Search Results for: red ponzi

Red Ponzi Update: Chinese Businesses Are Running Out Of Time—And Cash

The first quarter is always tough for such businesses in China because of bonuses paid to employees, combined with the long Lunar New Year holiday. The coronavirus has supercharged the problem. ANZ Bank estimates that the quarantine measures will cost corporate China at least 2.6 trillion yuan ($372 billion) in cash flow in the first quarter, while consulting firm Gavekal puts the hit at around 4 trillion yuan.

Red Ponzi Plunging

It Is A Red Ponzi! China’s Debt-Entombed Economy Is Unraveling Fast

Said otherwise, unless China reboots its economy, it faces an economic shock the likes of which it has never seen before. Yet it can’t reboot the economy unless it truly stops the viral pandemic, something it will never be able to do if it lies to the population that the pandemic is almost over in hopes of forcing people to get back to work. Hence the most diabolic Catch 22 for China’s social and economic system, because whereas until now China could easily lie its way out of any problem, in this case lying will only make the underlying (viral pandemic) problem worse as sick people return to work, only to infect even more co-workers, forcing even more businesses to be quarantined.

Red Ponzi Update—China’s Economy Far From Out Of The Woods

Earlier this month, over half of China extended shutdowns to contain the outbreak. Last year, those parts of China accounted for more than 80% of national GDP and 90% of exports. That disruption of the world’s manufacturing hub has severely hit supply chains globally, with companies still dealing with the fallout.

As China struggles to get back on its feet, with factories starting to reopen and workers trickling back, progress is slow. Returning workers need to follow quarantine orders, meaning factories are still operating at limited capacity.

% the year before.

https://www.cnbc.com/2020/02/19/xi-jinping-to-meet-chinas-2020-growth-target-amid-coronavirus.html

Red Ponzi Update: Sudden Clean Air = Accelerating Economic Shutdown

Specifically, Morgan Stanley suggested that real time measurements of Chinese pollution levels would provide a “quick and dirty” (no pun intended) way of observing if any of China’s major metropolises had returned back to normal. What it found was that among some of the top Chinese cities including Guangzhou, Shanghai and Chengdu, a clear pattern was evident – air pollution was only 20-50% of the historical average. As Morgan Stanley concluded, “This could imply that human activities such as traffic and industrial production within/close to those cities are running 50-80% below their potential capacity.”

Red Ponzi Update: Mind The Double-Think And Fake Facts

Of course, China is no stranger to Double Think: as Every put it, “a freely-floating, controlled currency; market-determined, state-directed interest rates; and free-trade mercantilism. Yet increase economic activity from here and the virus will spread, both internally and globally. Concentrate on just the virus, and the local and global economic impact will be enormous.”

Closed For Business! The Red Ponzi’s New Message To The World Economy

China has now placed hundreds of millions of its citizens under quarantine, leaving its economy grinding to a halt.

Workers can’t leave their homes. Factories are idle. Most (if not all) of China’s ports are no longer shipping. International flights are increasingly banned from the country. As PeakProsperity.com’s Chris Martenson details below, when the world’s #2 economy hangs up a big “CLOSED” sign, that’s going to result in a major negative impact on global trade.

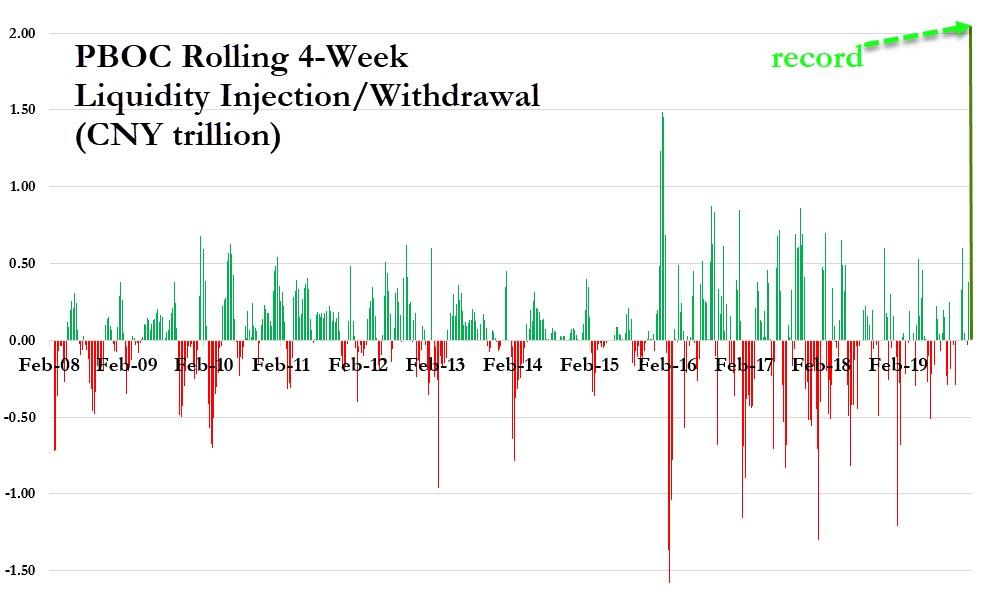

Whatever It Takes—Red Ponzi Version

Red Ponzi Wobbling: LNG Import Demand Crumbling As Virus Speads

Buyers of liquefied natural gas (LNG) in China are bracing for demand to be shattered by a virus epidemic that has killed 361 people, wiped billions off the value of companies in the world’s second largest importer of the fuel and threatens its growth.