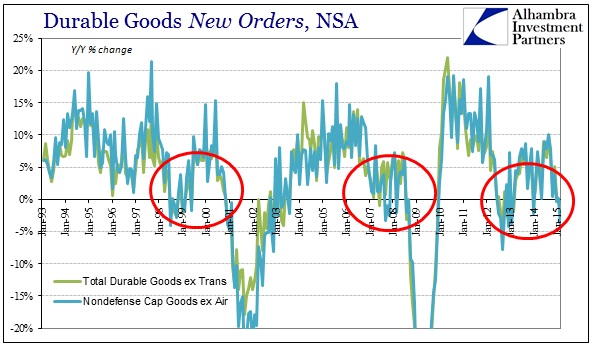

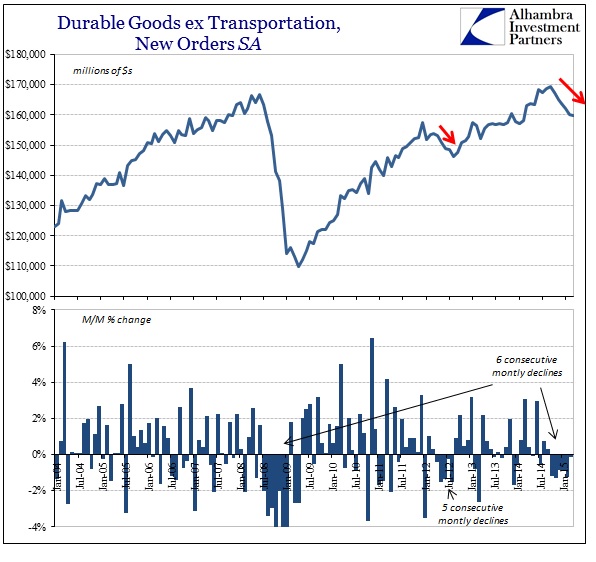

There were a lot of references to the top-line durable goods figure, which was better at 4% in March, but surprisingly almost every piece of commentary was acquiescent to the very disappointing internals. If there was weather depression in the Q1 “slump” so far, it should have abated in March and kicked off an unmistakable rebound –that was the expectation. Instead, core figures fell for the sixth consecutive month, an unbroken string that even had a few economists lightly teasing out the dreaded “R” word. For most, it was simply resignation that there are serious problems that have little now to do with snow.

With investors already on edge about the first-quarter economic slowdown, Friday’s report did little to signal that a spring bounce back may be in store. That perked up demand for safer assets.

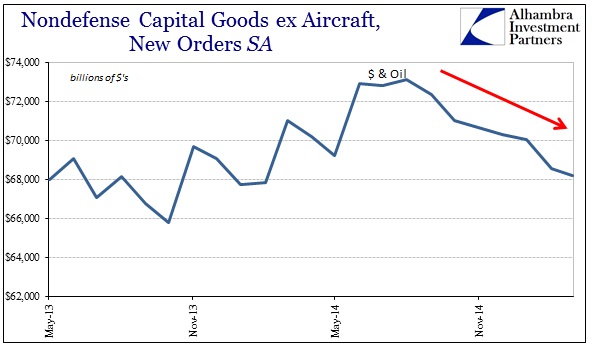

The transition is now one into the “dollar” as a means for explaining how a great economic setup could deliver so poor results. As noted yesterday, the “dollar” is really just the financial transmission of depressed financial expectations into real economic results. After the unrelenting slew of quarterly earnings reports infested with the words “cost” and “cutting”, the fact that the capital goods portion of the durable goods report was equal to the lowpoint of the 2012 slowdown really should not be surprising anymore.

Ex-transportation orders provide a clearer read on overall factory conditions, because they are less volatile. They dropped -0.2 percent, but more importantly, downward revisions pulled February to -1.3 percent from -0.4 percent as previously reported. The quarter-on-quarter annualized decline of -10.6 percent in Q1 compares to a contraction of -7.3 percent in Q4 2014. Bloomberg Economics views this as direct evidence of the degree to which U.S. factories are being impacted by the dramatic appreciation in the dollar over the past several months. [emphasis added]

Without a rebound in sight, and having already now tested the 2012 lowpoint, the concerns are and should be about how low and how bad this all gets. We have gone from 5% GDP certainty to genuine worries among even orthodox economists that serious decay has not just set in but is already deeply embedded and created far more than snowy cracks, but massive dollar fissures.

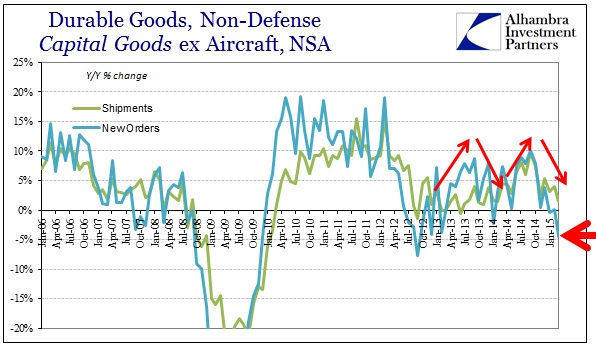

The problem for Q2, which is already being incorporated into a mass-migration of econometric reductions for growth expectations next quarter, is that orders are sinking far faster than shipments. That, of course, suggests that there is yet a bottom in economic activity, that the downside has still room to gather momentum. And the oil-related cutback is still just on the horizon. Durable goods ex transportation orders sank a rather large 2.17% year-over-year (NSA) in March while shipments were extremely weak, but still positive at +0.51%.

Worse, for capital goods, orders collapsed almost 5% Y/Y while shipments were up 1.44%. That, I believe, is these figures just now picking up on those promised cost cutting procedures that corporate America has been promising as a result of the “dollar.”

It is entirely possible that this is just another but larger aberration or anomaly, as last year was described, but the incorporation of a broad survey of business and financial factors suggest, ominously, that this is just beginning. If demand was bad enough before this point, what might happen once it really starts to spread out via these interconnected channels?

I said back when the February figures were released for a large subset of economic data that March would be pivotal in determining whether there was aberration in even a large setback, or whether this was the start of an accumulation of negative results. So far, of everything we have seen of March, the accumulation continues to grow and expand. Again, the major cutbacks that are clearly coming in the oil patch have yet to show up meaning that this already-large slump is predicated solely on the “earnings recession” of the “dollar.” Throw in the likely and further feedback effects on consumers and already-weakened incomes, cycle highs in inventories at wholesalers and retailers, and there is the makings of a very long and harsh winter.