April trade data for Chinese exports purportedly show a rebound forming, though its size and even legitimacy is still much in doubt. The fake Hong Kong invoice scandal of last year is making comparisons to this year difficult, but that doesn’t and won’t quell the extrapolations.

The export data are “somewhat inconsistent with the weakness seen in new export orders” in purchasing managers’ indexes from the government and HSBC Holdings Plc, said Barclays Plc analysts led by Chang Jian, chief China economist in Hong Kong.

This disparity doesn’t exclude the possibility of a rebound, only that any conclusions may need corroborative evidence to be consistent.

Exports fell 6.6 percent in March from a year earlier and plunged 18.1 percent in February, the biggest drop since the global financial crisis, based on previously released data.

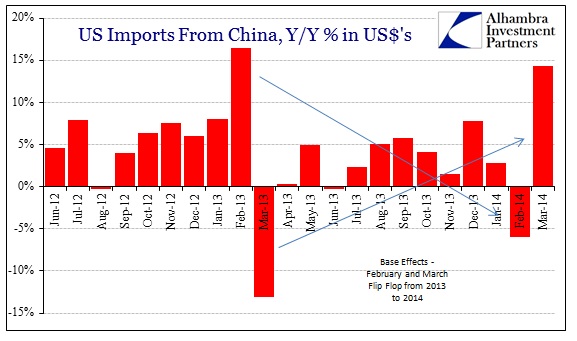

According to the Chinese figures, then, exports were still down in March after an atrocious February. That should be matched at the other end of the trade link in the destination countries. The problem, particularly for US trade with China, is that the Census Bureau estimated that imports from China rebounded in March rather than fell further as the Chinese claim.

Contributing to the confusion and inability to carve out straightforward interpretations is a clear base effect due to calendar issues and who knows what else.

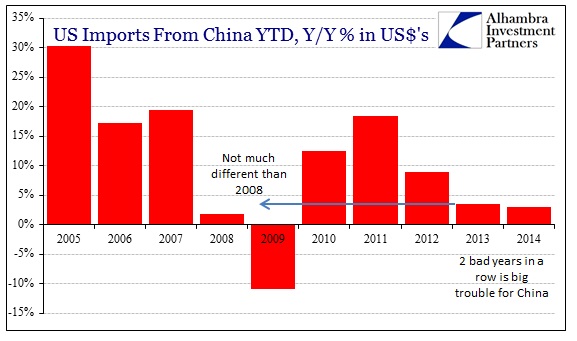

To clear up some of this mess, we can look at the figures YTD. What that shows is that the March rebound was only enough to partially offset serious weakness in earlier months.

That’s trouble for China because last year was just as feeble. Their entire growth and credit orientation is predicated on swift growth in end markets. Slow growth (or none) instead ends up feeding back as brewing credit issues from companies that were expecting robust growth projections to actually come to fruition in order to maintain the credit flow. After two years of this, accumulating defaults may just be inevitable.

To see these figures rise in March (or April, or whatever) should not be surprising because inventory cycles are far from linear. The ebb and flow is evident as firms try to assess future growth expectations as they relate to current business levels. After two (or three) really bad months, a rebound should take place and should be expected; however it is the net that is truly important to determine trend.

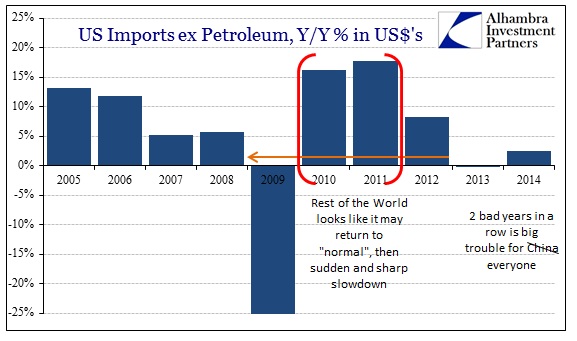

What is true for the Chinese import data was seen pretty much across the board. US imports picked up from nearly all destinations in March after a really bad start to the year. If you want to call that weather effects, fine, but, again, the net across the months is speaking about far larger and more pertinent implications than temperature.

In the first three months of 2012, total imports into the US were estimated at $552 billion. Import totals for the first three months of this year are only $547 billion, meaning that US demand is still running behind two years ago. That is not weather at all, but macro-driven weakness. If there are climate effects, they are only in the timing of the individual ebbs and flows.

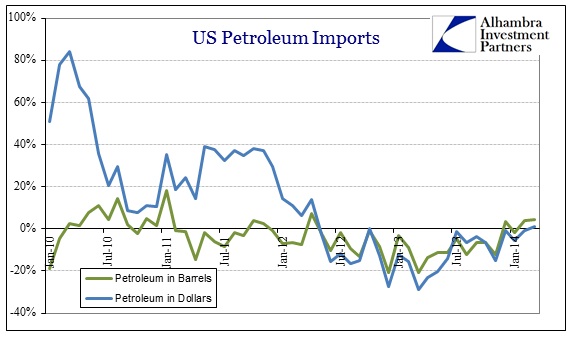

It must be noted, however, that some of the rebound in imports (not all, as there was a true widespread increase) was oil. The economic benefit of the past few years of not needing marginal expansion in importation of petroleum seems to have passed. For whatever reason, oil importation looks like it will again be a drag on growth unless whatever is causing this reversal again itself reverses (a new fracking find?). It doesn’t really matter if it is Canadian tar sand stuff, Saudi Arabian or Venezuelan (highly unlikely since production there is on a steady decline), in economic terms more imports will be a drag on future economy.

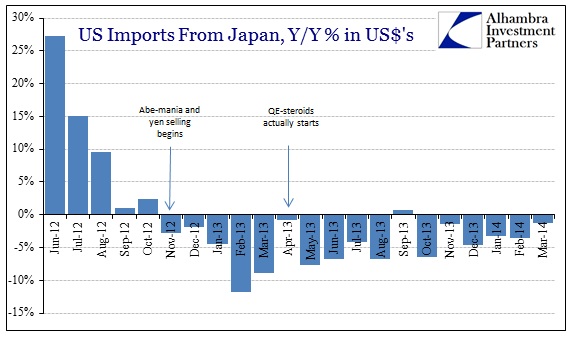

The one import originator that did not see a growth rebound in March was, unsurprisingly, Japan. Abenomics continues to underwhelm exactly where it was supposed to be indispensable and guaranteed.

There is nothing here to suggest a new trend that will get the world back on track to something more like historical growth. The results seem only to vary between troubling and less trouble. And that is trouble.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com