By Gaurav Agnihotri at Oilprice.com

As oil prices are now hovering around $45 per barrel, the entire oil and gas industry is looking forward to the next OPEC meeting, due to be held on December 4 this year in Vienna. On October 14, non- OPEC member Mexico confirmed its participation in a technical meeting organized by the cartel on October 21 in Vienna to which seven other non-OPEC members were also invited.

“We are going with a technical delegation to receive information and exchange it with other producers. But Mexico will not take part in any reduction in production volume,” said Mexico’s Energy Minister Pedro Joaquin Coldwell. The meeting was held last Wednesday and was attended by representatives of five countries: Russia, Brazil, Kazakhstan, Colombia and Mexico. The main agenda of the meeting was to exchange different market views and create a common strategy in response to the current market conditions and low oil prices.

What exactly happened at the meeting?

Venezuela has been the most vocal OPEC member when it comes to the issue of raising oil prices by altering the cartel’s production levels. During the technical meeting between OPEC and non-OPEC members, Venezuela proposed that OPEC must resume its policy adopted in 1980s of fixing the oil price. It suggested a possible ceiling price of $88 per barrel which would naturally require OPEC to reduce its current production levels. In addition, Venezuela also proposed another technical meeting of this kind to be held during the upcoming Dec 4 meeting.

Related: Iran May Not Be That Attractive To Oil Industry After All

“We are concerned about the depletion of reservoirs and about the decline of production. We are talking here about an equilibrium price to sustain the production,” said Venezuela’s Oil Minister Eulogio del Pino in response to his nation’s stand on the OPEC production levels. Although it was agreed that a similar meeting would be held again after December 4 for assessing the global oil markets, Venezuela’s proposal of reducing the production levels for setting a specific ceiling price was not even discussed.

With Russia and other non–OPEC members refusing to stand by Venezuela, the meeting re-iterated OPEC’s policy of sticking to its production levels instead of reducing them. Although Venezuela has received support from other OPEC members such as Ecuador and Algeria to some extent, the OPEC leaders dismissed any further speculations on production cuts.

With this firm stand, it is possible that we might witness the formation of two blocks within OPEC during the next December 4 meet in Vienna. One, led by Venezuela, Ecuador, Libya and Algeria that would want to reduce production levels and the other led by Saudi Arabia, UAE and Kuwait that would stick to the current strategy of defending market share. Iran may have a neutral stance as, although it ‘urged’ the other OPEC members to reduce their combined production to maintain a ceiling of $70-$80 per barrel, Iran would itself be ramping up its production levels to regain its lost market share, once the western sanctions against it are lifted.

What does this decision mean for the future of OPEC and the oil industry?

“OPEC made it very clear months ago they will not interfere to control prices and it is the market that should do that,” said one of the OPEC delegates during the meeting.

It is quite clear that even Russia (which produced around 10.74 mb/day in September, a new post- Soviet Era record) is not interested in reducing its output and is competing directly with Saudi Arabia in markets like Europe and Asia, battling for market share.

On the one hand, the Saudis are offering discounts to customers in Asia, Europe and the U.S. On the other, Russia is competing hard with Saudi Arabia in Eastern Europe and China.

In any case, a potential OPEC cut in production levels would not be the complete solution to the problem of the global supply glut as the U.S. shale patch has nearly doubled its production, up by 4 million barrels per day between the year 2011 and 2015, arguably making them more responsible for the supply glut and current oil price crash.

Survival of the Fittest

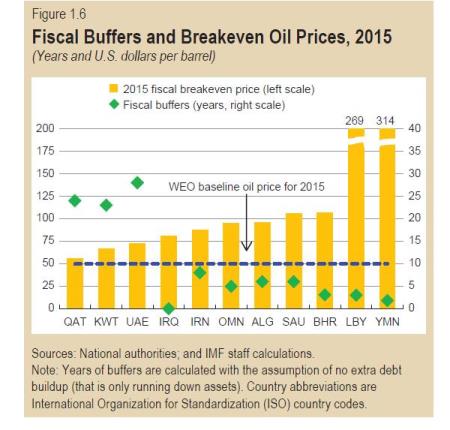

In the end, it will come down to survival of the fittest. Players who have higher breakeven costs will be the ones who will blink first and thereby reduce their production levels. In the present scenario, the U.S. shale drillers, who have very high breakeven costs, are going out of business and we are already witnessing how U.S. production is falling every month since April. Still, oil prices remain below the $50 per barrel mark.

The ‘survival of the fittest’ also applies to Middle East oil producers, and especially to Saudi Arabia, the undisputed leader of OPEC. As widely reported by the media, the International Monetary Fund has warned that Saudi Arabia is now facing the possibility of going broke in the next five years, while the other Middle Eastern nations like the UAE, Kuwait and Qatar have foreign reserves that could last for almost twenty years. The desert kingdom is now facing a massive budget deficit of $36.8 billion according to its 2015 budget figures and is burning its foreign reserves at an alarming pace. Although Saudi Arabia is responding to this crisis by cutting spending, postponing several projects and by attracting foreign investment, is it doing enough to salvage the situation?

Many experts now believe that Saudi Arabia will eventually be compelled to cut its production levels as its rising budget deficit will leave the desert kingdom with no other option. And, with Saudi Arabia deciding to cut the production, we can expect oil prices to bounce back in the longer run. Until then, oil prices will continue to remain bearish and volatile. Although it is almost certain that OPEC will not change its strategy in its next meeting in Vienna, it is unlikely that it would maintain this stance for too much longer in 2016.