By Ellie Ismailidou at MarketWatch

Markets are pricing in a higher default risk for the energy sector than they did at the peak of the Great Recession, according to data from Schwab Center for Financial Research and Barclays.

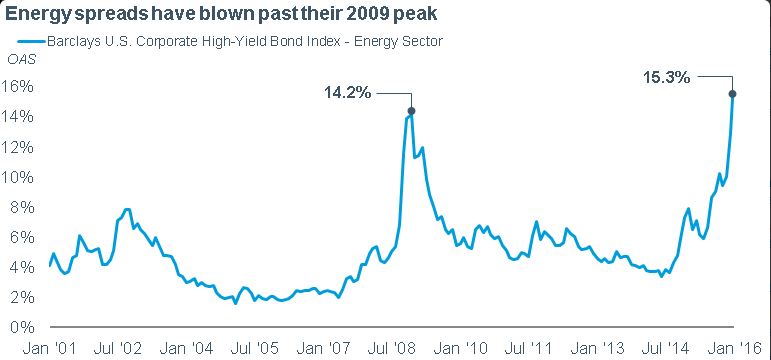

As continued concerns about oil’s global supply glut pushed crude futures below $27 a barrel, sparking a global stock selloff, energy spreads surpassed their 2009 peak.

A spread is a yield differential between the index and comparable risk-free Treasurys. Widening spreads mean investors are pricing in more risk for the energy sector and require a higher yield as compensation for their risk.

As the following chart shows, the spread on the energy sector of the Barclays U.S. Corporate High-Yield Bond Index, a widely followed gauge of market-priced risk, reached 1,530 basis points as of Tuesday’s close, compared with 1,420 basis points reached during the height of the financial crisis seven years ago.

One basis point is equivalent to 0.01% or one hundredth of a percentage point.

Credit-market spreads are often viewed as a leading indicator for equity markets. Spreads in the energy sector have been widening since the summer of 2014, and spiked over the past few months amid the recent rout in oil prices.

That dynamic has certainly played out lately. Stocks followed oil’s decline, weighed by sinking shares of energy companies. The energy sector was the worst performer on the S&P 500 SPX, +0.56% SPX, +0.56% on Wednesday, and is down nearly 15% since the beginning of the year. Meanwhile, energy companies led decliners among the Dow industrials DJIA, +0.76%

Widening credit spreads imply that “the market is clearly expecting the default rate to pick up, as the balance sheets of some of the riskier energy companies won’t be able to sustain this drop in oil prices US:CLG6 ” said Collin Martin, director of fixed-income strategy for the Schwab Center for Financial Research.

But there could be a silver lining, some analysts noted, as when energy companies’ cash flow turns negative, it could eventually lead oil prices to reach a bottom.

“At current prices the cash flow from the average producing well is estimated to be barely positive,” said James Meyer, chief investment officer at Tower Bridge Advisors, in emailed comments.

Profits are negative for most of the world’s energy producers today factoring overhead, depletion and depreciation costs, Meyer said.

“As oil gets below $25, cash flow begins to turn negative, meaning the more one produces, the more one loses. Clearly, that isn’t a scenario that can play out very long,” Meyer added, eventually leading to a bottom in oil prices.

Source: Default Risk in Energy Debt Seen as Higher than Great Recession – MarketWatch