Gallup’s survey of consumer spending in February conformed largely to the orthodox script of weather-beaten households forgoing January purchases. The large drop in January was thus assumed a temporary condition that would simply spillover into February. And that was the sense gained by Gallup’s results, with a large increase in February over January.

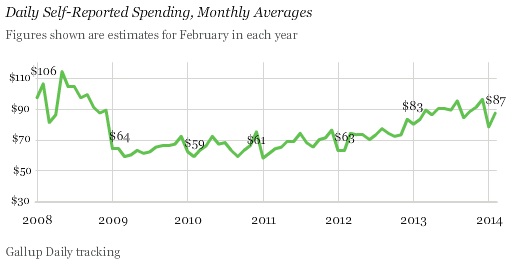

Americans’ daily self-reports of spending averaged $87 in February, a solid recovery after dipping to $78 in January, which had been the lowest estimate in 14 months.

While that focus of January-to-February led this analysis into more optimistic conjecture, it left off another pertinent observation. Outside of a few monthly peaks, spending appears to have flat-lined overall since the early portion of 2013 (clearly captured in Gallup’s own results above). Since concentration remained on the January to February change, Gallup left its February report with that noted sanguinity and confidence.

Spending typically picks up over the course of the year, and Gallup has observed increases from February to March the past four years. This year’s strong February spending could be a positive sign of things to come.

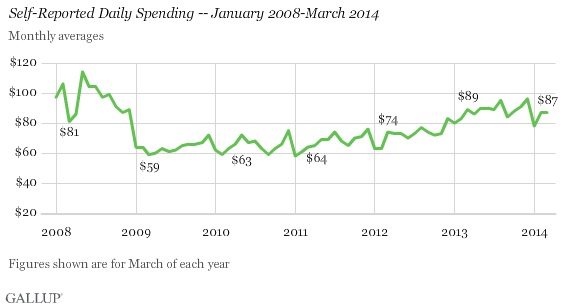

With the release of figures for March, it seems such weather-worn optimism was not as much warranted. There was, in fact, no change at all between February and March despite a much more favorable national weather pattern.

Worse than that, as Gallup commendably pointed out without qualification, March 2014 spending was actually below March 2013. That was the first negative March comp since 2009.

But the stall in spending, both month-over-month and compared with a year ago, most likely signals a continuation of the lackluster retail sales seen so far in 2014. Although government figures show that total retail sales, excluding motor vehicles (in line with Gallup’s definition of consumer spending), rebounded in February after January’s anemic sales, year-over-year sales were up by only 1.6% in January and 1.3% in February — the weakest retail growth figures since November 2009. Given the Gallup data, it is reasonable to expect that the March report, due April 14, will show more of the same.

That presents a fair and reasonable recap. What is left out is why. Again, as the calendar advances further away from winter we can put this silly appeal to temperature correlation behind. I have no doubt about the cleverness with which economists can find excuses for this sinking economic trajectory (the latest being demographic), however it should be increasingly clear that there is a larger macro component at work here (or, more precisely, a lack of work).

Thus the explanation for January’s deplorable state is not cold weather, but that consumers have reached an exhaustive point. Given that holiday sales were the weakest since the Great Recession, and further that even reduced spending in December led to such a slide in January, that does not position the economy for a robust rebound but rather toward the denouement of a cyclical slope inside a structural ruse.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com