In anticipation of tomorrow’s jobs frenzy, with all attention fixed to a statistic that was never meant to convey meaning in the current predicament (the unemployment rate is not supposed to be driven by the denominator), a review of context is in order. That is particularly true as I have detailed recent indications of a foul and maladroit trajectory for the economy in contradiction to mainstream interpretations. This morning’s post was a poignant example – the reason for the US economy’s conspicuous lack of demand is its conspicuous lack of productive circulation.

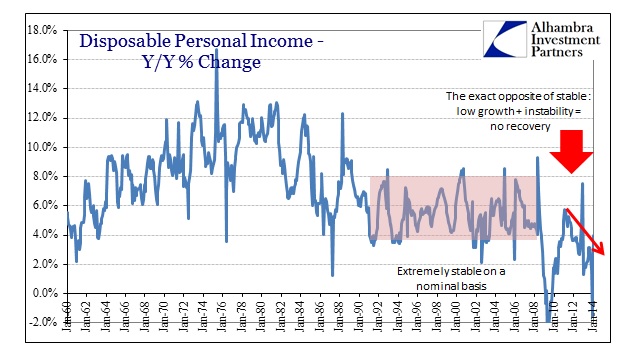

It doesn’t take much to see a drastic shift in income behavior during this “recovery.” But even this clear dysfunction hides much deeper dimensions of stress and imbalance. Disposable income includes every form of it, from interest and dividends to government transfer payments to the subtraction of taxes paid. In other words, a smaller proportion of total income is derived from productive activity.

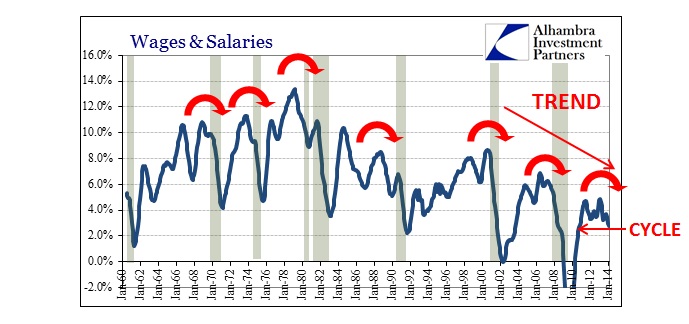

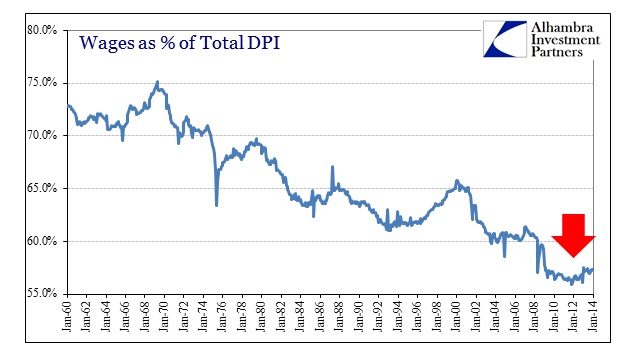

Wage growth has not kept pace with overall income, more than suggesting financial-driven concentration (aided by the increase in government transfers). In 1979, wages constituted just less than 70% of DPI; by 1996 it was 61.7% before rebounding in the late 1990’s to almost 67%. By the time the Great Recession began, wages were down to 60% of DPI, bottoming out under 56%. The proportion has only slightly retraced, now at 57.3%.

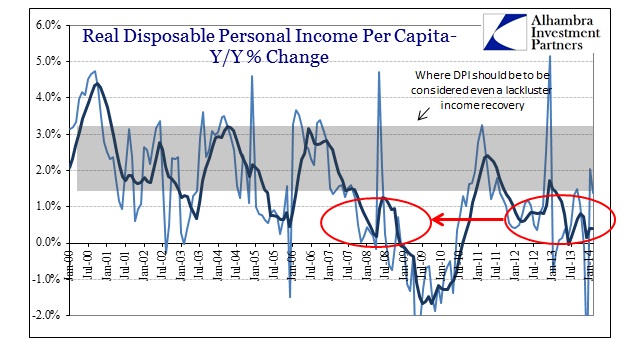

The net result is exactly what we see today, an economy that appears to be stuck for a lack of demand. However, that is but a symptom of the real problem, namely that financialism replaced productive behavior. Now we see the downside of that predicament as serious stresses in financial channels have disabled the current economy’s ability to replicate the illusion of stability from the previous periods. So households outside of the asset inflation channel are left with this:

If the labor market was growing and healing as has been proclaimed incessantly, then why haven’t these measures moved back toward what would fairly be considered “normal” behavior? This latest labor “surge” has yet to make even the slightest upward imprint on income in any form.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com