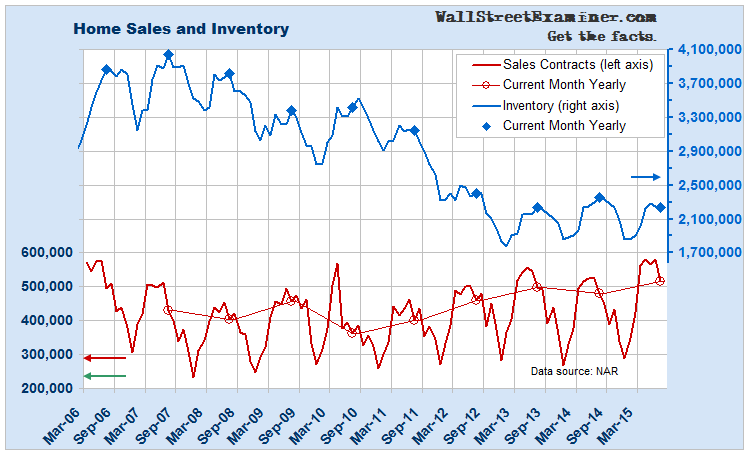

NAR data on housing sales showed the largest July decline since 2011, cutting the annual sales volume growth rate by 47% since March. However, while the growth rate is slowing, total sales volume was the heaviest for July since the peak of the housing bubble in 2005. Heavy but declining volume is a warning sign that you should heed.

Using the monthly seasonal adjustment error annualized, the Wall Street Journal and other mainstream outlets reported a 0.5% rise in July sales. In fact, using actual, not seasonally adjusted data, July sales fell by 11.5%. Sales always decline from June to July, but this July posted the second worst July performance since the housing crash. That contributed to the annual growth rate dropping from +13.5% in March to +7.2% in July.

Click here to view chart if reading in email.

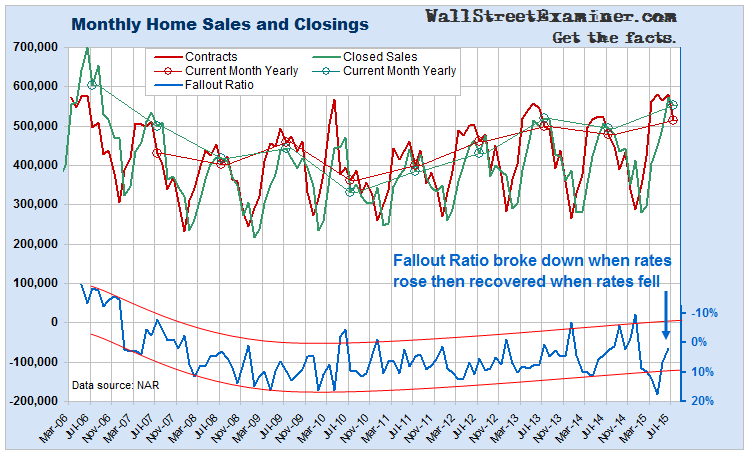

The fact that sales are slowing from bubble levels could be an early warning that the current version of the housing bubble is peaking. As house prices inflate and household incomes stagnate, affordability issues are beginning to have an impact in many markets. The market can ill afford any increase in mortgage rates. We saw evidence of that when the contract fallout rate spiked in April when rates briefly shot higher before settling back in ensuing months. Another rise in rates that sticks should be marked by another sharp increase in sales contracts that fail to go to closing.

Click here to view chart if reading in email.

In housing, volume precedes price. At the top of the housing bubble, sales volume peaked in 2005. As demand dried up and sales volume began to tank, prices peaked in most markets in 2006. The price crash began in 2007 as demand continued to fall.

With demand still high, there’s probably still time left in this market before it becomes essential to sell your house if it is you intention to move within the foreseeable future. But if mortgage rates should rise quickly at any time, the market could simply dry up, and you will be unable to sell at current prices. In the housing bubble of 10 years ago, while prices did not begin to decline until 2007, after 2005 it became increasingly difficult to sell. The market had dried up.

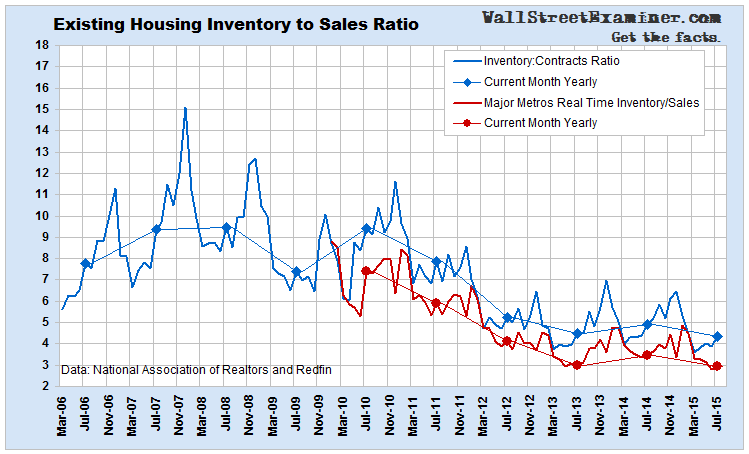

With the national median price inflating at an annual rate of just under 6%, the market seems not as overheated as in the Great Bubble. But the majority of big metro markets are inflating faster than that, and house price inflation in the old bubble markets is rising at double digits.The July sales and inventory data shows that a record low inventory to sales ratio is driving housing inflation rates.

Click here to view chart if reading in email.

This is a dangerous situation given the potential for rates to rise. Artificially depressed interest rates not only cause demand to increase above what it would be if the Fed allowed the money market to function normally, they also suppress supply. Normally as homeowners near retirement or become empty nesters, many would cash out their house and invest the cash for retirement income, either downsizing to a retirement home in Florida, or renting. Now, without the opportunity to earn a decent cash return on the funds, many owners opt to either stay put, or to rent out their properties for income rather than cash out.

For that reason, a material rise in rates would be a double barreled problem. It would adversely affect demand, forcing buyers to lower their bids or stay out of the market altogether. And it would induce more supply as the huge baby boom population cohort would see more incentive to sell and cash out if there was sufficient interest income available in the market.

If and when rates rise, prices could drop sharply just as they did in 2007-2010. This would destroy housing finance collateral values again and add to the woes of a financial system already strained on the recent disappearance of fictitious collateral value in commodities and in stock markets around the world. With debt no longer backed by adequate collateral value, another financial crisis would be upon us, and cash, as unappealing as it is at near 0% money rates, will once again be king.