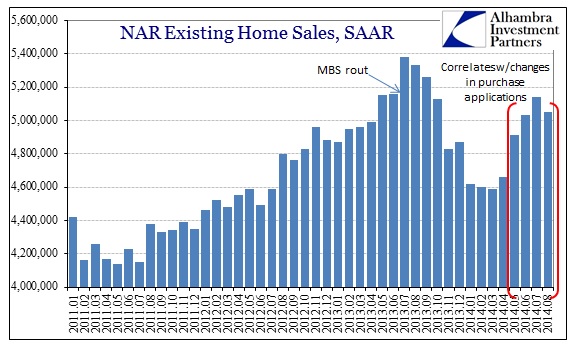

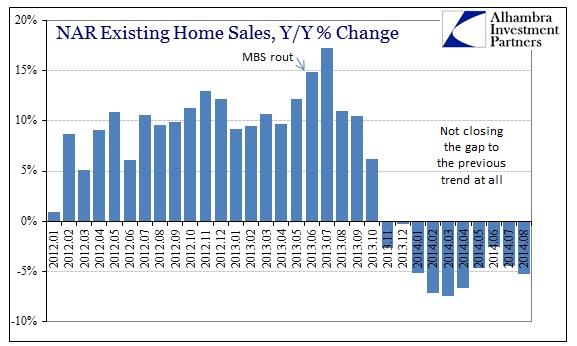

Since mortgage applications to purchase a home peaked back in June, it would make sense that home sales would follow a similar approach and pattern with enough lag. Not only are purchase applications down, they are back at the same low level that vexed the home market earlier this year – and this time without the “obvious” excuse of weather-forlorn real estate prospects. Given that erosion, there really should not have been much surprise that existing home sales in August were below July’s pace.

With housing data relatively volatile month-to-month, there is certainly the real possibility August was just an aberration all its own, with the prior rebound that began with spring re-asserting in autumn. However, with the timing factor exhibited by the application process, the decline in applications once more to the degree it has surrendered suggests that this may be more than a one-month interruption. It would not be at all surprising if this latest retrenchment picks up in the months ahead (as we have seen in home construction).

As it is, the current pace of home sales remains well-behind last year and seemingly unable to catch up despite the spring being “less worse” than the winter.

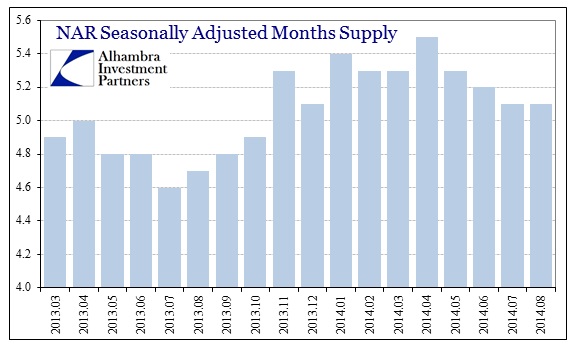

In my opinion, that has begun to factor into the sales process itself as inventory had risen (nominally) alongside sales until earlier in 2014. The “backup” in sales activity seemingly has had an impact on the number of homes on the market, finally, as there has been a small but noticeable downshift in the “supply.”

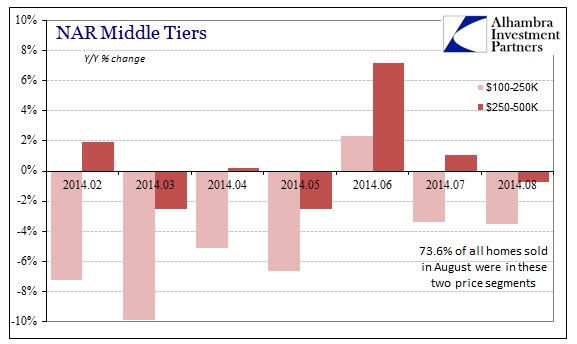

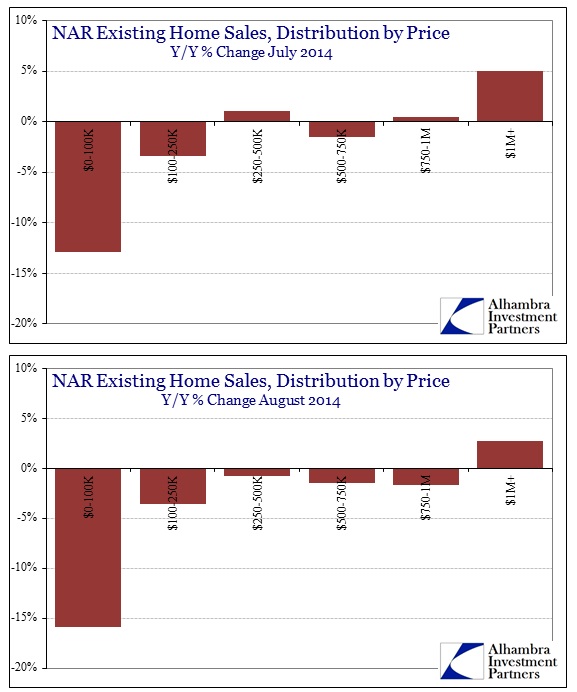

Without the “support” of institutional buying in bulk, there is less pressure from below driving not only prices but the psychology of rationalizations that ultimately sustains bubbles. The middle tiers are consistently (outside of June) leading the sales rate lower instead of taking the lead into a more sustainable rebound. With more than 44% of all home sales conducted in the $100k-$250k segment, rather highly depressed activity there (shifting upward in the price structure, though August was pretty bad all the way up to the top) is a serious deficiency in actual market function.

First-time home buyers continue to be conspicuously absent (this is the place where they would normally be entering) pointing to both the lack of actual economic progress in jobs and wages (household formation) as well as the intrusion of monetarism, particularly QE3, that skewed totals for the past few years. In other words, the artificial portion of the mini-bubble is steadily being revealed as institutions realize that their initial estimates of REO-to-rent were unsuitable for these conditions: lack of actual economic progress (to maintain rental price increases) and sustainable housing advance.

The results for August weren’t terrible, but it’s what could be shaping up as another downturn that is more relevant. The upstream conditions are not looking all that bright, and are actually declining once more, so existing sales could be set to re-aligning (down) again with what we see in home construction.

Click here to sign up for our free weekly e-newsletter.

“WEALTH PRESERVATION AND ACCUMULATION THROUGH THOUGHTFUL INVESTING.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@alhambrapartners.com