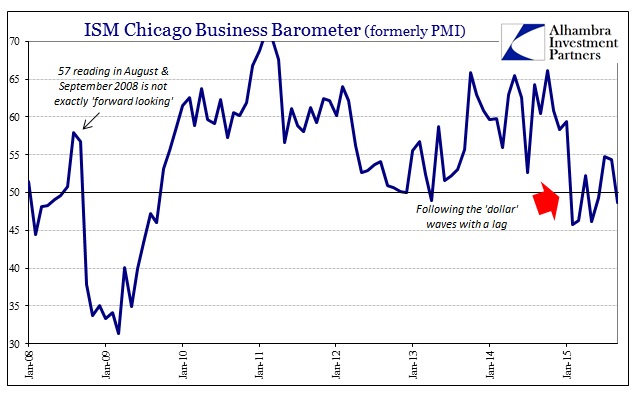

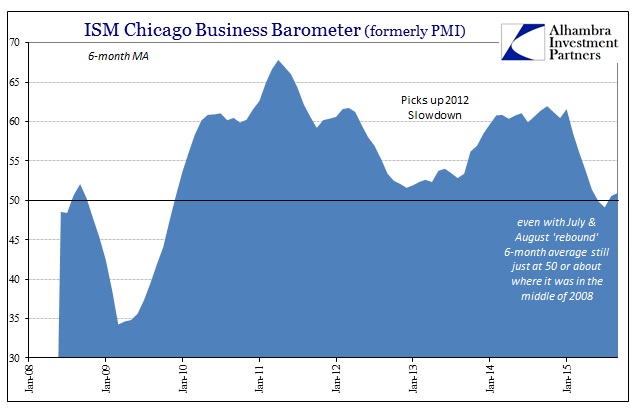

The last few pieces of data for Q3 more than suggest the US economy faltered in August/September. That trend would be alarming on its own had it occurred in a financial vacuum (as if ceteris paribus actually existed), but following along against the “dollar” is especially so. There was the initial, large decline in early 2015 that “unexpectedly” shocked economists and commentary off their 2014, GDP is 5% perch. That slump was initially met by derision and disembodiment as if it were yet another aberration (continuous anomalies tend to be something other than anomalous) to be discarded in serious analysis.

When the “slump” continued on past snowfall and port strikes, it was upgraded to “transitory.” That even appeared to be the reflection of the data as it, again, followed the “dollar” out of the first wave. The idea of “transitory”, then, meant expectations (and monetary promises) that there would be no second wave.

Obviously, starting around July 6, there was a second hitting everything from oil to China to even the here-to-fore unthinkable denting of stock market certainty. With economic data, especially spending and related manufacturing (since inventory is stuck in between them), now falling again as the “dollar”, all those prior benign interpretations risk undoing if not full repudiation. That is a big risk to markets in terms of prices caught wrong-footed about expectations (reordering assumptions to incorporate “transitory” being not that) but there is also great economic risk as at some point inventory imbalances demand correction.

The idea of “transitory” in that context is for manufacturers, wholesalers and retailers (to a more limited extent) to only make slight adjustments to production and trade levels to reflect inventory (and the “dollar”, by extension) but maintaining a positive outlook once the “temporary” problems abate and that 5% GDP comes roaring back as is proclaimed at every juncture. That had already occurred, as production levels have been declining but not sharply so. If business outlooks suddenly shift away from that orthodox tendency, then the inventory problem becomes much, much more than a temporary nuisance; deeper and sharper cuts to production become necessary.

Thus, the “dollar” reflects potential “demand” and then that outlook follows the “dollar.” So far, again for August and September, that alarming trend has already led to potentially recessionary fruition:

The Chicago Business Barometer declined 5.7 points to 48.7 in September as Production growth collapsed and New Orders fell sharply.

The drop in the Barometer to below 50 was its fifth time in contraction this year and comes amid downgrades to global economic growth and intense volatility in financial markets which have slowed activity in some industries. The latest decline followed two months of moderate expansion, and while growth in Q3 accelerated a little from Q2, the speed of the September descent is a source of concern.

Indeed, as it isn’t just the Chicago version of some manufacturing PMI. Every one of the regional Fed manufacturing surveys is harmonized on that negative outlook and potential:

Surveys conducted by regional Federal Reserve banks signal that U.S. manufacturers came under severe stress in September.

Seven of these surveys have been released over the course of the month, and only one, the Dallas Fed Manufacturing Index, has exceeded economists’ expectations.

All these regional surveys pointed to shrinking manufacturing sectors, with some prints coming in at their worst levels since the Great Recession.

As usual, this commentary focuses on the dollar only as it relates to some assumed, mythical currency translation with regard to export competitiveness. The idea of the wholesale “dollar” dictating “demand” is completely lost (again, Socrates parable of the cave applies). So we are to be reassured that none of this weakness is anything but a minor inconvenience (which is already a downgrade from when it wasn’t even supposed to linger as a problem before August):

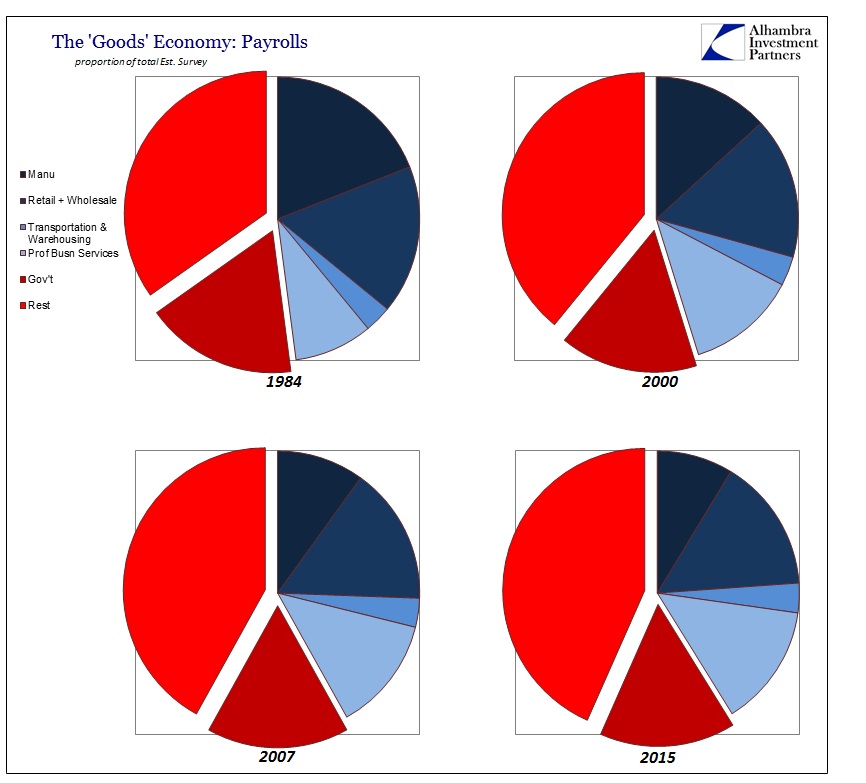

The good news in all this? Manufacturing isn’t nearly as big a part of the U.S. economy as it once was, and all indications are that services sectors are still humming along at a robust clip.

As detailed previously, that might be true in terms of longer-term comparisons, but manufacturing and goods are still the same proportion in the economy as they were in 2007. The problem with services “humming along at a robust clip” is that there isn’t anything to base that view upon apart from imputations of government statistical efforts, but more so that if that were true then it is coming at the expense of the goods economy. If healthcare spending, as one major part of “services”, is rising but forcing consumers to cut back in goods, then that is a huge economic problem since healthcare (and other services, real and imagined) is far less efficient in terms of economic circulation.

These blatant attempts to blindly reassure the “recovery” narrative aren’t serious considerations, particularly in light of “transitory” finance being undone so thoroughly; and, worse, that continued financial pattern has translated already and directly to stark economic deficiency even if it is “lowly” manufacturing and goods. The narrative trajectory is thus easily extrapolated as degrees of “unexpected”:

1. Dollar doesn’t matter, indicates strong economy relative to the world

2. Dollar matters for oil, but lower oil prices mean stronger consumer

3. Manufacturing slump doesn’t matter, only temporary

4. Manufacturing declines are consumer spending, but only a small part

5. …