By Bradley Olson & Erin Ailworth

Crude-oil prices plunged more than 5% on Monday to trade near $30 a barrel, making the specter of bankruptcy ever more likely for a significant chunk of the U.S. oil industry.

Three major investment banks— Morgan Stanley, Goldman Sachs Group Inc. andCitigroup Inc.—now expect the price of oil to crash through the $30 threshold and into $20 territory in short order as a result of China’s slowdown, the U.S. dollar’s appreciation and the fact that drillers from Houston to Riyadh won’t quit pumping despite the oil glut.

As many as a third of American oil-and-gas producers could tip toward bankruptcy and restructuring by mid-2017, according to Wolfe Research. Survival, for some, would be possible if oil rebounded to at least $50, according to analysts. The benchmark price of U.S. crude settled at $31.41 a barrel, setting a 12-year low.

More than 30 small companies that collectively owe in excess of $13 billion have already filed for bankruptcy protection so far during this downturn, according to law firm Haynes & Boone.

Morgan Stanley issued a report this week describing an environment “worse than 1986” for energy prices and producers, referring to the last big oil bust that lasted for years. The current downturn is now deeper and longer than each of the five oil price crashes since 1970, said Martijn Rats, an analyst at the bank.

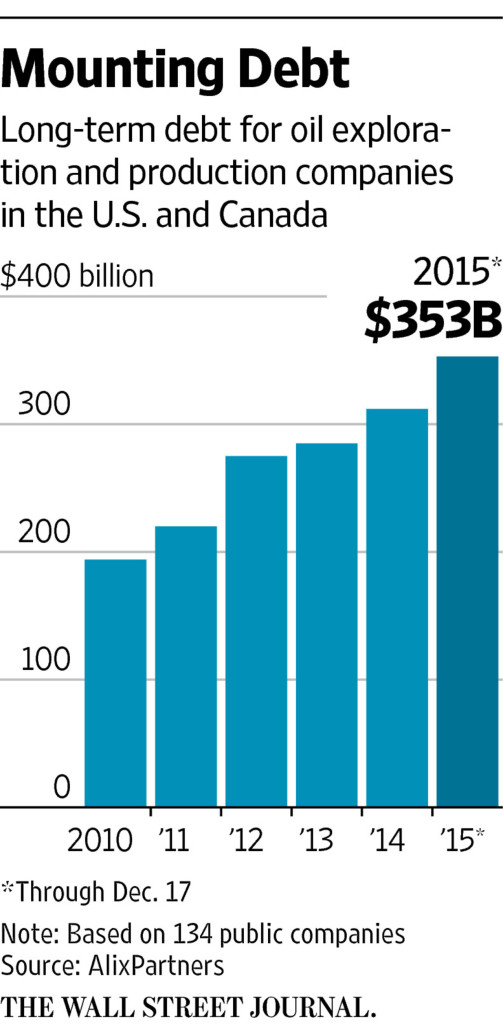

Together, North American oil-and-gas producers are losing nearly $2 billion every week at current prices, according to a forthcoming report from AlixPartners, a consulting firm, that is set to be published later this week.

“Many are going to have huge problems,” saidKim Brady, a partner and restructuring adviser at consultancy Solic Capital.

American producers are expected to cut their budgets by 51% to $89.6 billion from 2014, a reduction that exceeds the worst years of the 1980s, according to Cowen & Co. There is no relief in sight: The oil glut is expected to continue well into 2017, according to several banks, analysts and industry executives.

With little likelihood of an oil price rebound in the coming months, the companies that tap shale wells from Texas to North Dakota are splintering into the haves and have-nots.

Energy companies that took on huge debt loads to finance their slice of the U.S. drilling boom have no choice but to keep pumping to generate cash for interest payments. As they do, they are drilling themselves into a deeper hole. Companies including Sandridge Energy Inc., Energy XXI Ltd. and Halcón Resources Corp. all paid more than 40% of third-quarter revenue toward interest payments on their loans, according to S&P Capital IQ. Representatives for Sandridge and Halcón didn’t respond to requests for comment.

Greg Smith, Energy XXI’s vice president of investor relations, said the company has bought back more than $900 million in bonds to reduce interest expenses.

Some of the strongest operators with superior assets have locked in oil prices well above $50 a barrel this year through hedges, which serve as a kind of insurance policy against low prices. Even those producers with better balance sheets say they will keep pumping more. ConocoPhillips and Pioneer Natural ResourcesCo., two of the most successful shale operators in the U.S., plan to boost production this year.

Scott Sheffield, chief executive at Pioneer, said pulling more oil and gas out of the ground makes sense even though prices are low because the company’s most efficient wells still make good returns. Plus investors keep rewarding growth at energy companies considered to be solid.

“The ones that announced production declines into 2016, their stocks are getting hammered,” Mr. Sheffield said in an interview. Pioneer’s shares have lost about 16% in the past year, but the company successfully sold $1.4 billion worth of new stock last week in an oversubscribed equity offering.

Companies that drill themselves into a hole so deep they cannot escape will be forced to sell assets or tap revolving credit lines. That is a tricky proposition given that many energy players expect to see their borrowing bases cut as debt limits are reduced in light of the plunging value of oil-and-gas reserves in the ground.

More than $100 billion from private-equity firms is waiting in the wings to scoop up assets that are sold either before, or after, bankruptcy, experts say. But major corporate mergers and acquisitions remain unlikely, because any buyer would have to pony up voluminous amounts to cover the debts of a seller. Instead, opportunistic firms are waiting for the wave of bankruptcies to arrive. Once debt is wiped out, oil-and-gas fields will be cheap. The longer the oversupply sticks, depressing prices, the more companies will falter, leaving their assets ripe for picking at a discount.

“There’s no reason to be anybody’s savior,” said Chad Mabry, a senior energy analyst atFBR & Co. “If you can just get the assets out of bankruptcy, then you don’t have to save anyone.”

If an array of U.S. shale companies go bankrupt or assets fall into new hands and bondholders get crushed, bankruptcies will wipe the debt slate clean and lower the oil price needed to fetch a profit.

Projections for losses on energy loans continue to rise broadly, and some banks have started to raise their own forecasts for such losses. In a biannual review by a trio of banking regulators, the value of loans rated as “substandard, doubtful or loss” among oil and gas borrowers almost quintupled to $34.2 billion, or 15% of the total energy loans evaluated. That compares with $6.9 billion, or 3.6%, in 2014.

The largest U.S. banks have relatively small energy portfolios in the context of their overall lending. For instance, in the third quarter Wells Fargo & Co.’s oil-and-gas loan exposure was 2% of its total loans, roughly $17 billion, according to company filings. The bank, one of the largest energy lenders in the U.S., reports earnings Friday.

Since financial distress hasn’t been a good mechanism for slowing down U.S. oil production, many analysts fear that any pullback may come too late. U.S. government estimates pegged output at 9.2 million barrels a day at the start of 2016—1% higher than the start of last year when oil was trading for 40% more.

Source: Oil Plunge Sparks Bankruptcy Concerns – The Wall Street Journal