JP Morgan announced back in February that the firm would be scaling back, particularly in “non-operational” deposits. These were not retail deposits in the traditional sense from regular folks doing actual banking, but rather institutional “deposits” linked to shadow conduits and wholesale functions. The idea, along with some other restructuring measures, was to cut about $5 billion in costs over the next few years. As per usual, the announcement was led by commentary striking for a regulatory framing.

As of its latest quarterly earnings report, the bank has been successful, to varying degrees, in managing its cost structure but to little avail. Revenues are falling faster than JPM can pull back resources from those business lines most affected; as you may have guessed, that means largely FICC and the guts of the eurodollar system.

Fixed income revenue fell by 11% in the quarter, which is pretty bad on its own but was actually down by nearly a third when adjusting for disposed “assets.” In fact, the firm’s overall asset balance declined again in Q3, by more than $30 billion which isn’t much in absolute terms but everything since banking is always and everywhere supposed to be growth. With assets cut by almost 5% in Q2, the bank shrunk for the second consecutive quarter for the first time since the darkest days of 2009.

From that anecdote, you can begin to appreciate the dire straits the world faces in 2009. If the global economy was set about a true and unfettered recovery, this would be celebratory news, an end to the financialism that has dominated and strung along inefficiency the whole way from its 1995 launch. But that isn’t how it is “supposed to be” in a world where central banks dominate over not just money, not just finance but all economy. In aiming for a purely financialized recovery, you better have the bank balance sheet “printing press” at your back.

The fact that it just isn’t there has left “experts” and policymakers somehow stumped. That is why they keep rolling back to this nebulous idea about “regulatory pressure.” It is both convenient and to some extent valid; the problem is in analyzing that range.

The largest U.S. bank is shedding holdings to appease regulators including the Federal Reserve: if the bank gets rid of enough trading assets, derivatives, and investment securities, it can be deemed a little less risky by the Fed, which in turn could help it boost profitability and return more capital to shareholders.

JPMorgan’s efforts underscore the extent to which regulators are influencing banks’ business decisions after the financial crisis cost the global economy trillions of dollars. In the first nine months of the year, the bank returned $150 billion of deposits to customers, largely hedge funds that were parking money not immediately needed for trading. The bank is hoping to shed more assets over time, and may also look to do less trading business with other financial institutions and more with companies, which would allow regulators to view it as less risky.

All that is true save one predominating factor; eurodollar banks as they want to be would not care about rising regulatory influence. In other words, they would accept the increasing capital charges on leverage and anything else the incompetent bunch at Basel and in DC would come up with to stave off the panic that already happened if there were “generous” returns to be had. A wholesale bank will chase anything regardless of the hurdles if there is actual opportunity.

That is the circle that won’t square in the conventional narrative that tries to explain this dichotomy (at least as it existed not long ago; even the narrative is starting toward cloudy of late). The world was supposed to be set upon the great balance of full recovery, the US leading the way into the light of monetary and financialized economic pull; i.e., great opportunity if there ever was. If the world was heading in that direction, regulations or not, there would be banks jumping all over the chance. Indeed, that was the case, but only on a strangely limited basis (as I have chronicled of late; Deutsche Bank and Credit Suisse, of note) which has instead of forming a leading edge of resurrection offers now only a painful reminder of the mistake.

But that difference is only one of time not direction. In fact, if you look at JP Morgan’s situation throughout the recovery it follows from that return profile quite against expectations of more intrusive regulatory fodder. The dark leverage contour of the bank offers just that view; Dodd-Frank was passed in 2010, and the intentions of regulators the world over has been plain (if haphazard) since the panic. Risk and leverage was going to be targeted at some point by some means;that has been a constant feature this entire “recovery.”

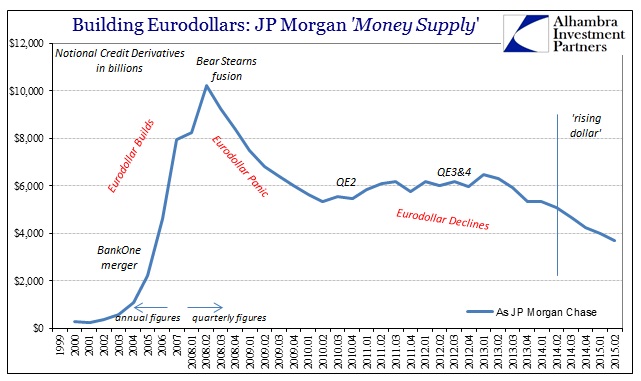

Viewing JPM’s credit derivatives notionals in its book, you can plainly see how returns, at least expected returns, drove at least the quantities (which I reasonably assume from there is a good proxy upon eurodollar function and intention). The panic is clearly visible especially in credit derivatives, the vast majority bespoke, bilateral CDS, but so too is an almost unbelievable rebound starting around the middle of 2010. That was just after the “flash crash” and the first (and related) euro crisis outbreak. JPM responded to those conditions by reversing its CDS avoidance prudently in place since the panic?

I think the hints of QE and then its re-injection later in 2010 explains that shift, especially how it continues all the way until the middle of 2013 when Bernanke “betrayed” his word about QE3 and QE4 being “open ended” or semi-permanent. In other words, in this one view of dark leverage at one bank, a big one (the largest US-based derivative book), the firm took little care of regulatory intentions and tried to resurrect at least partially the “glory” days of eurodollar expansion pre-crisis – which is exactly what QE was intending to do in generic terms.

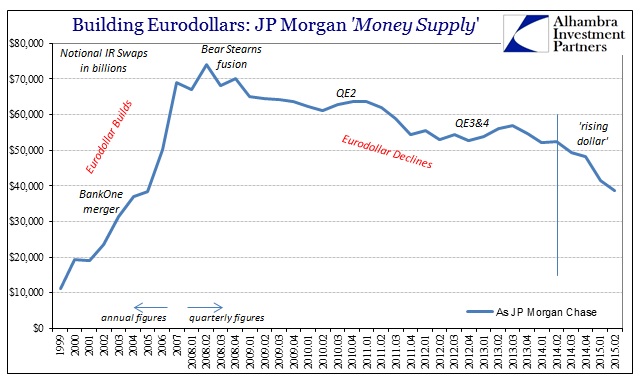

The same trend is visible, though less straightforward, in Morgan’s interest rate swap book. What is different about the past year and a half is thus ordinary; the expected return environment (which includes volatility expectations and calculations) for FICC and eurodollar money dealing has gone from unfavorable to downright dangerous with or without regulatory pressure. In that sense, the regulatory inefficiencies being imposed are just another burden adding to the amplified pressure to get the hell out of Dodge.

The acceleration starting in late 2014 is, again, obvious in this context, particularly as we “celebrate” the first anniversary of the events of October 15, 2014. The Fed and US Treasury Department have dismissed the irregular (read: illiquid, disastrously so) trading of that day as some computer issue when in fact it was a proper systemic issue. Both volatility and unfavorable return profiles in the eurodollar system of bank balance sheets were the only lessons taken into banking from that day; it simply hasn’t been the same since, but now extending beyond oil prices and EM currencies to the heart of even the US economy and its unthinkably “resilient” asset markets (as Janet Yellen proclaims).

As noted a few days ago, central bankers from around the world sat in Lima, Peru wondering where all the “dollars” went. The “hot money”, some estimating as much as a gargantuan $800 billion cumulatively across developing markets, simply disappeared where it was expected instead to have been at least reallocated. But that is wholesale banking; it does “disappear” as eurodollar banks withdraw the internal, esoteric and blindly misunderstood factors that make it work. JP Morgan’s credit derivatives book has been cut nearly in half again since the middle of 2013, while the IR book has been reduced by $18 trillion gross notional (-32%); $14 trillion of that just since this “rising dollar” problem.

In a cosmic twist of irony, from its Q3 balance sheet existence, JP Morgan was reported by the FDIC as the #1 US bank in US deposit growth (in this sense meaning actual customers and not useless bank “reserve” byproducts on balance at the Fed from some QE transaction). It is almost cruel that sense, given the hugely dramatic shrinking in wholesale, how the bank would look to a rise in actual banking as a growth outlet on the liability side. If only someone at a central bank had planned for it, a true recovery might have been found. Instead, they all wanted 2007 again and only 2007 again, but could catch just brief and fleeting QE-inspired moments of it; to which that bill still needs to be paid.