We will find out Sunday if all the rumors are correct (and by how much) about a significant portion of European banks either failing or still with their “feet wet” after the usual comedy of the stress tests. You never really know with these types of weighty events, as there are all sorts of biases and trading considerations in where these rumors come from and how they manifest. However, the ECB’s history here is far less than ideal, which places them in a precarious position of a huge conflict of interest.

Given what the ECB is trying to accomplish with regard to lending, there is enormous pressure to simply “pass” everyone, or at least most of them, in order to move in that direction (though it is as yet unclear as to why struggling banks will suddenly lend since their struggles have not magically been contained to this point under any of the dozens of “liquidity” programs started and completed by now).

For his part, Mario Draghi has been talking and talking the “stimulus” game, and I have little doubt that he is trying to assuage growing nervousness not just about the direction of Europe (economy and finance) but now to questions about depth once more. To that end, I have to give him credit as it appears, somehow, as if his words still carry some weight. Credit markets in Europe have paused this week, and whether that is the reverse condition of widespread stress test “failures” bringing about even more “stimulus”, as might relate to why Draghi has been so vocal this week, should be cleared up by Monday. You would think that rumors of so many failures would be driving credit markets even more bearish, so I have to assume that contrary take here (or that markets are unconvinced by the rumors).

For the most part, European credit, the primary drivers of ECB ire at the moment, has moved to the sidelines for whatever ultimate reason.

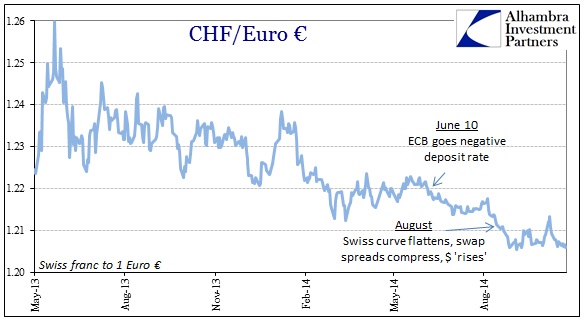

The only indications of any merit to my own attention are the shifts in Swiss currency and swaps. The franc has moved upward once more (against the euro) to the closest “challenge” to the peg since September 4. That would indicate cash market hedging or laying off some risk should this weekend go badly (or Europe stumbles further).

Against that setting, swap spreads in Switzerland have been moving around, but particularly at the shorter end in reversal of the prior week. That, too, could be hedging, perhaps even against the cash market and the franc (if everything goes “well”). In other words, I don’t think there is much conviction in European credit this week, a marked change from the previous week’s drama (including the “dollar”).

On net, then, I interpret this to be somewhat the opposite of how US credit viewed conditions evolving in 2014 (“wanting” to believe in the FOMC’s narrative, but hedging carefully against it) with Europe seemingly “wanting” to believe the downside but hedging carefully in case it doesn’t turn out so bad (or that Draghi goes someplace even more drastic). I think that stays with the theme that the ECB (and other central banks) have lost credibility, and no wonder given the direct rejection of all these accumulated attempts – revealed impotence is as much a rebuke.

At some point, even heavily goosed markets will reach their limit – we are not there yet, but I believe it is all still trending that way. You can only go so long, as a central banker totally committed to monetarism, without actual recovery and growth. Beyond some point, Draghi’s words will be just that and nothing more.