As I noted yesterday with US housing construction, there has been a very unusual amount of emphasis added to the month-to-month changes of various indications. Maybe that is no more than normal, but it seems as if the confidence displayed in the minutiae has been amplified. Given the circumstances, that is both understandable and reprehensible at the same time.

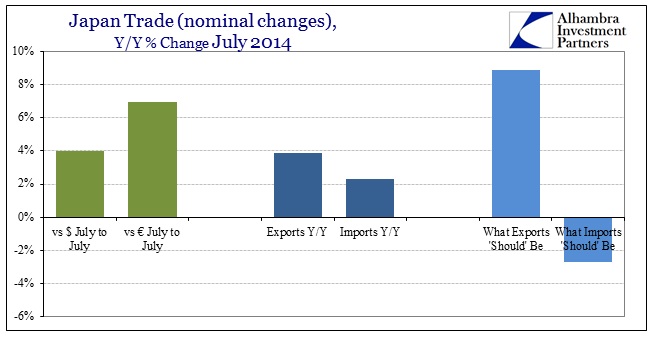

The commentary on Japan’s July trade figures is a perfect example of that. There is much being offered as certainty over a tiny advance in exports. That is undoubtedly an improvement over the nominal declines in May and June, but reduced standards should not apply in any cases let alone where monetary intrusion has been downright immense and historic. You don’t run a multi-trillion yen program for 3.9% in one month as a “bounceback” toward epic revival.

That sentiment is further reinforced by the degree to which exports are supposed to be leading this “recovery.” Yet, again, the slightest indication toward the “right” direction will be extrapolated. To wit:

Overseas shipments rose 3.9 percent from a year earlier, the finance ministrysaid in Tokyo today. That’s higher than the median estimate for a 3.8 percent gain in a Bloomberg News survey of 28 economists. Imports rose 2.3 percent, leaving a deficit of 964 billion yen ($9.36 billion).

The rebound in shipments may help Prime Minister Shinzo Abe to raise the sales tax again after boosting it to 8 percent in April. The economy is forecast to expand an annualized 2.9 percent this quarter after contracting 6.8 percent in the April-June period, as consumers and businesses cut spending after the tax increase.

The amount of blatant framing in those two paragraphs alone from Bloomberg is indicative of desperation more than anything else. On a currency-adjusted basis, exports may have “beaten” expectations by the smallest amount (without ever mentioning that imports were expected to decline rather than increase in tandem) but the increase in nominal terms was still less than the trade-weighted change in the yen:

If this is the basis for another tax increase then the level of sanity left in monetary policy and unjustifiable faith in it is plumbing new depths. By any reasonable observation of trends, which is far, far from ambiguous, Japan’s expectations for a trade-led renaissance has gone about as badly as possible. I don’t think there are any regression models or Monte Carlo simulations at the Bank of Japan that would have predicted what has taken place as even a “triviality” or six-standard deviation “impossibility.” In other words, Japan has “bested” the forecast “worst” case by some considerable amount.

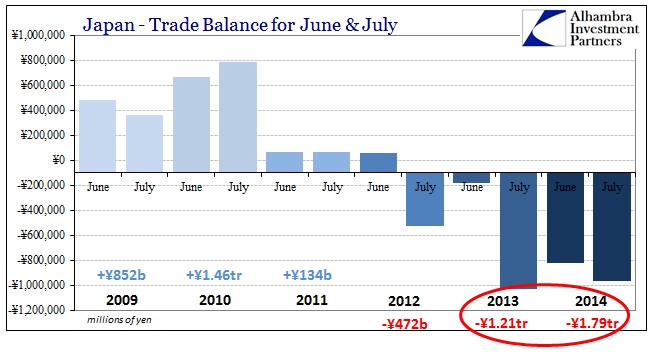

The trade deficit in the first quarter was absolutely immense, of historic proportions not just for Japan but for almost any nation outside of any economic system beyond nascent development. If that was driven by importation ahead of the tax increase (which, as a reminder, was not supposed to happen at all since it was fully expected that any such pulled forward activity would largely be domestic in nature) then the second quarter and beyond “should” have seen a massive improvement in the trade balance.

July 2014 was only a slight improvement over July 2013, which is itself indicative of that deterioration. Combined with June, however, the two months are a further disaster that confirms its ongoing defilement:

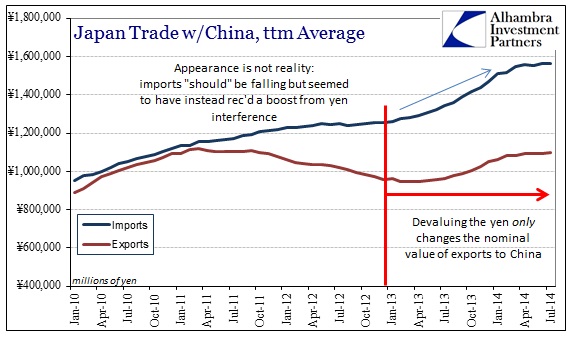

The very purpose of devaluing the currency is to ensure the opposite actually takes place, which is why Japan’s current reality is far, far worse than any envisioned “worst” case. Nobody models the exact opposite of intent; they only anticipate that the actual course might underperform to some crafted variation.

These observations should disqualify each and every one of those expectations and the theories by which they were incorporated. Orthodox economics stays far too close to the surface to be of any use in the real world – everything is generalized and generic without any thought or impression of the vast and largely unmeasurable (by current techniques and statistics) interactions of a highly complex system. For the economist/regressionist, all that matters is generic currency devaluation leading to generic export activity without pause over how and where that might happen – and how and where counterforces might thwart the effort (and then some).

As I have pointed out far too many times to recount, this monetary experimentation of the statistically generalities of orthodox theory is not (NOT!) a neutral proposition. And that is where Japan’s plight and pity is so very relevant beyond the Western end of the Pacific. It offers a pure look upon how monetary policy is not in any way, shape or form neutral. The Japanese economy is far worse off for its implementation, as the erosion in trade represents a very real impoverishment that is simply as yet fully appreciated.

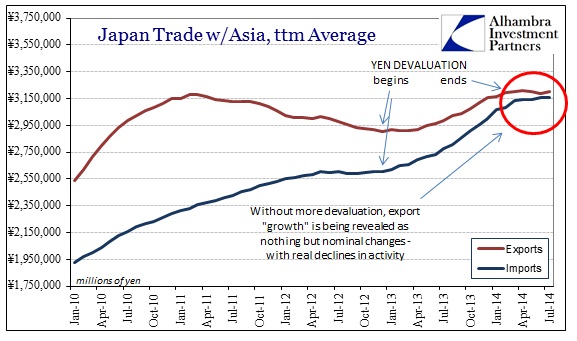

Exports volumes were 5.6 percent higher in July compared with December 2012, when Abe took office, even as his reflationary policies have driven the currency down 17 percent against the dollar.

Only in a regime desperate to court any positive number as “evidence” would the above count as anything remotely recovery-like. The scales of such “benefit” are, in my estimation, two orders of magnitude off; 5.6% over eighteen months after the gigantic monetary proportion? There is never any serious cost-benefit analysis done for monetary policy because the generalizations prohibit the exercise. It is just simply assumed to be fully beneficial on net, and where it becomes very apparent in the opposite (as above) past anything other than the shortest terms the monetarist instead retreats back into “neutrality” and looks instead for some other “mysterious” force or “headwind” to blame.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com