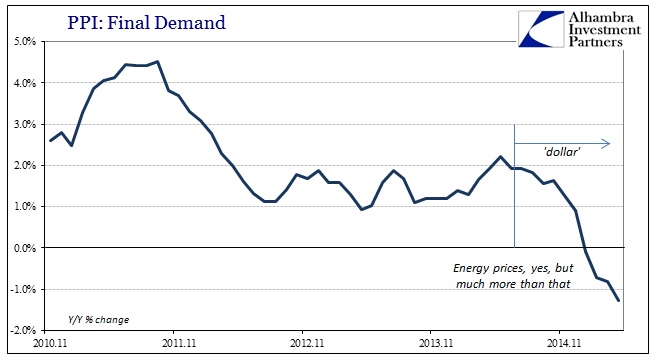

There are some incoming indications that lean already in that direction, including this morning’s PPI report. It is too easy to dismiss the PPI as solely a product of petroleum related to the “rising dollar” (a “dollar” that has been, with a proper interpretation as wholesale finance, anticipating just this sort of determined negativity). Total PPI: Final Demand Goods less energy was negative in April as February. Further, on the services side, which includes the retail and wholesale supply chain, the trade PPI was down 1.5%, 0.2% and 0.8% in the past three months. That looks a lot like the opening rounds of inventory liquidation.

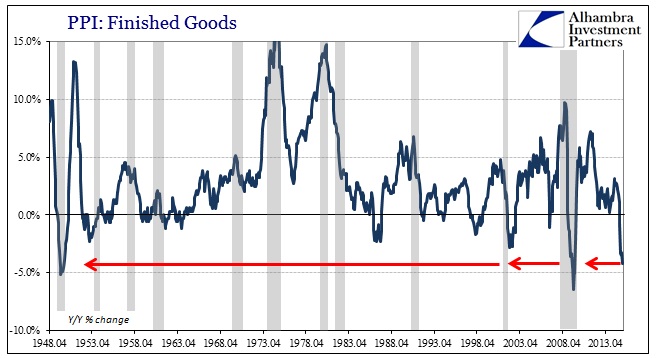

The overall PPI is at a level that is consistent with that view as it takes on recessionary form. The -4.2% year-over-year change in finished goods is equal only to the Great Recession itself.

This is much, much more concerning that just oil prices shocked by the good fortunes of sudden production from shale plays. The PPI is demonstrating, as retail sales, that there is enormous and still-building negative pressures that are in danger of breaking the longer this “transitory” garbage continues, especially as it remains “mysterious” for the mainline baseline of economists and FOMC members.

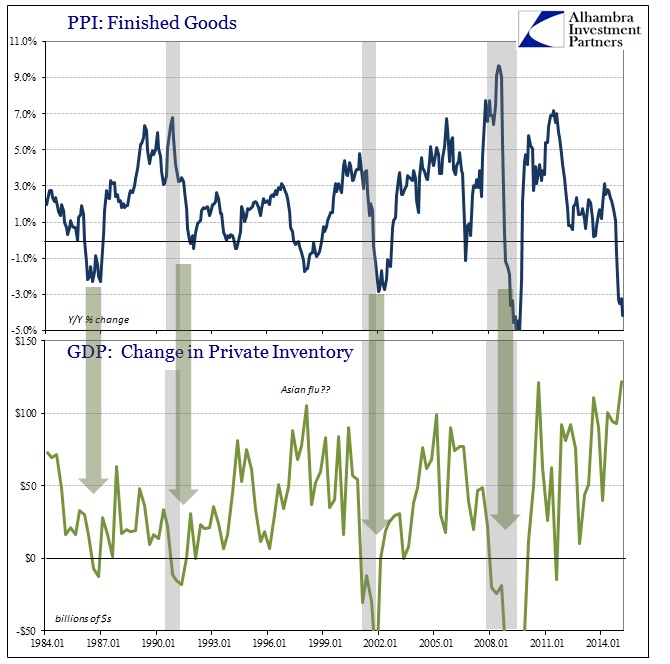

In fact, the history of the PPI coincides, with only one exception, to a decrease in inventory as picked up by GDP estimates.

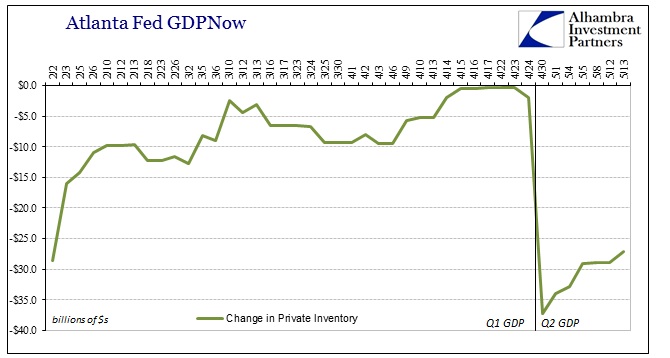

With the exception of 1998, the correlation is quite consistent. The Atlanta Fed’s GDPNow tracker itself is forecasting/picking up the expectations for a sharp, but not yet devastating, inventory liquidation in Q2.

They did forecast that same liquidation idea for Q1, but it didn’t last long and, once more, you have to wonder how much the incessant aberration, transitory, anomaly talk might have interrupted that. So further weakness, even consumer recession itself, extending into Q2 endangers that proclivity to “ride it out.”

From a very broad perspective, we already have what looks like contractionary pressure in consumers for various reasons, including healthcare and a lack of wages. The alternate view is instead based on dubious statistics of increasingly dubious arrangement. Now we are seeing some initial signs of that shifting into the next stages, infecting deeper and penetrating wider. All of that could, certainly, turn around once more, but the longer this goes and the more that is pulled into the “vortex” (to pun around these orthodox dismissals) the less likely that will occur.

The wild card maybe if the bond market is correct in its “hope” for the FOMC to not only ditch their present suicidal course but to also gain a QE5. I can’t fathom as to why that might excite anyone but the habitual stock rationalizer, but you never know in that it may take some edge off business nervousness. The assumed power of QE is eroding quickly anyway, a lesson being learned the hard way as I write, but it isn’t quite exactly knowable how the economy might respond again. The deeper this goes before the FOMC might even get to that point, the less relevance even a big QE5 might have at that point (monetary history is always, always one of being too late due to overestimation and total misunderstanding; see: 2008).

It is a cornerstone of orthodox economics that recessions are not just emotion and pessimism but spring out of an exogenous “shock.” There is none to be found here in sharp contrast to 2008 which at least had a deep financial panic. However, the trajectory of the economy since 2012 has been seeded by a distinct lack of growth especially in wages and incomes – what economists have been taking as slow but steady growth was actually much more nefarious. We may find out that recession shock includes just generic and basic attrition; that “demand”, despite all the attention and “stimulus” given it, can only hold out for so long without any actual (as opposed to purely statistical) alleviation.