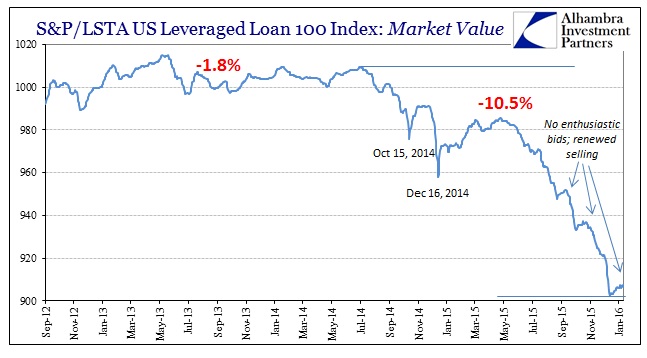

You almost have to marvel at the resilience shown in leveraged loan pricing over the past nearly month. Prior to the Fed’s rate decision on December 16, the leveraged loan market, as with the rest of the junk bubble, was sinking fast and furiously. Since then, however, despite great financial turmoil all over the world, and even in the places which had shown strong correlations to leveraged loans before (JPY, notably), the S&P/LSTA Leveraged Loan 100 has hung in there. Perhaps Janet Yellen’s influence still holds for something in these smaller spaces, instilling a bit of confidence (though no true buying vigor) to avoid at least the onrush of further selling.

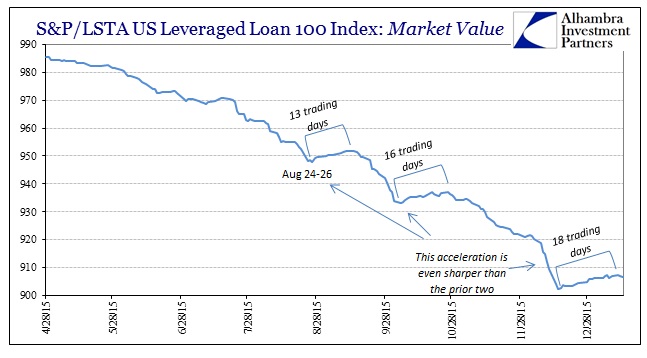

As enticing as that possibility might be to the conventional recovery narrative, I think in practice it more so conforming to something like fractal symmetry. In general terms, the selloff that preceded this pause was the largest and most intense yet, so it is easily within the realm of expectation that the counter-effect would be balanced.

As each successive selloff wave intensifies, the reset immediately thereafter seemingly gains a little more of the calendar. The current trend worked out to 18 trading days lasting through yesterday. It might be too early to dismiss today’s lower price as an end to that pause, but the indications that another selloff wave is building are too numerous to dismiss. Apologies to Yellen and the FOMC, but I don’t think it was ever going to be that easy.

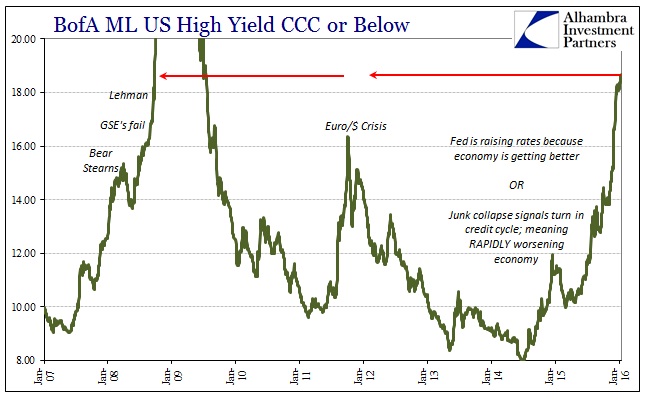

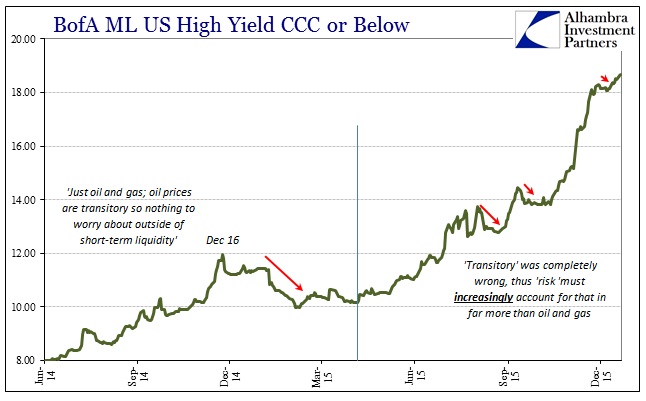

Starting with the junkiest of the junk, the triple-hooks, there really wasn’t much of a retrace at all nor even really a pause through December. While there was something of a brief respite after the terrible blow up in late November and the first two weeks of December, the implied yield on the BofAML High Yield Master II Index is now at new “cycle” highs again and still rising. The last time we saw 18.68% here was September 25, 2008; the very edge of the 2008 panic. This is not to say that this segment of high yield expects something similar in financial terms, only that the probability of a similar economic outcome in devastating junk obligors can no longer be ignored.

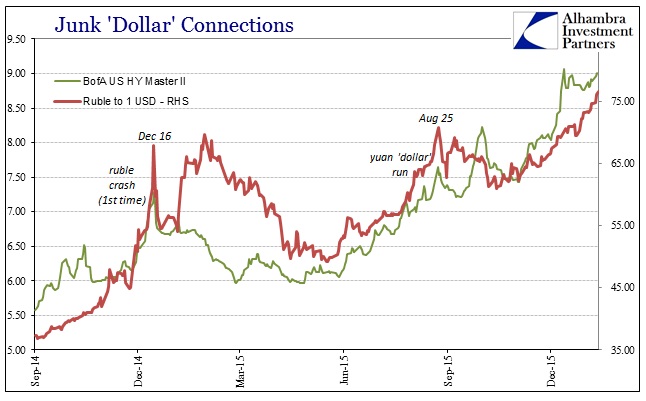

The Master II Index, by comparison, has a ways to go to catch up in that view but it, too, has returned to the selloff trend. That much was seemingly determined by of all things the Russian ruble, which provides significance in terms of the relationship between the junk bubble and general “dollar” liquidity.

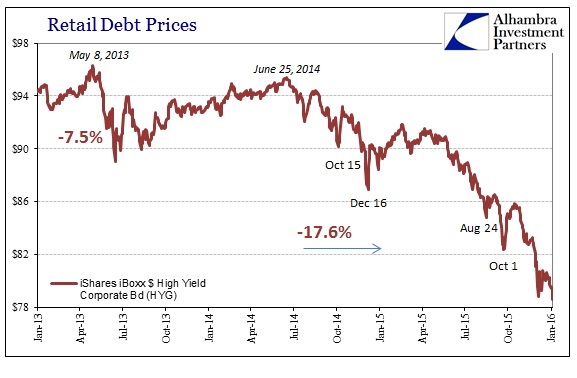

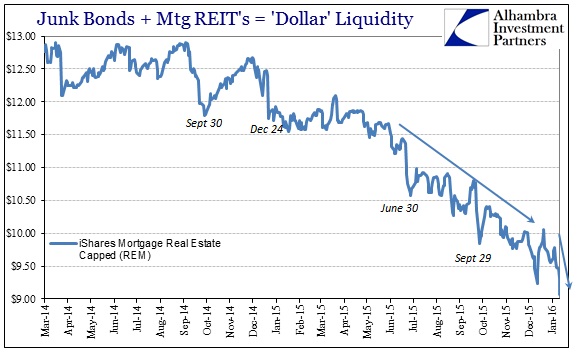

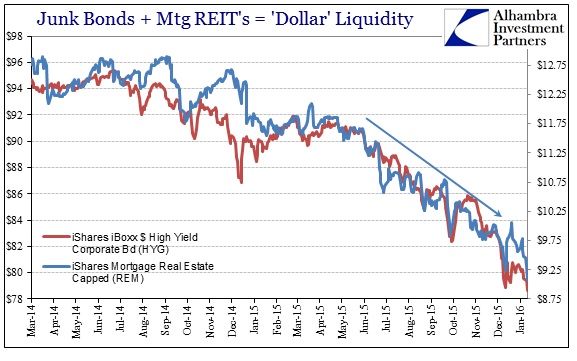

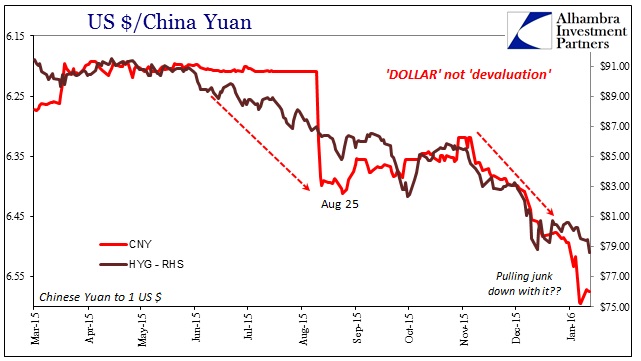

Beyond those, we saw new lows in the retail junk proxy, the ETF HYG. That was also true of another liquidity proxy, the mortgage REIT index mimic REM. Like the ruble and the Master II, the close relationship between HYG and REM tells us a lot about the financial relationship between economic expectations and general perceptions of “money” availability to put them into effect. I think that correlation also details the assignment of credit cycle expectations as a function of that liquidity.

All of that raises an intriguing question that is somewhat chicken and egg. While Chinese financial conditions were terrible to the point of near disaster, junk bonds were, on the whole, almost inconceivably placid at the same time. But now that Chinese factors regarding the likely Asian “dollar” state have gone on and gone so far, it appears as if the US junk bubble can no longer idly withstand it. Again, all indications here are for renewed selling and participation in the “run.” Does that mean the Asian “dollar” is driving the junk bubble?

In looking at it more closely, it seems along those lines as if that might be the conditional setting; with China and Asia more cause to the junk effects. It’s not nearly as strong a correlation (above) as that between CNY and WTI, but there is enough to offer that kind of suggestion even if it doesn’t answer the divergence in December. In the end, it may not matter as, again, more and more indications are picking up building pressure directed toward renewed selling. Whether from China and the Asian “dollar” is not abundantly clear, but high yield may soon be heading for CNY regardless.