Y/Y Change In CPI, June 1977 to December 1982

Alas, Volcker's victory turned out to be far from long-lasting. In fact, after he was ushered out of the Fed in August 1987 by the GOP politicians who had taken-over the Reagan White House, it was soon back to the inflationary races under Alan Greenspan and his heirs and assigns at the Federal Reserve.

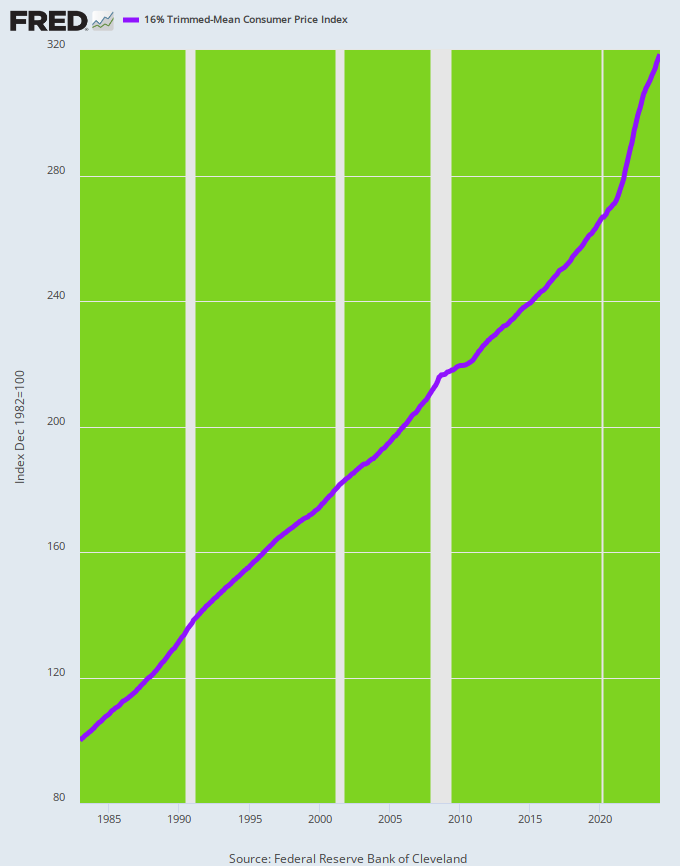

During the 41 years since December 1982, the CPI has risen by a staggering +217%. In everyday terms that means the dollar on the eve of Volcker's hard-won triumph is now worth just 31 cents.

16% Trimmed Mean CPI, December 1982 to February 2024

Of course, the Fed heads and their shills on Wall Street say not to sweat this nearly half-century long tidal wave of inflation because other than the temporary breakout of the late 1980s and during the pandemic supply chain disruptions of 2020-2021, the annual rate of inflation posted pretty predictably in the 2-3% lane most of the time.

In fact, during the eight years between the Fed's formal adoption of inflation-targeting in January 2012 and January 2020, the trimmed mean CPI rose at an average of exactly 2.0% per year. The presumption was that everyone on main street got their 2.0% inflation-boost in wages, salaries, rents, interest income and small business profits, and that prosperity therefore marched steadily higher in lockstep under the expert guidance of the Eccles Building.

After all, if an ever rising CPI did not spread its purported munificence uniformly among sectors of the economy and income classes over extended periods of time, the very idea of pro-inflation, +2.00% goal would be hard to defend owing to the implicit inequities and capricious windfall gains and losses.

And that would be even more so, if the alleged benefits of its 2.00% inflation goal on the supply-side of the economy---growth, investment, jobs and real incomes---were not appreciable. That is, why in the world would rational policy-makers impose what amounts to a 22% rise in the price level every decade if it does not generate material off-setting macro-economic benefits?