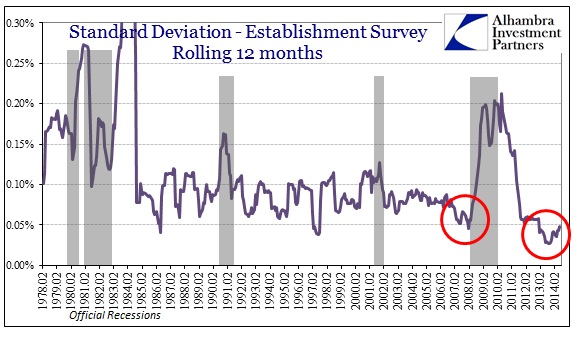

With all due respect to durable goods, perhaps I was a bit too hasty in assigning it the moniker of most boring. There is certainly competition now, as the monthly payroll euphoria has become just as homogenous, curiously, and engrained enough where commentary can simply be copied and pasted from month-to-month. Most people probably will not recall that such regularity was never a semi-permanent feature, even in the best of times (which most people can’t remember either since it has been buried so far now in the past).

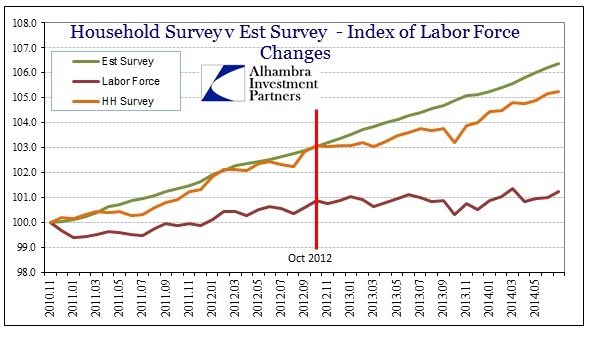

Unfortunately, part of that lack of entertainment stems from not just the extremely low volatility of the Establishment Survey but also the degree to which it remains unconfirmed by the other pieces of the very same payroll report. The Household Survey continues to undercount (or more accurately count, depending on your view of the collective data pulse) the trajectory of jobs, numbering only 69% of what the Establishment Survey figures since the divergence began about 21 months ago.

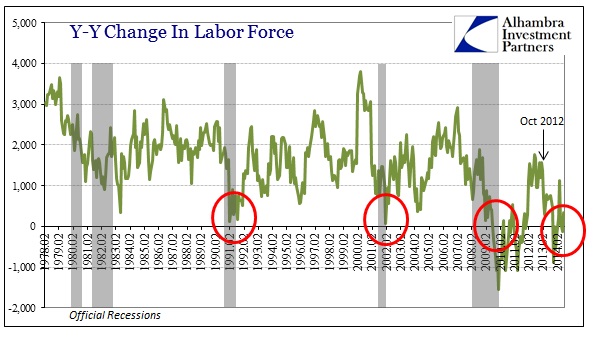

And despite all these payroll gains, for some reason the labor force has been stuck at zero for almost two years. It needs to be said every month, but a rising, to the point of robustness as it has been told, job market would bring in new entrants at a rapid rate where the unemployment rate would rise (for more than one month) significantly for some time. That is especially true given that there are millions of former labor force participants still willing to work but haven given up on it – thus shunned by the official measures.

There are no realistic scenarios where the job market is expanding greatly into a self-sustaining recovery that would simultaneously leave out and behind so much of this labor “slack.” The only plausible scenario is one in which all these purported new jobs are mostly unappealing, meaning paying little and offering even less by way of future prospects, and thus emblematic not of a return to economic health but continued redistribution via asset inflation.

Since October 2012, the Civilian Non-institutional Population has grown by 4 million people, and only one in eight of those newly arrived entered the labor force? Between December 2009 and October 2012, the non-institutional population grew by just over 7 million, but at least then 2.4 million of them entered the labor force, or one in three (which is itself a criminally deficient result, but at least something far better than now).

What is perhaps more instructive, over the same months (Nov ’09 to Oct ’12) the number of new households in the US expanded by just shy of 3.5 million. Since October 2012, through the latest figures for June 2014, the number of US households has actually declined by 19k.

Household formation was better in the second quarter than the first, but, once more, that is an exceedingly low standard to the point of irrelevance. None of this adds up to a robust economy, producing a great many jobs that indicate a direct turnaround from consistent misfortune. Instead, they all point to the same conclusions – that the macro environment changed toward the end of 2012, and, more importantly, has never regained even the weak but at least positive footing that occurred prior to the inflection.

One set of figures, and thus one interpretation, has to be wrong. There is no room in this massive and growing dichotomy for both. The most charitable assertion is, again, that there is some job growth in low-end areas that are representative of asset inflation redistribution rather than actual and true wealth creation. That is an entirely different character than what is being asserted about the state of the US economy, particularly as it relates to the state of labor markets leading to the as-yet mythical new golden age.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com