As is usual at this time of year, the Chairman of the Federal Reserve Board and FOMC will gain inordinate attention due to the upcoming Jackson Hole assembly. Ben Bernanke in his stint made use of the PR to first introduce his ideas about coming intervention and manipulation. Janet Yellen may or may not do the same, but she will gain a wide audience regardless of her ultimate and actual remarks.

That highlights the level of intrusiveness into which monetarism has sprung upon the rest of us. Prior to 2008, and even 2010, the Jackson Hole fete was barely even noticed let alone beset with stories and projections of bias. Now it is an annual ritual by which the economist class will tell us in various ways (and they have to have varied) they have succeeded in every possible aspect save the most important. Nowhere in Wyoming will anyone think to ponder the primary deficiency, namely the persistence of manipulation itself.

In that regard, this year will be far different as QE is finally on its way out (for now). But that has produced a somewhat comical and entertaining conundrum as this very same “elite” has to play Goldilocks – QE has been successful “enough” to withdraw it, but not too successful as to “warrant” rapid “normalization” in whatever form that may take (a topic at the conclave, to be sure).

Bloomberg provides this very context that is quite revealing about biases and tendencies in the “mainstream.”

That leads to two starkly different views of the U.S. economy. In one, job growth is increasing along with inflation, leaving Yellen, now at the helm of the U.S. central bank, behind the curve with recession-era monetary policy still in place. The other view portrays a fragile recovery that owes its modest gains to the Fed’s near-zero interest rates. The job-market contrasts are dividing economy-watchers on when the Fed should start raising rates, which it hasn’t done since 2006.

I don’t get the impression the author of the article quite appreciates the idea of “starkly different”, or that it was intentionally placed in discriminatory fashion. Both of those “choices” in the quoted passage above are really just two sides of the same coin, as both place QE as a positive force, just moderating the degree to which is attributed as being so beneficent. To place an emphasis on this, the article makes no illusion as to where it’s foundation for observation is grounded:

The target overnight bank lending rate will first increase to 0.5 percent after the Fed’s July 2015 meeting, according to the median of economists’ estimates in a Bloomberg survey. That’s two months sooner than economists had projected in a survey last month.

That raises the same dichotomy I referred to some time ago, namely that economists are convinced, as they always are, that monetary policy works and therefore the recovery is here. That they differ only on the degree to which that seems, to them, to be the case is not really a choice of observations at all. Everything else is differing with that interpretation of nothing more than the Establishment Survey. I used “mainstream” in quotes above because this economist-driven presentation is so at odds with what would really be called “mainstream”, such as the current state of consumers and households.

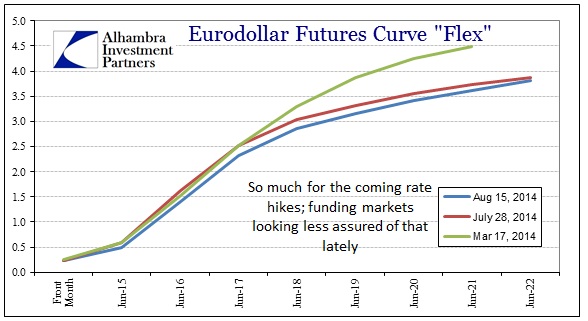

It is also dramatically opposed by bond and even funding markets where you would think this would be explosively received. As I noted late last week, even the eurodollar market seems to be having second thoughts about those rate increases. Where economists see them moving ahead on the calendar, dollar markets are moving toward the opposite interpretation especially in the past few weeks.

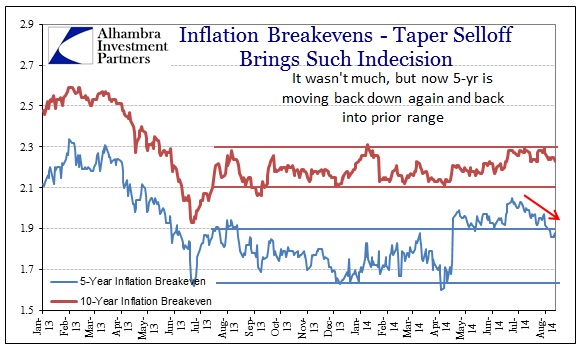

That includes, as a direct matter of more than thirteen months now, TIPS and the treasury curve. Economists see inflation rising as a threat, the bond market is, at best, something else, and, at worst, wholly unconvinced.

There is far less “faith” in the recovery now, as viewed from credit, even after the GDP revisions and “aberrations” clinging upon the “strongest labor market since forever.” If QE worked even modestly well, why is there no confirmation outside of economists looking for anything to validate their questionable regressions?

That last phrasing may seem overly harsh, but recent comments in that direction simply confirm as much. Contained in the very same article is a quote from Joe LaVorgna that I think demonstrates the cheerleading, and thus largely disqualifying, aspect to all of this:

By pressing on with easy money policies in the face of such data, the Fed is playing “a very dangerous game,” said Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York. “What are you waiting for? Everything to get back to the cyclical peak to take rates off of zero?”

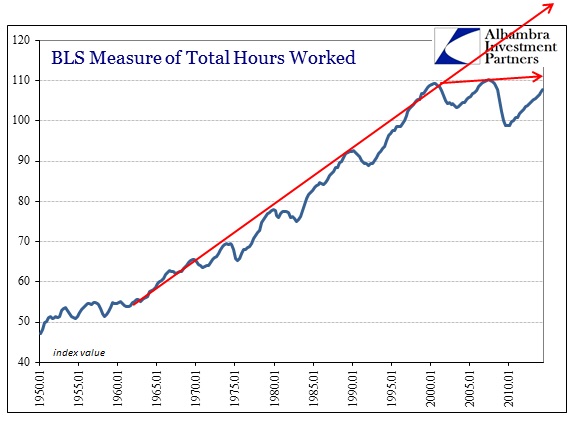

It may be subtle, but it is no less disingenuous. “Everything to get back to the cyclical peak” is no standard of success or even recovery. That it has taken more than six and a half years to even use those words in a limited number of instances is a mark of failure and disaster, not a springboard to float hopes and dreams of finally getting it right on the sixth try. The goal is not simply to retrieve the same level of jobs, for instance (and not even full-time, as those remain almost 4 million shy), but to press and prod symmetrically upon potential and prior trends. In other words, if QE hasn’t got us back to the previous trend, it never will and it never really worked.

That is what should actually define the discussions at Jackson Hole, not some manufactured and convenient benchmark for media consumption. The premiere topic should be as to the chart above; the reasons why the US economy so diverted in the age of bubbles. Economists working on their regressions in the 1970’s and 1980’s were cautiously optimistic they could defeat the business cycle, but at least yieldingly worried that they may “shave off the peaks.” Now that it is openly evident and obvious, that must dictate accountability in order to create the room for reform and actual hope for economic growth.

Perhaps Stanley Fischer said it best last week, “Year after year we have had to explain from mid-year on why the global growth rate has been lower than predicted as little as two quarters back.” This year is no different, but it has a different spin. Instead of exercising that PR, perhaps more self-reflection and adherence to actual standards of performance are in order outside the media bubble that nurtures this behavior as if it were something like “science.” It’s not as if our future isn’t unfolding before our very eyes under much the same conditions (and fallacies).

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com