By Michael Lebowitz at 720Global.com

The sequence of events leading up the French Revolution are likely unfamiliar to most. Yet money printing and a debauched French currency played no small part in those events. As a sequel to “Shorting the Federal Reserve”, 720 Global aims to provide an historical example of excessive money printing which lead to financial crisis, and ultimately the revolution of a major sovereign nation. More than a history lesson, this article effectively illustrates the road on which the U.S. and many other nations currently travel. The story relayed in this article is not a forecast for what may happen but a simple reminder of what has repeatedly happened in the past.

As you read, notice the story lines the French politicians used to persuade the opposition and justify money printing. Note the similarities to the rationales used by central bankers and neo‐ Keynesians today. Then, as now, it is promoted as a cure for economic ills with manageable consequences and where failure to generate a sustainable recovery are thought to be a failure of not having acted boldly enough.

Our gratitude to the late Andrew D. White, on whose work we relied heavily. The exquisite account of France circa the 1780‐1790’s was well documented in his paper entitled “Fiat Money Inflation in France” published in‐1896. Any unattributed quotes were taken from his paper.

Before The Presses Rolled

During the 1700’s France accumulated significant debts under the reigns of King Louis XV and King Louis XVI. The combination of wars, significant financial support of America in the Revolutionary War, and lavish government spending were key drivers of the deficit. Through the latter part of the century, numerous financial reforms were enacted to stem the problem, but none were successful. On a few occasions, politicians supporting fiscal austerity resigned or were fired because belt tightening was not popular and the King certainly didn’t want a revolution on his hands. For example, in 1776 newly anointed Finance Minister Jacques Necker believed France was much better off by taking large loans from other countries instead of increasing taxes as his recently fired predecessor argued. Necker was ultimately replaced 7 years later when it was discovered France had heavy debt loads, unsustainable deficits, and no means to pay it back.

By the late 1780’s, the gravity of France’s fiscal deficit was becoming severe. Widespread concerns helped the General Assembly introduce spending cuts and tax increases. They were somewhat effective but the deficit was very slow to decrease. The problem, however, was the citizens were tired of the economic stagnation that resulted from belt tightening. The medicine of austerity was working but the leaders didn’t have the patience to rule over a stagnant economy for much longer. The following quote from White sums up the situation well:

“Statesmanlike measures, careful watching and wise management would, doubtless, have ere long led to a return of confidence, a reappearance of money and a resumption of business; but these involved patience and self‐denial, and, thus far in human history, these are the rarest products of political wisdom. Few nations have ever been able to exercise these virtues; and France was not then one of these few”.

By 1789, commoners, politicians and royalty alike continuously voiced their impatience with the weak economy. This led to the notion that printing money could revive the economy. The idea gained popularity and was widely discussed in public meetings, informal clubs and even the National Assembly. In early 1790, detailed discussions within the Assembly on money printing became more frequent. Within a few short months, chatter and rumor of printing money snowballed into a plan. The quickly evolving proposal was to confiscate church land, which represented more than a quarter of France’s acreage to “back” newly printed Assignats (the word assignat is derived from the Latin word assignatum – something appointed or assigned). This was a stark departure from the silver and gold backed Livre, the currency of France at the time.

Assembly debate was lively, with strong opinions on both sides of the issue. Those against it understood that printing fiat money failed miserably many times in the past. In fact, the John Law/Mississippi bubble crisis of 1720 was caused by an over issue of paper money. That crisis caused, in White’s words, “the most frightful catastrophe France had then experienced”. History was on the side of those opposed to the new plan.

Those in favor looked beyond history and believed this time would be different. They believed the amount of money printed could be controlled and ultimately pulled back if necessary. It was also argued new money would encourage people to spend and economic activity would surely pick up. Another popular argument was France would benefit by selling the confiscated lands to its people and these funds would help pay off its debts. In addition, land ownership by the masses strengthened French patriotism.

The debate was won by those in favor of printing. As we have seen many times before and after this event, hope and greed won out over logic, common sense and most importantly, history. Per White‐ “But the current toward paper money had become irresistible. It was constantly urged, and with a great show of force, that if any nation could safely issue it, France was now that nation; that she was fully warned by her severe experience under John Law; that she was now a constitutional government, controlled by an enlightened, patriotic people,‐‐not, as in the days of the former issues of paper money, an absolute monarchy controlled by politicians and adventurers; that she was able to secure every livre of her paper money by a virtual mortgage on a landed domain vastly greater in value than the entire issue; that, with men like Bailly, Mirabeau and Necker at her head, she could not commit the financial mistakes and crimes from which France had suffered under John Law, the Regent Duke of Orleans and Cardinal Dubois”. This time was different in their collective minds!

April 1790

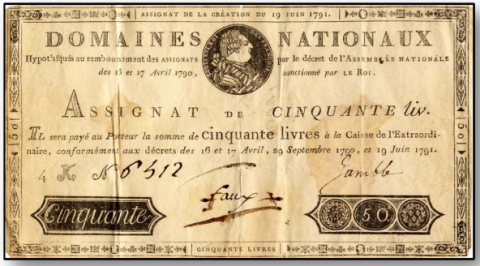

The final decree was passed and 400 million Assignats, backed by confiscated church property, were issued. The notes were quickly put into circulation and “engraved in the best style of the art”, as shown below.

As one might suspect the church decried the action, but the large majority of French were in favor. The press and assemblymen extolled the virtues of this new money. They spoke and wrote of future prosperity and an end to the economic oppression. They thought they found a cure for their economic ills.

Upon the issuance of the new money, economic activity picked up almost immediately. As expected, the money allowed for a portion of the national debt to be paid off as well. Confidence and trade expanded. The summer of 1790 proved to be an economic boom time for France.

Fall 1790

The good times were limited. By October, economic activity was back in decline and with it came a renewed call for more money printing. Per White‐ “The old remedy immediately and naturally recurred to the minds of men. Throughout the country began a cry for another issue of paper”. The deliberations regarding money printing were rekindled with many of the same arguments on both sides of the debate re‐hashed. A new argument for those in favor of printing was simply that the original 400 million Assignats was not enough.

While those favoring money printing acknowledged the dangers of their actions, they were also dismissive about them at the same time. These Assemblymen believed if a little medicine appeared to work with no side effects why not take more. Debate this time around was easier for the pro‐printing consortium. Of note was a well‐respected elder statesman of the Assembly and national hero named Gabriel Riqueti, Comte de Mirabeau (Mirabeau). During the first round of debates, Mirabeau was strongly against the issuance of the new currency. In fact he said the following: “A nursery of tyranny, corruption and delusion; a veritable debauch of authority in delirium” in regards to paper money. He even called the issuance of money “a loan to an armed robber”.

While Mirabeau clearly understood the effects of printing money, he was now swayed by the arguments of a stronger economy. He also appreciated the benefits of making a large class of landholders for the first time. Mirabeau reversed his opinion and joined the ranks of those believing France could control the inflationary side effects. He now argued for one more issue of Assignats. As a precautionary measure he insisted that as soon as paper became abundant, self‐governing laws of economics would ensure the money was retired. Mirabeau went as far as recommending the new amount of printed money should be enough to pay down the entire debt of France ‐ 2,400 million!

The naysayers warned of the ills of the proposed second printing. Of note was Necker. If you recall he was partially responsible for the debt buildup that led to France’s problems. Necker “predicted terrible evils” and offered other means to accomplish economic growth. His opinions were not popular and Necker was “spurned as a man of the past” by the Assembly and ultimately left France forever. A powerful pamphlet, written by Du Pont de Nemours was popular amongst the nays and was read to the Assembly. It declared that doubling the money supply would “simply increase prices, disturb values, alarm capital, diminish legitimate enterprise, and so decreases the demand for both products and for labor. The only persons to be helped by it are the rich who have large debts to pay”.

The arguments of Neckar and Du Pont de Nemours fell on deaf ears. Those in favor rebutted with comments that printing more money was “the only means to insure happiness, glory and liberty to the French nation”. They took the prior debate a step further and now theorized that the gold and silver Livres would be undesirable as Assignats would be the only currency people demanded.

On the 29th of September 1790, a bill authorizing the issuance of 800 million Assignats was passed. The bill also decreed that when Assignats were paid back to the government for land they should be burned. This added measure was thought of as a way to ensure the newly printed money was not inflationary.

White commented: “France was now fully committed to a policy of inflation; and, if there had been any question of this before, all doubts were removed” he went on discussing how “exceedingly difficult it is stopping a nation once in the full tide of a depreciating currency”.

It turns out the money returned to the government wasn’t burned but was re‐issued in smaller denominations. Within a short period 160 million was paid to the government for lands and was reissued “under the pleas of necessity”.

June 1791

Nine months after the second issue of 800 million Assignats, and another cycle of good economic activity followed by bad, pressure grew for more money printing. With little fanfare or debate, a new issue of 600 million was issued. With it, once again came “solemn pledges to keep down the amount in circulation”.

This experience, like the previous two, was followed by a brief period of optimism that quickly faded. With each successive printing came currency depreciation and higher prices. Despite the beliefs of those in favor of printing, hoarding of gold and silver backed coins was occurring. The French people were watching their paper money lose value and becoming more interested in preserving their wealth. The coins were in limited supply while paper money was being printed with increasing frequency. In their minds, gold and silver offered the stability that paper money was rapidly losing.

“Still another troublesome fact began to now appear. Though paper money had increased in amount, prosperity had steadily diminished. In spite of all the paper issues, commercial activity grew more and more spasmodic. Enterprise was chilled and business became more and more stagnant”.

With each new issue came increased trade and a stronger economy. The problem was the activity wasn’t based on anything but new money. As such, it had very little staying power and the positive benefits quickly eroded. Businesses were handcuffed. They found it hard to make any decisions in fear the currency would continue to drop in value. Prices continued to rise. Speculation and hoarding were becoming the primary drivers of the economy. “Commerce was dead; betting took its place”. With higher prices, employees were laid off as merchants struggled to cover increasing costs.

The only ones truly benefiting were manufacturers producing goods for foreign countries and the stock brokers. The rapidly declining value of their currency attracted orders from other countries that were now able to purchase French goods very cheaply. Those businesses and consumers that relied on goods from outside the country were battered by higher prices. With the increased money supply and economic uncertainty the “ordinary motives for savings and care diminished”. Speculation increased significantly. While some stock investors in the urban regions were exploiting the condition, the onus fell on the working man. Inflation, weakening currency and lack of jobs was damaging to a large majority of Frenchmen.

The economic conditions also brought on more crime and increased instances of bribery of government officials. Conditions were described by White as “the decay of a true sense of national pride”.

December 1791

A new issue of 300 million more Assignats was ordered to be printed. With that decree it was also ordered that a previous limit on the total amount to be printed be repudiated. By this point it was estimated the value of their currency was cut in half and inflation was rampant.

“The consequences of these over issues now began to be more painfully evident to the people at large. Articles of common consumption became enormously dear and prices were constantly rising. Orators in the Legislative Assembly, clubs, local meetings and elsewhere now endeavored to enlighten people by assigning every reason for this depreciation save the true one. They declaimed against the corruption of the ministry, the want of patriotism among the Moderates, the intrigues of the emigrant nobles, the hard‐heartedness of the rich, the monopolizing spirit of the merchants, the perversity of the shopkeepers, ‐‐‐each and all of these as causes of the difficulty.”

French Revolution

Throughout 1792 and 1793 there were instances of mobs demanding basic necessities such as bread, sugar and coffee. Peaceful demonstrations turned violent and plundering of the local shops was commonplace. The French Revolution was born.

Money printing was not the sole cause of the revolution, but it certainly helped light the fuse. In all fairness, the French people were demanding the same liberties they helped America fight for. The idea of a Monarchy was fading and those supporting democratic principles were leading the charge. In hindsight, money printing was a last ditch effort to create prosperity and keep the Revolution at bay. Poverty and despair spread through France. Malnutrition and hunger due to lost employment and inflation fed the Revolution. In 1792 a republic was proclaimed and in the following year King Louis XVI was sent to the guillotines.

Conclusion

The story retold in this article echoes that of other nations before and after it. The language, promises, and ultimately the excuses used by the politicians are a familiar refrain. There is nothing new with money printing or “quantitative easing” as modern day central bankers call it. Despite the passing of over 200 years and substantial development in the world, plus ça change (the more that changes, the more it is the same thing).

As stressed in part 1 of this series “Shorting the Federal Reserve”, gold has a long history serving as a tool of wealth preservation. After numerous financial crises caused by the debasement of currencies have modern day economists and central bankers finally figured out how to print money with no consequences? Despite our wishes to the contrary, every action still has an equal and opposite reaction (consequence). The investment pundits who see nothing wrong with the actions of the world central banks regard holding gold as ridiculous. We consider an allocation to gold as a matter of prudence given what we have seen and expect to see from central bankers desperate to maintain status quo.

Hopefully after reading this and “Shorting the Federal Reserve” you will understand a little protection may go a long way in what may not be as clear cut an economic future as some would lead us to believe.

Source: 720 Global