In addition to the worrisome durable goods report (in the respect that it just continues the same contraction part of the slowdown), consumer confidence slipped suggesting that the rebound in stocks and prices of other risky assets are not striking a direct correlation. There may be a delayed effect, with “confidence” or sentiment in April still more focused on the “markets” in January and February, but overall there seems much less correlation with the specific gyrations in asset prices and more so the general trend. In economic terms all across Q1, that is decidedly weak:

The durable goods report added to recent reports on retail sales, trade and industrial production in suggesting economic growth slowed further in the first quarter. The economy grew at an anemic 1.4 percent annualized rate in the fourth quarter.

First-quarter GDP growth estimates are as low as a 0.3 percent rate. The government will publish its advance first-quarter GDP growth estimate on Thursday.

A second report on Tuesday from the Conference Board showed its consumer confidence index fell 1.9 points to a reading of 94.2 in April. Consumers were a bit pessimistic on the economy’s short-term prospects, implying they did not expect a pick-up in activity.

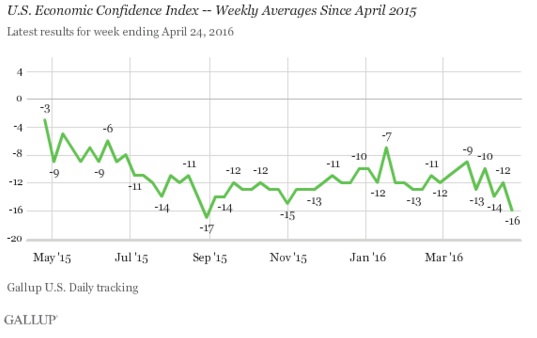

That interpretation is consistent with other survey-based estimates including a trio of polls conducted by Gallup. Their US Economic Confidence Index dropped to -16 in the latest week (thru April 24), the lowest reading of 2016. Both the current conditions component and economic outlook piece dropped, though the decline was far more pronounced for future expectations. According to the survey, only 35% said the economy is getting better while an alarming 60% are saying it is getting worse.

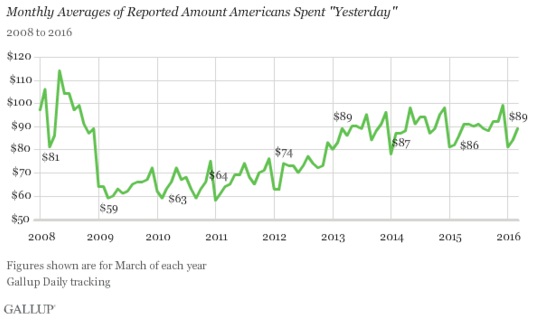

That is already a potentially significant problem since Gallup’s monthly spending poll continues to show no overall growth in consumer activity. Dating all the way back to 2013 (lagged reaction to the 2012 slowdown), Gallup’s survey of daily consumer spending has conspicuously stagnated no matter what the unemployment rate has done, how high stock prices traversed, or how many times some FOMC member claimed emphatically that the economy is far better than generally believed. Gallup’s estimate for March 2013 was $89 and it was $89 yet again in March 2016 (not adjusting for actual price changes outside calculated “inflation” rates).

It is perfectly consistent with the continued downward trend in the economy observed in every other economic account except what the BLS publishes for labor data. It also adds depth to the charge that the US economy shrunk after the Great Recession; despite eight years’ time consumer across this slowdown spending according to Gallup remains generally lower than what was figured for 2008. It suggests, strongly, that income growth has been at best very limited and sparse, contrary to the mainstream view of the economy through the unemployment rate.

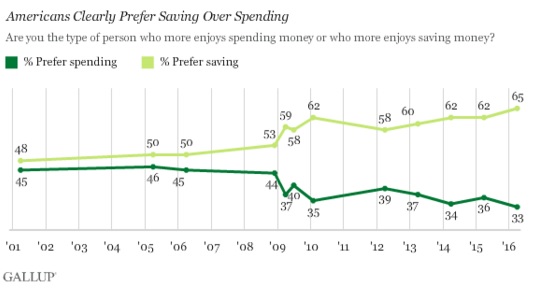

Finally, in terms of monetary policy and QE specifically, Gallup finds even more evidence they were complete failures. The number of Americans that claim they prefer saving to spending is at a high for this century. With a clear shift in preferences dating to the Great Recession, US consumers (at least according to this survey) remain unimpressed by the huge monetary policy commitment to the “wealth effect” that was supposed to have been summoned by four separate QE’s and more than seven years of ZIRP “stimulus.”

At best, there might have been some minor reaction in 2011 into 2012 (this question was apparently not polled in 2011) but once again we find a durable shift in recorded sentiment perfectly timed with the appearance and settled state of the slowdown. Like Gallup’s tracking poll for consumer spending, starting in 2013 Americans reported only greater preference for saving even though that was the year where stock prices broke out to new all-time highs, zooming ahead in expectation that QE would work in the near future. Where stock “investors” may have been so easily convinced, real economic agents were instead apparently focused only on real economy conditions on the ground.

No matter the financial interventions and distortions, these three polls continue to point to actual income (not academic concepts of what income might be at some point in the future if QE might ever produce an intended effect) as the only factor that truly mattered(s). Therefore, we can infer that QE does not actually produce economic income in any of its expected channels, rather it only produces expectations of a “wealth effect” exclusively among those that always expected it to work.

There is broad-based evidence and agreement in these anecdotal surveys consistent with other economic accounts. They are: the slowdown has been constant since at least 2013; it is likely to have intensified in 2015; and monetary policy is totally absent from any of them. The economy is the economy, meaning the Fed is and has been powerless against the consistent “headwinds” (primarily the “dollar”) that deepened after the financial events of 2011 and 2012.