Janet Yellen’s circuitous prattle before the congressional committees this week is a reminder that the Humphrey-Hawkins Act is an obsolete relic and should be repealed. It arose out of the Keynesian heyday in the 1970s and is predicated on a closed US economy. That is, it presumes the macro-economy is a giant bathtub in which demand can be filled to the brim through “monetary accommodation”, and that a full tub will float jobs, GDP and public well-being to their optimum state.

Likewise, the other part of the “dual mandate” is also purportedly easy. Under the closed economy model, “price stability” can be readily assured—-so long as the wise men and women who operate the FOMC don’t become too enthusiastic and cause the tub to overflow with inflation-fueling “excess demand”.

But this is horse and buggy era economics. Today the US economy functions within an open $80 trillion global GDP—which washes vast flows of goods, services, capital and finance through its every nook and cranny. There is not a domestic price, wage rate or rate of return on capital assets that is not impacted directly or indirectly by global considerations. Accordingly, aggregate measures like GDP are nothing more than the sum of billions of domestic wages, prices and transactions that have been touched, shaped and bent by global forces.

In this context, demand injected into the Keynesian’s domestic bathtub leaks into the global economy and the Fed’s targets for inflation and unemployment are whip-sawed by forces arising from outside the domestic tub. The price of labor, for example, is especially internationalized because at the end of the day nearly everything can be off-shored—-from widget manufacturing to bill collection and remotely performed surgery. So filling the US bathtub with more “demand” does not automatically float more domestic jobs to the surface. An “easy-money” auto loan can just as readily pull more labor hours through an assembly plant in Korea to build an American destined import than tap an extra 28 hours of UAW labor to make a car in Detriot.

The internationalization of wages, prices and production obviously makes a mockery of the Keynesian’s closed economic bathtub model. But beyond that it makes a positive laughing stock of the primitive quantitative targets that have been used to translate the dual mandate into operational policy. Yesterday, for instance, Yellen averred that the maximum employment objective could be quantified as an unemployment rate in the range of 5.5% to 5.2% on the BLS’ U-3 measure.

Well, now, why would the monetary central planners stop filling the tub at 5.2%? After all, that would still leave 8 million Americans unemployed according the U-3 metric. In truth, however, it would also mean that 102 million adult citizens (over 16 years) would not have jobs—of which only 43 million are retired and on social security OASI.

Beyond that, the Fed’s U-3 target is way too simplistic and primitive because it measures payroll slots, not labor hours as they are managed to the minute in today’s world by employers from Wal-Mart to Hooters Inc. Were the Fed’s U-3 target to be achieved, for example, there would be about 147 million workers counted as “employed”. Yet our monetary politburo would have no way of differentiating as to whether such workers supplied 4 hours or 40 hours of labor per week to the US economy.

Nevertheless, the Keynesian monetary central planners embrace the blunt instrument of the U-3 unemployment rate as one prong of their dual mandate because that purportedly marks the boundary where all the “slack” in the labor market is used up. At the precise point of 5.2% unemployment, therefore, the bathtub is allegedly full to the brim and further injections of monetary stimulus could adversely impinge on the price stability objective.

Needless to say, this amounts to mindless, paint-by-the-numbers ritualization of economic analysis. The Fed has no way to meaningfully measure something called labor market “slack” because in today’s world there is always massive “slack” in the global labor market—-regardless of where the U-3 unemployment rate stands at any given point in the US business cycle. So injecting monetary demand into the domestic economy does not automatically pull more labor into production at 6.1% unemployment, nor does it push inflationary pressures onto domestic retail shelves at 5.1%.

Moreover, there is now also massive “slack” in the internal US labor market that is not captured by the U-3 metric, either. That is because payroll positions are not a meaningful proxy for available labor hours in an economy that essentially rents labor by the hour—from contract coders to peak hour parking attendants.

Indeed, here’s where the rubber meets the road on the maximum employment mandate. Notwithstanding the Fed’s misguided belief that it has twice driven down the unemployment rate toward 5% during this century, there has actually been no sustained growth whatsoever in labor hours employed during the entirety of the last 14 years.

Zero growth in labor hours on a trend basis constitutes overwhelming empirical evidence that hitting the monetary stimulus dials does not push domestic labor into production on a sustainable basis. Indeed, notwithstanding the massive monetary stimulus since the late 1990s, the true labor utilization rate in the US economy has sharply deteriorated.

Stated differently, the Fed’s obsession with its full employment mandate amounts to tilting at windmills. When it believes itself to be driving the U-3 rate lower it is not necessarily adding permanent labor hours to the economy’s supply side. And when it proposes to stop stimulating at it arbitrarily chosen full-employment marker on the U-3 scale—that has virtually nothing to do with the full absorption of the actual “slack” labor in the US economy measured by adult labor hours available.

As shown below, actual hours worked in the US economy today stand at about 230 billion annually—-the identical figure that was recorded in the year 2000. Yet during the interim the adult population adjusted for the gain in the OASI retirement rolls has grown by 28 million persons or about 55 billion potential labor hours annually. Moreover, the modest 2% fluctuation in labor hours utilized as between high and low years over that period— tracks exactly the business downturns and recoveries that were caused by the Fed created dot-com and housing boom and bust cycles.

So while no sustained employment gains floated to the top of the macro economy since the turn of the century, it cannot be gainsaid that the Fed did inject massive stimulus into the bathtub. To be precise, the Fed’s balance sheet was $500 billion as the new century opened and stands at $4.4 trillion today. That 9X gain reflected relentless tinkering of the monetary dials by the FOMC and long periods of absurdly low interest rates pegged by these actions, but it accomplished nothing on the sustainable employment mandate.

So like lab rats on a treadmill, the Fed chases the U-3 rate up and down the fluctuations of the business cycle that its own policies exacerbate. Worse still, it obsesses on a clunky unemployment metric that is self-evidently not measuring the same thing over time. This is in part due to the sharp decline in the labor force participation rate from 67% to 62.8% over this period, which alone takes 10 million workers out of the U-3 denominator, and thereby converts the current 12% unemployment rate measured against the year 2000 participation rate to the 6.1% rate reported at present.

But the distortion owing to the Fed’s U-3 obessions is especially due to the internationalization of the labor market, and the atomization of jobs slots into variable labor hours domestically. Self-evidently, the rate of unemployed labor hours has been steady rising for a decade and one-half.

When labor hours are viewed for just the private economy (i.e. less the government sector), the same picture emerges. At about 196 billion annual hours, there has been no gain since the year 2000.

That the bathtub economics of the Humphrey-Hawkins Act is totally obsolete is further underscored by a longer-term look at labor hours employed by domestic private industry. As shown below, the annual compound growth rate between 1960 and 1999 was about 2.0% per year. Since then, however, the trend growth rate has been a big fat zero!

In short, the American economy is not generating labor hour growth and that baleful condition has nothing to do with the level of so-called aggregate demand being injected into the Keynesian bathtub by the Fed. Instead, part of the problem is that American workers are way over-priced relative to the vast amounts of “slack” labor that have been brought into the world’s economy since the China/EM boom was triggered by global central banks in the 1990s.

When the rice paddies of Asia were drained into the mercantilist export factories of China, Korea, Taiwan etc., the price of American labor needed to go down— if the quantity of labor demanded by the domestic economy was to keep going up. Obviously, that didn’t happen. And this kind of structural adjustment can’t possibly be accomplished by means of pegging interest rates and ballooning the balance sheet of the central bank. Its a job for the free market!

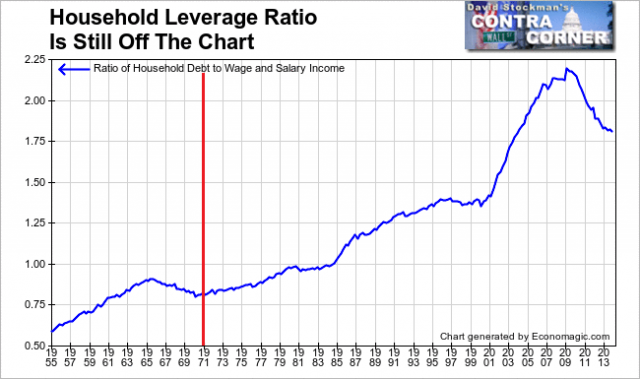

At the same time, it is also evident that after peak debt was reached in 2007 that the Fed’s monetary stimulus did not generate any incremental spending on main street, anyway. That’s because the credit transmission channel by which higher leverage ratios had historically added credit based spending to income-derived consumption was no longer operative at peak debt.

Stated differently, American households tapped out their leverage ratio at 220% of wage and salary income in 2007, and have been deleveraging ever since. Accordingly, since the financial crisis, household spending has been limited to income growth—-which is to say, it has returned to the natural, sustainable path that it was on before that massive upward ratchet in leverage ratios commenced in the 1970s. Accoridngly, the Fed’s massive money pumping has done nothing to expand household spending.

At the end of the day, therefore, the Fed’s paint-by-the-numbers pursuit of its alleged Humphrey-Hawkins mandate amounts to a double failure. It can no longer pump aggregate demand into the domestic economy despite massive monetary expansion—owing to the reality of peak debt; and its machinations have manifestly not generated employment growth—-properly measured as labor hour utilization—-for this entire century to date.

Moreover, the quality and productivity of the static level of labor hours since the turn of the century has definitely taken a turn for the worse. As shown below, labor hours in the HES complex (health, education and social welfare) have soared by 33% since 2000. By contrast, labor hours in domestic manufacturing have plummeted by 30% during the same period.

So the bottom line is this: The U-3 obsessed Keynesian central bankers ensconced in the Eccles Building have thrown historical monetary prudence and wisdom to the winds by increasing the Feds balance sheet by 9X since the turn of the century, yet all of that insane monetary pumping has resulted in no gain in the quantity of labor employed by the US economy and a serious decline in the quality mix within this static total.

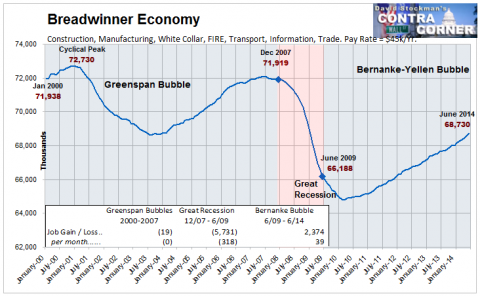

As shown below, there are now 4 million fewer breadwinner jobs—in construction, manufacturing, energy and mining, the white collar professions, FIRE, trade and transportation, business management and services and core government—- than there were in the year 2000. These jobs are overwhelmingly full-time and full-pay jobs that generate upwards of $50k per year in pre-tax income. Yet the paint-by-the-numbers money printers at the Fed have never betrayed even a hint of recognition that these essential “breadwinner” jobs have been slipping away.

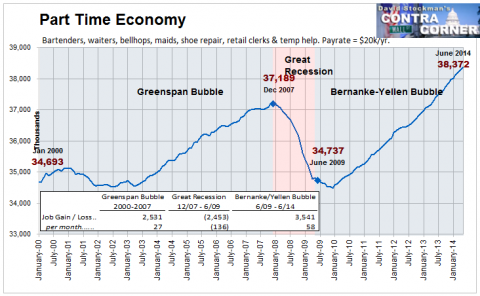

By the same token, the monetary politburo has also never noted that the cyclical up-welling of “jobs” they claim so much credit for are actually part-time jobs in bars, restaurants, retail emporiums and temp agency sweat shops that pay on average hardly $20k on an annualized basis.

These dismal trends in the quantity and quality of labor employed by the US economy are also a thundering indictment of the second prong of the Fed’s dual mandate. Namely, its obdurate insistence that “price stability” should be defined as 2% inflation on the PCE deflator—a flawed measure that easily understates actual cost-of-living increases by 1-3% annually. Still, the very last thing the US economy needs, given its uncompetitive position in the global economy, is any inflation at all. In fact, the nominal cost of domestic production and wages needs fall in order to reduce imports and off-shoring and to improve the price competitiveness of US exports.

So in pursuit of its senseless Keynesian campaign to cause consumer goods and services inflation to rise, the Fed is perversely undermining the employment prong of its so-called dual mandate. Rather than freaking-out about “deflation” on the grounds that it will reduce that Keynesian ether called “aggregate demand”, the Fed should actually welcome deflation because only through a downward adjustment of billons of domestic prices and wages will it be possible to regain international competitiveness, and, on the margin, shift output and jobs back into the domestic economy.

These considerations point to a larger issue. Namely, that Keynesian demand management and central bank targeting of arbitrary unemployment and consumer inflation rates is a futile and counter-productive undertaking in the context of an open, integrated $80 trillion world economy. This means that the domestically focused dual mandate of the Humphrey-Hawkins Act should be repealed forewith, but also much more.

The dual mandate targets are just clunky expressions of an obsolete idea that was inherently mistaken from the get-go. That is, that the aggregate GDP and all its leading indicators—-jobs, consumer spending, housing starts, business investment, industrial production etc.—-can be central managed by the monetary authority. Two decades of failure, however, says it can’t be.

So the real import of repealing Humphrey-Hawkins is not to merely substitute another set of arbitrary targets for monetary central planning—such as professor John Taylor’s foolish “rule” based on unmeasurable “potential” GDP and arbitrary inflation and unemployment gauges. Rather, what should be abolished is the very central planning mechanism that requires such macro targets—-which is to say, the Fed’s open market committee (FOMC) itself.

More than anything else, the financial markets need to be liberated from the current destructive regime of monetary central planning. Let the money market determine the market-clearing price for speculative borrowing to fund the carry trades. Let price discovery determine the price of long-term debt based on the supply of real savings versus the demand for honestly priced debt capital. Let two-way markets re-establish themselves in the risk asset sectors by removing the Fed’s “put” under the stock market and its systematic undermining of fear and short interest in the Wall Street casino.

At the end of the day, the Fed can only do one useful thing—and that is to passively provide standby liquidity at a penalty spread on top of market driven interest rates; and in so doing, to only accept sound collateral consisting of short-term treasury bills and blue chip business paper against inventory and receivables. Indeed, just put the penalty spread for discount loans at 300 basis points, at least. That change alone would eliminate the ability of Wall Street gamblers to fund their carry trades by arbitraging the yield curve at the Fed’s discount window.

Needless to say, such a post Humphrey-Hawkins regime would end the massive inflation of financial assets which have been harvested by the Wall Street gamblers. And it would also end the practice of monetizing the Federal debt by the FOMC. Consequently, Uncle Sam’s voracious borrowing would once again crowd-out other borrowers and drive long-term interest rates to higher, market clearing levels. Under that scenario, the beltway’s bipartisan posse of fiscal sleepwalkers might actually be stirred from their slumber.