Despite all domestic reports to the contrary, the rest of the world is having a very difficult time seeing any recovery yet in the United States economy. With recent trade data in hand, it is not difficult to discern why oil prices are heading so much lower and the Chinese (and then Brazil and every other resource economy) are left to their own monetary devices. There simply has been no rebound in US demand for foreign goods.

If that were the case alongside a durable trend whereby US consumers are buying more American-made products instead, that would be at least somewhat encouraging (though only in the narrow context of where we are right now). However, given spending and income data that is not likely the case either. Instead, there simply remains no improvement in US demand for anything.

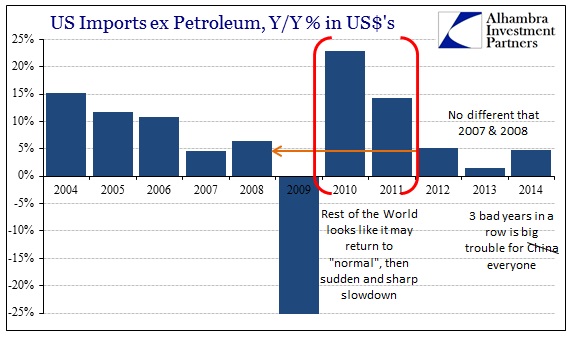

Like durable goods, the nominal change in US$ imports began to “accelerate” at the end of 2012 and beginning of 2013 (belying the “weather” excuse). However, that increase is nothing like what would fairly be called actual growth, instead mimicking far too closely the cyclical peak behavior that formed 2007 and the first two-thirds of 2008.

Such a comparison is interesting certainly in the context of that cycle’s entry into recession (depression), but also because the word “decoupling” became economists’ favorite. Though then the term applied to the world in reverse to what they thought would only be US slowing (missing, of course, not just recession but the severity of it entirely); today “decoupling” is meant to explain how the US can be at such a comparatively good station in light of the rest of the world’s far more apparent struggles.

This narrative rests itself upon the assumed divergence with China, of all global supply chain participants. Economists in the US see US recovery, but then puzzle about China’s well-documented sputtering; and therefore can only conclude of Chinese idiosyncrasies. The data just does not support that interpretation, though clearly China has its own internal imbalances weighing on currency circumstances.

Those imbalances, though, must still be placed into the global context, including this very clear lack of US demand. The Chinese, through the PBOC and its blessing, went on bubble credit because demand from the US (as well as Europe) simply collapsed not unlike the period entering the Great Recession (after the US housing bubble burst). In that very important respect, all of China’s current problems relate to the inability of the US economy to actually perform as it is being described by economists and policymakers.

If the US economy had been growing like what is being described of it (particularly since the massive 2012 slowdown) the PBOC likely would have not “allowed” the incredible debt production to take place and the ghost-city bubbles in property and “wealth products” – they wouldn’t have needed it if US imports were growing at 20+% again. Again, the data makes it very clear that the Chinese are in trouble because the US economy is as well; decoupling is a myth.

What we are seeing with this now third straight year of recession-like “growth” is the elongated cycle, especially at the peaks, that started to appear before the dot-com burst and recession.

From the Chinese perspective, they have seen US demand at 2008-levels for three years running, and not much of even more recent months to suggest that is about to change (at least for the better). While September imports from China were 12% above September 2013, that simply continues a pattern that stretches back to that time. There is now a definitive quarterly pattern established that I think relates to inventory and disappointing results that diverge from overly optimistic forecasts.

The final month of every quarter has seen a “surge” in importation only to have the first two months of the next quarter suffer from it. On average, then, quarterly growth (as shown immediately above) in Q3 was not all that better than the first two “cycles” and more than a bit below the “sunshine” rebound in Q2. Again, in context, 5.7% is atrocious and indicates nothing good for China, Brazil and the rest of the world.

If there is a defined trend for global growth, this is it. There is no decoupling, especially since the 2012 slowdown caught all these central banks and their policies completely by surprise (though it should not have if they were unbiased toward monetary and Keynesian ideology). Now they are left trying to explain, in curiously very convoluted terms, why the world economy can “suddenly” be so unsupportive of the established narrative that monetary policy is an unqualified “good.”

It really is that simple – the US economy is struggling at what might be an elongated recessionary pace, and the world downstream of that is reflecting as much. After seven years of “demand” policies, it is more than disqualifying to see still no demand. The bubbles this time are having diminished marginal effects, which is why secular stagnation is “forcing” central banks to change their course (all except BoJ’s full-speed debauchery).