By April last year, it had become clear that conditions in China were heading into dangerous territory. Even though most mainstream attention was fixed on the then-still growing stock bubble, there was so much that was wrong almost everywhere else. The economy would not stop slowing, and indeed still has not. The financial system was worse, so much so that in the middle of last March the PBOC decided to just end CNY currency volatility.

Trading sideways for five months is about the most visible signal of distress and turmoil aside from open, crashing disorder; the re-pegging of the currency was just one step shy of that. That leaves two important unanswered questions and a further inquiry about which one of them is the most pressing: what is causing the imbalance such that the PBOC feels the need to so evidently suppress it?; what is the PBOC doing to actually stamp out volatility in CNY exchange, which is not exactly a minor factor?

By July 2015, with Chinese stocks now crashing, the first question was being answered leaving the second open to interpretation (with most ignoring it entirely). I wrote in late July:

The yuan has suddenly, right at the March FOMC meeting, gone limp. Trading has been confined, except for very brief, intraday outbursts, to an increasingly narrow range. Given its behavior particularly as a full part of the reform agenda to that point, this amounts to what can only be hidden and inorganic factors. Whether that means PBOC intervention is unclear, though suggested by even TIC, but this is the most important and unexplained dynamic in the “dollar” world at present.

Perhaps the June TIC updates will help shed some light on what has been going on with China’s “dollar short”, but I doubt it. The nature and especially the scale of what might be happening in the money markets has global implications, and may (conjecture on my part) start to explain the reversal in the Chinese stock bubble and ultimately even relate to the “dollar’s” renewed disruption in July so far. [emphasis added]

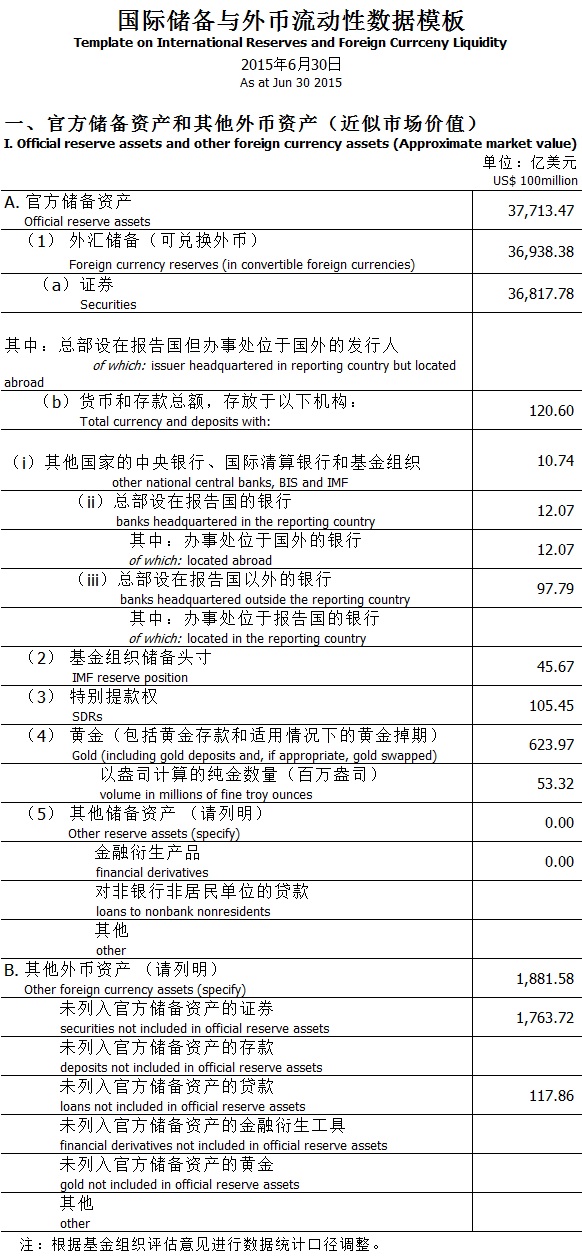

Those “inorganic” factors are not supposed to hidden as almost every other country on Earth reports to the IMF their “reserves” and related activities via a formal call sheet. China had until the November 2015 refrained from participating in the reporting, leaving only the headline “reserves” as its depth of information. The call sheets themselves are structured to give that impression, with those reserves placed prominently in Section 1 even though reserves are anything but in this eurodollar, credit-based system. The wholesale stuff, what is truly relevant, is all in Section 4’s Memo Items.

Starting with the month of June, the PBOC began to report what it calls the “International Reserves and Foreign Currency Liquidity Data Template Template on International Reserves and Foreign Currency Liquidity”, though it’s not clear what exactly the PBOC is reporting. Is this a “template” in the most literal sense, meaning that it is hypothetical, or is it what the PBOC would report if it disclosed what the IMF wants? Given the (lack of) information contained especially in Section 4, there is no doubt that it is the former and that a great deal remains missing.

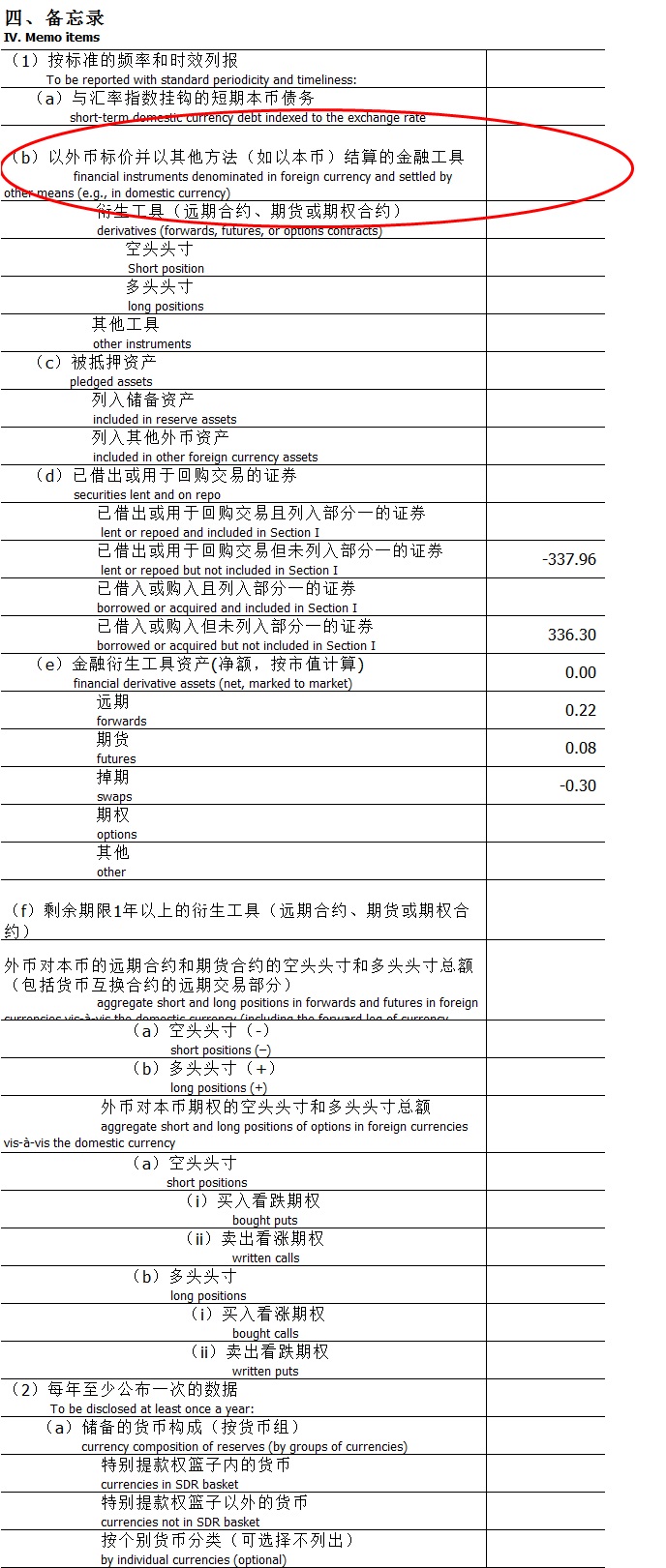

Section 1 contains information that is available elsewhere through SAFE; Section 4 (below) contains some numbers but nothing where (1b) we would expect to find significant digits given what was transpiring in CNY (and elsewhere); only blank lines.

No swaps, options, swaptions or forwards, just $33.7 billion in almost perfectly balanced repo. It is possible that this is correct as the PBOC will often use its influence to get banks to undertake any direct interventions on its behalf, leaving individual bank balance sheets containing the appropriate balances. However, in this case given these conditions, that was not likely as even if Chinese banks were directed (meaning no alternative but to follow policy intentions even if reluctantly) to wholesale means of enforcing a CNY peg that still would have left a future leg (forward) leading back to the PBOC.

This lack of disclosure, as well as misunderstanding the wholesale nature of the “dollar” problem, led to huge mistakes in interpreting what was to come and then afterward what had just happened. The world on August 10 was shocked to find China had “devalued” its currency when that just wasn’t the case. Some were openly applauding the move as if it were intentional “stimulus” rather than harbinger of great and widespread financial difficulty. As I wrote on August 12:

The PBOC’s commitment isn’t to a devaluation for China’s exports, but undoubtedly its actions are directed toward trying to keep the wholesale finance interfaces somewhat orderly. When the yuan was trading exactly sideways for nearly five months, that was the same setup; the PBOC was keeping the yuan stable so that it wouldn’t devalue and thus signal the depth of the “dollar” financing strain.

That is the problem orthodox commentary and theory has with wholesale finance, they just don’t get it. Devaluation of currency doesn’t mean that in this context just as a “strong dollar” isn’t anything like the term. Both are forms of internal disruption, the direction of that is just an expression of what manner of wholesale finance is becoming most unruly. Credit-based “money” systems do not operate like the currency systems from before 1971. Floating currencies aren’t really that, so much as they are just another form of traded liabilities in global banking.

It’s the “traded liabilities” part that is of upmost importance and it is the one segment that discloses almost nothing to the outside world. Even when numbers do appear on the IMF call sheets they are still derivative, meaning that “it” is not what central banks are doing but what in private banking has caused them to respond to it. We have to infer instability from what we see second- and third-hand, including a major currency exchange rate that suddenly appears “too” stable. Without China participating in the IMF’s Section 4, we are left with imprecise inferences based on an imperfect sense of proportionality. In other words, the more it seems the PBOC has to do to claim a small window of temporary calm, the greater the effort we can assume that is had to expend to achieve it. Like July 2015, that last part is the most important as it dictates what happens down the road.

That is the ironclad reality of “traded liabilities”; they all come with expirations and maturities. Once the interventions are initiated, the clock starts ticking on the “next one.” Having gone through two full cycles now, the wider world seems to be catching on especially as “devaluation” fades toward obscurity. It isn’t really hard to figure out the connection even if its exact nature is foreign in so many ways; when China “devalues” the rest of the world goes in the toilet with it. Thus, it is highly relevant to figure out what the PBOC was doing, exactly, in January and February this year so that we might anticipate April and May.

The International Monetary Fund is pressing China to disclose more information about its currency operations based on standards the Chinese central bank had pledged to follow, people familiar with the matter said, as Chinese authorities resort to more-discreet ways to support the yuan.

In recent months, the People’s Bank of China has turned to the derivatives market to help prop up the currency—a shift from its traditional approach of dipping into its dollar pile to buy yuan.

The IMF is calling on the Chinese central bank to release more data on its holdings of derivatives such as forwards, which have become the main financial instrument used by the PBOC for currency intervention, the people said.

I seriously doubt that the PBOC has “in recent months” shifted “from its traditional approach of dipping into its dollar pile to buy yuan.” First, that’s not the goal at all, as the value of the currency exchange is not the problem but the symptom; the PBOC is not attempting to “buy yuan.” The intent is to supply “dollars” (selling “dollars”) to a market starved of them. Second, this is obviously not something the Chinese central bank just decided to do in 2016; it has been doing it all along, only it has taken economists and the media this long to figure it out. It should have been apparent, as noted above, through the middle of last year right into August 10.

What is still misunderstood is the essence of what the PBOC is doing, and thus why it matters. As in Brazil, in general terms, the central bank is pressing local banks into shorting the “dollar” under forward cover (it’s a bit different in Brazil mechanically, but the process is largely the same) – they “borrow dollars” and then “sell them” into a domestic liquidity process that is already highly short of them. It is a redistribution scheme (central banking, after all) that ends up with the banking system even more “short” the “dollar.” If that were a temporary disruption then it can be an effective tool, but in the eurodollar system of 2015 and 2016 it is the worst possible method – going more short right into the teeth of an epic, historic short squeeze. Worse, the “squeeze” is structural not cyclical, meaning that unless there is a full paradigm shift it will not end.

Recent indications suggest only that, especially in what has to be the primary “dollar” conduit for Chinese banks – Japan. The scale of forwards and wholesale methods deployed in China matters for estimating the “next one” since the structural problem of a systemic “dollar shortage” all but guarantees that there will be a “next one.” Even the IMF seems to have finally glimpsed the countdown.

Some market participants estimate that China’s current holdings of forwards range between $150 billion and $300 billion, as the central bank has stepped up the use of such stealth intervention to support the yuan in recent months.

Illustrating how the complex trades reduce—or at least delay—the hit to China’s foreign-exchange reserves, the erosion of China’s currency pile significantly slowed in February, dropping by $28.57 billion, to $3.2 trillion. That compared with a plunge of $99.5 billion in January.

For reference, the Brazilians engaged about $115 billion in “short” currency swaps (that aren’t really swaps) and found the real depreciating in devastating fashion on the slightest unwinding (September 2014). I think that, ultimately, $150 billion to $300 billion might be revealed by future events on the low side. We can never really know for sure, leaving us with only one solid conclusion – the clock is ticking. With IMF suddenly and publicly involved unlike, say, October, does that also imply increased concern?