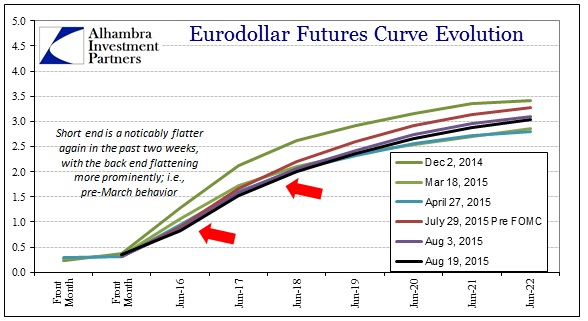

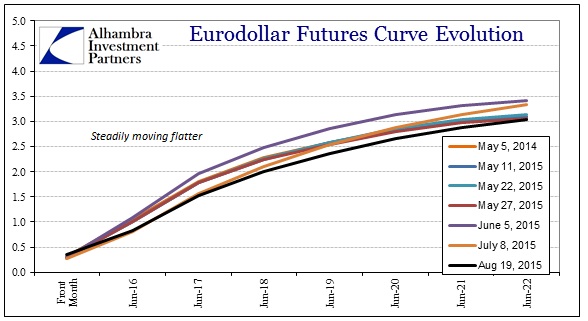

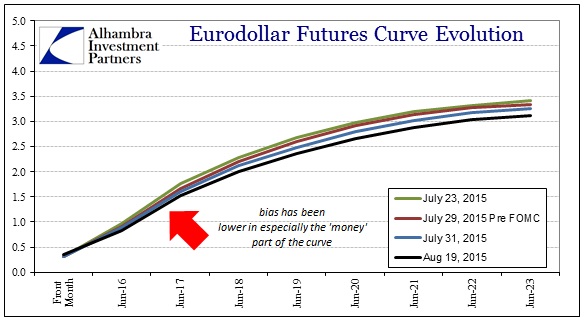

June was the for-sure liftoff point early in the year. That followed last year’s for-sure exit as March, April at the latest. Now more than a halfway through 2015 September is increasingly in doubt. They have to start somewhere even if they claim a methodical and slow pace to ensure as little disruption (in their twisted view). As I wrote yesterday, “’Intend to move slowly’ gets slower with each ‘dollar’ wave and that is the relevant motion of policy and economy quite against all the continued propaganda.

The first reaction from the Wall Street Journal is telling in that regard:

The Federal Reserve’s next policy meeting is four weeks away and officials show no clear sign of having settled on a decision about whether to raise short-term interest rates at that time.

That cannot be in light of all the certainty with which the recovery was given and not all that long ago. Last year was 5% GDP and full employment while this year stands as the gaining drip of “downside risks.” At the very least, it shows the FOMC knows nothing when it comes to this economy (and any other).

Several of these participants cited evidence that the response of inflation to the elimination of resource slack might be attenuated and expressed concern about risks of further downward pressure on inflation from international developments. Another concern related to the risk of premature policy tightening was the limited ability of monetary policy to offset downside shocks to inflation and economic activity when the federal funds rate was near its effective lower bound.

I think that has been the problem all along, namely that the economy never did live up to their hype and now they realize it may well be too late. They are stuck in a trap of their own making, and money markets and especially the “dollar” are taking that to the core. When almost every market facet, especially those risky parts like equities and the corporate credit bubble, has been based on central bank mellifluence turning into real stability, this disappointing downgrade into “downside risks” is itself highly destabilizing. What kept those markets up (and stocks certainly remain so, for now) was central banks being right and getting it right; the FOMC’s reluctance even this far into 2015 demonstrates with bleeding ambiguity how they have been increasingly wrong on both counts.

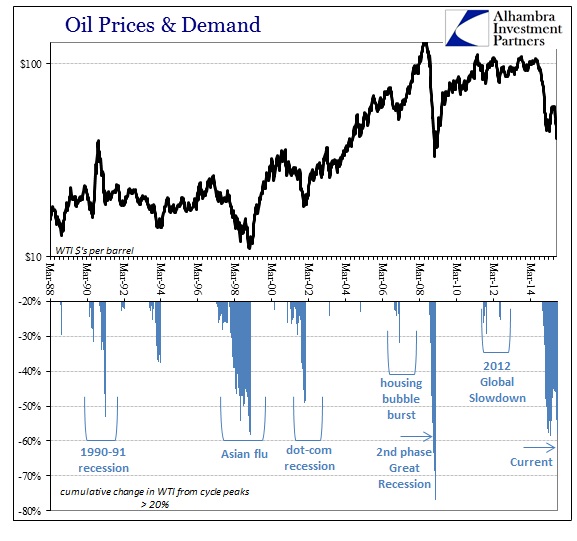

The Federal Reserve, because of rational expectations, will be the last governmental organ to declare a contraction. That means, on their own terms, their general admission comes from the probabilities they assign to the worst cases, the lower economic deciles. At the beginning of this year it was “oil prices are good for consumers” and “strong dollar” as market confirmation of monetary success; those are long gone. Oil was mentioned twelve times in the minutes (to just one for “consumers”) and all were some form of “it only looks bad because of oil.”

The staff’s forecast for inflation was revised down, particularly in the near term, as the decline in crude oil prices over the intermeeting period was expected to result in lower consumer energy prices. Although energy prices and non-oil import prices were expected to begin rising steadily next year, the staff continued to project that inflation would be below the Committee’s longer run objective of 2 percent over 2016 and 2017.

With “inflation” their central focus, as that includes wages, the statement above simply assumes oil prices have no economic bearing on anything except the calculation of the CPI or their preferred PCE Deflator. In that second sentence, the FOMC admits it will fail to reach its “inflation” target for a period stretching at least five years dating back to 2012; half a decade of undershooting. Because it is oil prices in this part of that we are to assume that is all superfluous and irrelevant to the wider economy?

Perhaps that would be easier to take if the history of oil prices were more reassuring; they are not. Oil collapses occur in proximity to global recession for a reason, especially in this hyper-financialized system they have allowed and courted.

There is another downgrade of sorts in the chronological trajectory of these ridiculous FOMC exercises. Not only did they start the year with “oil prices are good for consumers” and “strong dollar”, the pillar of hope for the future was unequivocal on wage growth; as in “it hasn’t happened yet but job growth undoubtedly signals wages are going to rise quickly soon.” Now, wage growth has been removed as that pillar, rendered also questionable with the overall assessment (the word “some” accomplished that in the policy statement).

However, several were concerned that labor market conditions consistent with maximum employment could take longer to achieve, noting, for example, the lack of convincing signs of accelerating wages, which might be signaling that the natural rate of unemployment could currently be lower than they previously thought.

It has been replaced by only this oil price misreading. Where once the upside in the economy was upon at least future wages, now it is only limited to “oil prices don’t matter.” No more benefit to consumers, just now ignoring them for all economic settings good or bad.

If it weren’t for the overwhelming weight of circumstances, we could better appreciate the comic quality to all this. What else is left? They gave it their best shot last year with all the questionable but surging mainline statistics and their incessant rhetoric about how certain the economy was to be this year. That the FOMC itself admits, by words and lingering inaction, how uncertain it is now tells you all you need to know about the state of the world.