By Tyler Durden at ZeroHedge

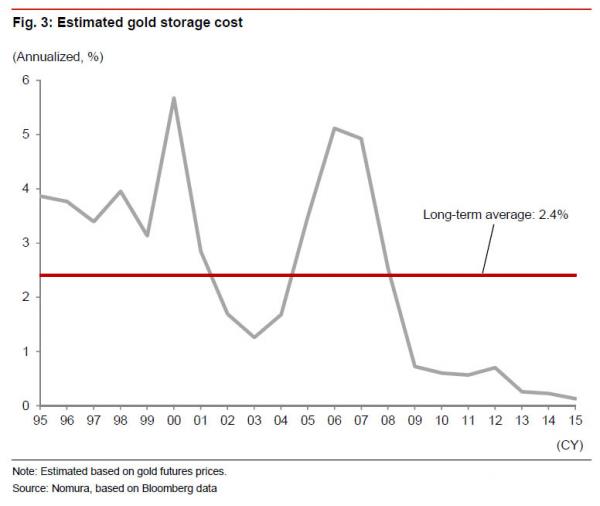

One week ago, in the aftermath of Japan joining the NIRP club, we wondered how low Kuroda could cut rates if he was so inclined. The answer was surprising: according to a Nomura analysis the lower bound was limited by gold storage costs. This is what the Japanese bank, whose profit was recently slammed by Japan’s ultra low rates, said:

“theoretically, negative interest rates’ lower bound depends partly on the cost of holding cash in the form of physical currency. When people hold cash out of aversion to negative interest rates, they risk losses due to theft and the like. The cost of avoiding this risk could be a key determinant of negative interest rates’ lower bound, but it is hard to directly quantify. As a proxy for the cost of holding physical currency, we estimated the cost of storing gold based on gold futures prices. This cost has averaged an annualized 2.4% over the past 20 years, though it has varied widely over this timeframe.”

Which, in conjunction with Kuroda’s promises that “Japan will cut negative rates further if needed”, raised flags: once the global race to debase accelerates, and every other NIRP bank joins in, will global rates be ultimately cut so low as to make a “gold standard” an implicit alternative to a world drowning in NIRP?

According to a just released report by JPMorgan, the answer is even scarier. In the analysis published late on Tuesday by JPM’s Malcolm Barr and Bruce Kasman, negative rates could go far lower than not only prevailing negative rates, but well below gold storage costs as well.

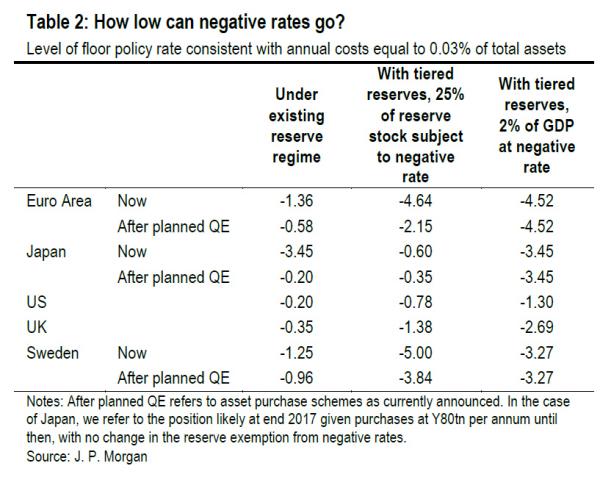

JPM justifies this by suggesting that the solution to a NIRP world where bank net interest margins are crushed by subzero rates, is a tiered system as already deployed by the Bank of Japan and in some places of Europe, whereby only a portion of reserves are subjected to negative rates.

Which leads to the shocker: JPM estimates that if the ECB just focused on reserves equivalent to 2% of gross domestic product it could slice the rate it charges on bank deposits to -4.5%. Alternatively, if the ECB were to concentrate on 25% of reserves, it would be able to cut as low as -4.64%. That compares with minus 0.3% today and the minus 0.7% JPMorgan says it could reach by the middle of this year as reported yesterday.

In Japan, JPM calculates that the BOJ could go as low as -3.45% while Sweden’s is likely -3.27%.

Finally, if and when the Fed joins the monetary twilight race, it could cut to -1.3% and the Bank of England to -2.69%.

As Bloomberg adds, easing the fall is that the JPMorgan economists bet that banks are unlikely to be able to pass on the cost of the policy to borrowers, reducing potential repercussions. They also see limited pressure on bank profits or for a need to stash cash. On the other hand, DB has suggested that it is time to pass on NIRP to depositors in the most aggressive forms possible.

While Barr and Kasman still expect policy makers to tread carefully, such analysis may temper the recent fear of investors that after seven years of interest rates around zero and bumper bond-buying, central banks are now out of ammunition. Indeed, a fuller embrace of negative rates could “produce significant reductions in market rates,” said the economists.“It appears to us there is a lot of room for central banks to probe how low rates can go,” they said. “While there are substantial constraints on policymakers, we believe it would be a mistake to underestimate their capacity to act and innovate.”

Here are the key observations by JPM:

- Sluggish growth and low inflation is building the case for further DM monetary policy stimulus. With term premia and forward rate expectations compressed, the benefits of additional QE and forward guidance is likely to be limited.

- The alternative of negative interest rate policy (NIRP) has been viewed as constrained as banks, corporates and households can increase holdings of zero-yielding physical currency when rates move negative.

- Innovations by central banks in Europe and Japan have enabled central banks to push policy rates well below zero. Using a tiered deposit scheme, deposit rates have fallen as low as -0.75% in Europe with no significant signs of a move into cash.

- Our analysis suggests that the use of these schemes could allow for considerably lower policy rates without undue pressure on bank profitability or creating a powerful incentive to move into cash.

- Calibrations based on Swiss experience suggest that with modest changes to the reserve regime, the policy rate in the Euro area could,in principle, go as low as -4.5%.

- Estimated bounds for the US (-1.3%) and UK (-2.5%) are higher, reflecting their larger bank reserve to asset ratios. We believe this bound is not binding and that rates could fall further in both cases.

- To date, markets price only a small probability of sustained NIRP of -0.75% or lower in the G4. This suggests that a strong signal that policymakers are willing to actively use NIRP could produce significant reductions in market interest rates.

- The actual transmission of NIRP is likely to be muted as we expect household deposit rates to remain sticky around zero which will limit pass-through of NIRP through the retail banking sector.

- Central banks are also likely to move cautiously into NIRP as they are sensitive to the uncertain consequences of these policies on local markets. This suggests their response to weakness may prove slower than in the past.

- Having put in place a three tiered deposit system and facing a significant inflation undershoot, the Bank of Japan is expected to lower its deposit rate to -0.5% alongside additional QQE this year.

Recall that JPM yesterday set the bogey on the one event that could prompt Yellen to go NIRP: a recession. Here is the latest take by JPMorgan on this:

With IOER at 0.5% and the Fed maintaining concerns about US money markets, the US is not close to considering NIRP. However, if recession risks were realized, the need for substantial additional policy support would likely push the Fed towards NIRP.

In other words, once the Fed makes up its mind, all that will be needed is for economic “data” to turn even more severely southward thus giving Yelen the required political cover to join the final lap of the global race to debase.

Finally, here is the summary table of where to look for the real negative lower bound.

Source: JPM’s Striking Forecast: ECB Could Cut Rates To -4.5%; BOJ To -3.45%; Fed To -1.3%