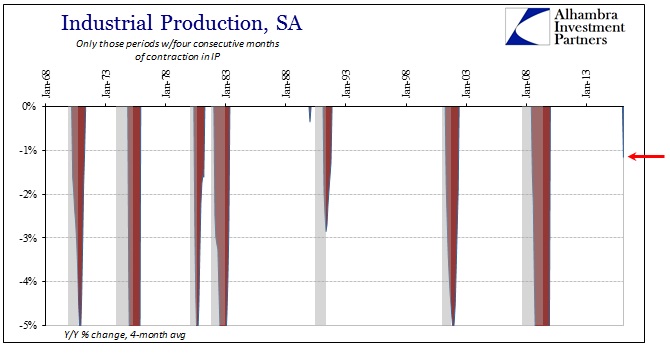

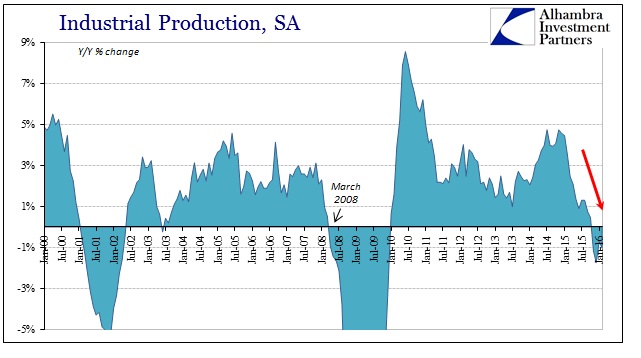

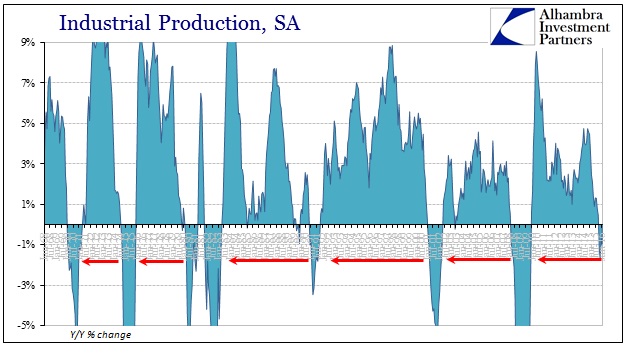

US Industrial Production contracted for the fourth consecutive month in February, falling 1.03% year-over-year. It was the third drop of more than 1% in those four months, leaving the 6-month average now at -0.57%. A single month of -1% is usually associated with recession, let alone three of the past four and a negative six-month average. Except for one four-month period in 1952 and one in 1934, four straight months of IP contraction meant recession every other time in figures that date back to 1919.

Despite the widespread slowing in US industry, inventory remains as abundant as ever and still growing if now more slowly. These estimates on industrial production suggest serious omissions from activity and economic momentum but really not yet any sort of intensity or escalation. I still believe that a very bad sign given that industrial activity may already represent enough deceleration to be consistent with past recessionary appearance but not yet fully involved like one.

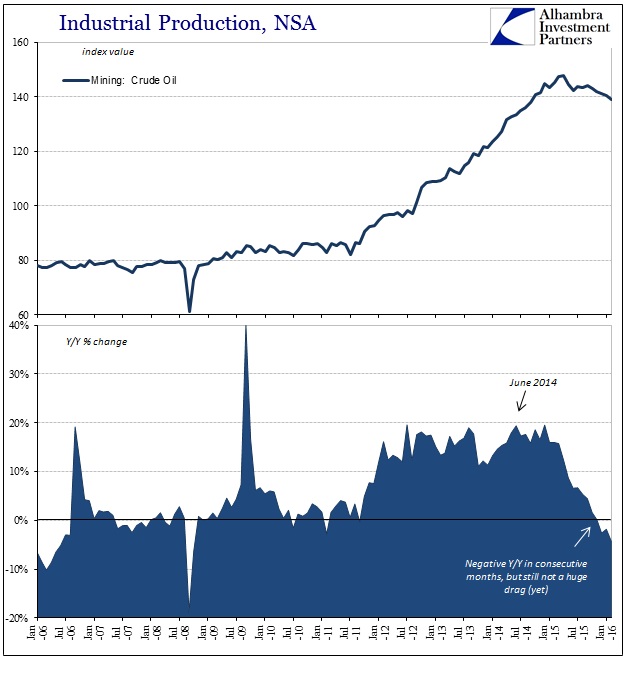

The deceleration is widespread and has only recently seized oil production. Even still, the contraction in industrial activity attributed to energy production is not yet large but it is persistent and that does seem to be the direction. The only factor that at this point might force deviation from that likely track is if oil inventories begin to fall quickly enough that production could be restored. That scenario, of course, depends on “demand” suddenly shifting which is not at all indicated by the rest of these industrial estimates (nor financial).

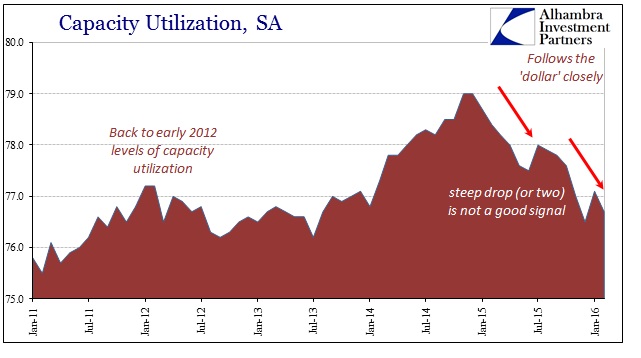

Capacity utilization dropped to just 76.7% in February, only slightly above the low registered in December (revised). Again, that indicates not just widespread industrial slowdown but also inefficiency that usually accompanies it and turns a slowdown into a wholesale adjustment. It is possible that commodity prices have relieved some of the pressure on manufacturing, in particular, insulating those businesses from having to make heavier resource adjustments (especially labor).

However, no business is going to pay labor to do less unless they think that labor will be needed and necessary in relatively short order. The longer this deceleration/contraction lingers, the more likely greater adjustments will be forthcoming – leading only to more cutbacks in “demand” and then further adjustments in production and so on.

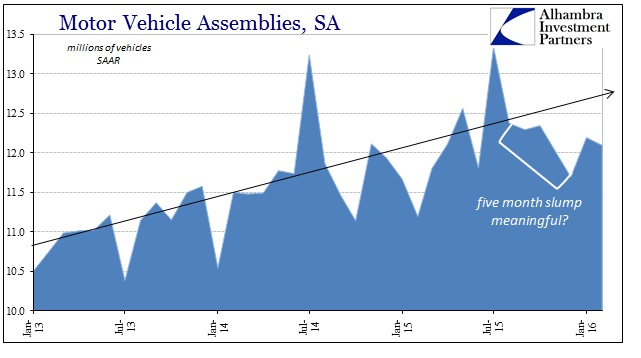

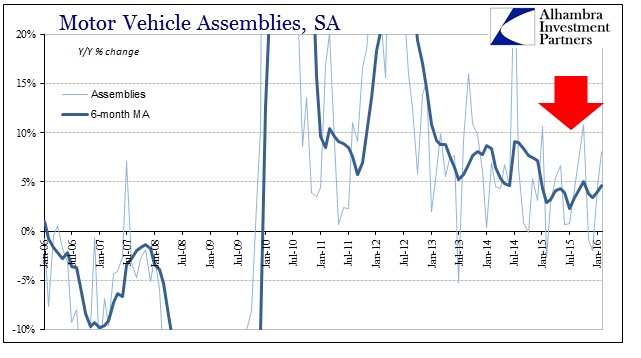

The fact that this slowing overall (and its inventory component) may have finally reached the apex of the industrial “recovery” in the US suggests getting closer to such finality. Motor vehicle assemblies, a measure of domestic auto and transportation production, are notoriously volatile and difficult to interpret without an absolutely clear trend. Given those data complications, there may be just the slightest hint that the very large inventory of automobiles that appeared last fall may have started to affect auto production.

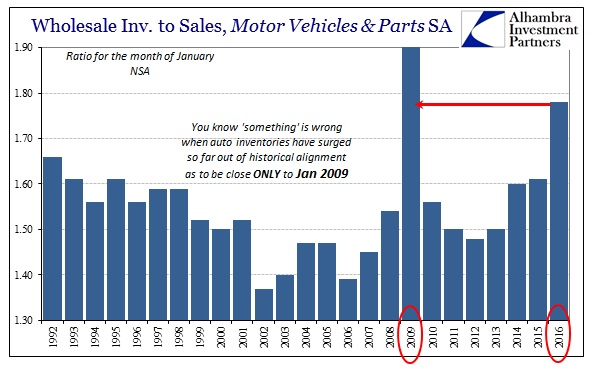

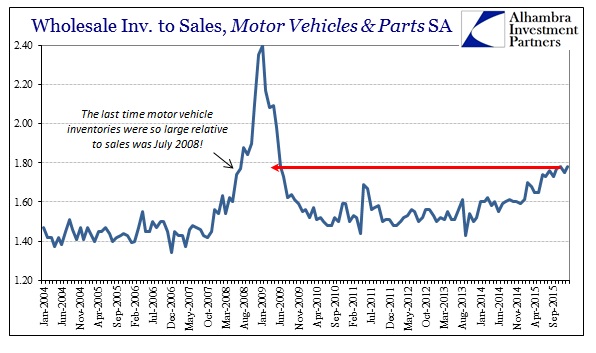

Motor vehicle assemblies data suggest a possible “slump” starting around last August (the timing certainly fits) and lasting through at least December (with January offering something of a rebound, though it isn’t clear how much of that is due to seasonal adjustments). The Fed estimates total assemblies at just over 12 million (SAAR) in February, down slightly from January but flat, mostly, since last April and more than 1 million below the peak in July. At the same time production has come down by however much in reality, auto inventories have simply surged and have been far out of historical alignment (comparable only to the Great Recession) ever since.

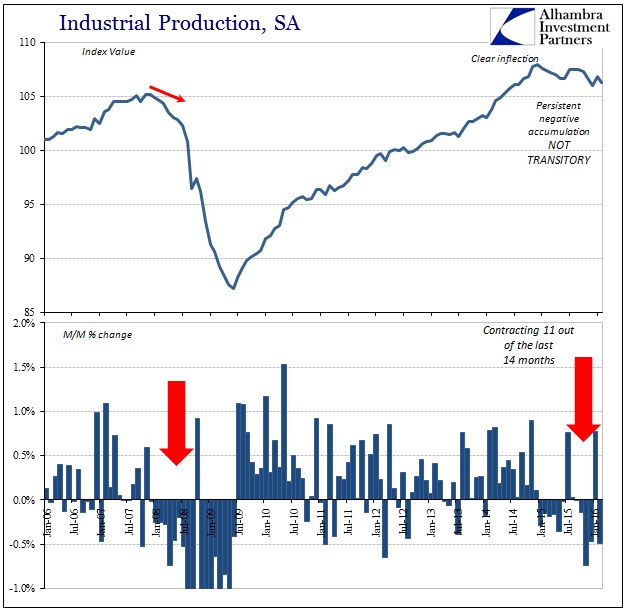

If the inventory imbalance is finally capturing auto production, then it would represent a serious shift in overall economic fortunes (since autos have been about the only bright, artificial piece of this “recovery”). Overall, however, the industrial production estimates still suggest what we have seen since the middle of last year – a serious and widespread slowdown but not yet much more than that. Even though contraction and recession is already indicated by this data, that has occurred without the more intensive and determined efforts on the part of industrial participants to enforce basic balance and convergence sales through inventory to production levels. The more months that fall into this trend leave less likelihood that it will end any other way.