Value as a foundation seems almost too literal to be an economic or financial concept, but it is perhaps the bedrock association that makes the economic system. We are used to aspects like profits and money, even inflation, but those are all symptoms of the ever-changing world surrounding value. Karl Marx understood very well how deeply embedded value was even by the 1850’s, unleashed in just a few centuries’ time as Adam Smith’s wonderful summation recounted how mercantile capitalism was more than just some “invisible hand.” For Marx, he knew that the very rise of modern economic orientation would spoil all his plans and conceits for instituting equality as he saw it; that is why his revolution had to be worldwide and comprehensive, to totally and completely destroy all notions of value in order to start over.

I wrote quite exhaustively (as I typically do) about the socialist strands in our economic history here, but it is, I think, useful to emphasize the role of value in theory that animates if not all of the historical progression of the elements that define our systemic operation than at least a majority portion. As early as the 1830’s, “reformers” of all kinds were beginning to examine how value might be “exploitable” as means to achieve desired results.

In the 1830’s, Robert Owen, a Welsh “reformer”, had tried repeatedly to convert currency to labor function. Time-based currency was an idea where you were “paid” in time for labor (notes actually denominated in hours), exchangeable for products “valued” under the same terms. The idea was simple, namely that all labor should be equal so that inequality of class would be abolished. Time currency, then, meant that there was no value to labor, only to goods, which presented inordinate problems in valuing goods as they were also intermediate to labor.

Owen, therefore, had very little luck in actually creating a workable system outside of that theory. He had close experience with a similar system, though wholly opposite his egalitarian intentions, in the “truck system” of early 19th century Britain. Owen was a part-owner of a mill and it was typical practice to pay mill workers in tokens (either in part or even in full) that were only exchangeable at the mill owner’s “truck shop.” Since the owner would often supply the worst kinds of inferior goods and charge the highest prices for them, Owen realized the relative exchange equation here was to devalue labor; he intended to accomplish the opposite thinking it would not only be more equitable to labor but far more efficient for everyone (instead of benefiting the mill owner almost exclusively, a far more fair labor “value” might benefit all of social society).

Socialists independent of Marx, including Owen who had influenced Marx with his time currency, shared many of his ideals if not his fervor for destroying everything in a clean and devastating break. For many, money could be the agent of change, whether in the course of redistribution (including government taxation and “spending”) or outright redefinition. If they would not go so far as to destroy value from the root, then they thought it, as Owen, potentially effective to manipulate money as a substitute or proxy for value. And a great deal of socialist contribution had little to do with equality other than utopian ideals of creating “optimal” outcomes. The shared methodology was simply to reduce individuals to cogs in order to more cohesively control the macro mess of them.

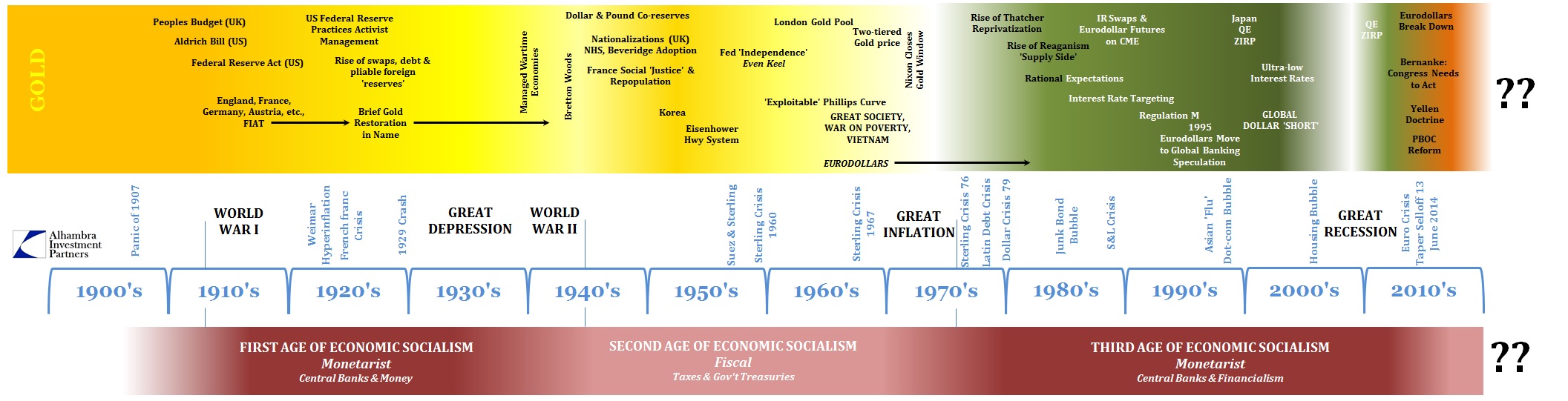

The development of economics as both a study and a political expression is certainly non-linear, but in the 20th century there is a clear progression; we started in gold and ended under much less certain terms, a process that seems chaotic, and often was, but with its own guiding if largely invisible hand. The battles in the various marginal directions seemed to take shape over money and currency, but in reality it is and has always been about value. The intent at times has been to separate money from value, but the grand mistake seems to have been where theorists simply assumed that all money and currency are eventually perfect substitutes. That may be true in at least one monetary function, payment terms, but has proven far more stubborn in practice across the whole spectrum of monetary discipline.

At the start of the 20th century, value was relatively easy to describe and its role was just as straightforward. The decade of the 1890’s proved that inordinately (as it was known up until the 1930’s as the Great Depression) where value was imposed on financial society through the act of convertibility. Numbers and quantitative descriptions did not apply, which is why so often the ire of “experts” is invoked against this type of expression, but it comes down to a simple and collective judgment (not aggregated) of the people to disassociate their property from financial components; the latter being judged un-valuable with respect to the former.

The result was banking panics and depression, negative outcomes which opened the door to anyone promising relief including through the growing collectivization of monetary affairs. Nobody likes a panic, and certainly not a depression, but to claim that they hold no role in systemic health is to ignore reality, to ignore value. But that is exactly what occurred at the start of the 20th century, given great vigor after the Panic of 1907 even though it produced only a minor (in historical terms) economic dislocation. The institutional intention toward “elasticity” in currency was not just a means to end bank panics (it worked out poorly anyway) but to disrupt the balance of power in the economic arrangements toward the socialist expression of the whole rather than individuals.

For some, that meant egalitarian ends, for others just the quest for economic utopia largely of mathematical origin in those optimal outcomes. In any case, the balance of the last century and the first parts of this one all trace in governing dynamics to that introduction. What we can piece together, quite seamlessly, is different tones of aspiration and methods in trying to attain these largely socialist ideals.

The American changes after the Panic of 1907 were just in many ways catching up to Europe, but at the start of World War I the gold standard would end and never truly return. All the theories, policies and programs put together thereafter were simply means to exercise greater control out of that momentous, cardinal shift – with gold gone, the opportunity to refashion was there. The problem was always value, in that it survives the deeper defenestrations of money and currency, even if only to interrupt, often terribly, these “best laid” plans for achieving either equality or optimal outcomes.

The first age, out of necessity of the Great War, was monetary in character; the first international experimentation with fiat currency. As with most things, it started out as just a means to a specific end but overgrew and lasted far longer. The 1920’s were not simply a Golden Age particularly of American economic prowess and remarkably consistent monetary programs (how could it be, with what came immediately thereafter?), but were marked by serious incursions of monetary experimentation. The gold standard that was reworked after the war was by no means a traditional gold standard, featuring more than enough clearance for central banks to begin exercising “flexibility” outside of the more rigid historical arrangements. The results were predictably disastrous and monetary in nature.

There is no mystery as to why the first socialist age ended in bubbles and depression (and then total war) and why they revisited again only so far in the third – those were both overriding of monetary character. The second was not, taking the form of fiscal dominance. The Federal Reserve today takes credit for the post-war period as if it were an island of perfect competence, but it was far from it as the Great Inflation (which marked the turn from the second age into the third) showed all too well.

In that respect, the British experience in the second age is quite emblematic of these marginal shifts. Churchill was a hero, a great man of all history, on May 8, 1945 (V-E Day) and out of office six weeks later; and not just barely, but in one of the most lopsided electoral shifts in democratic history. The Great Depression had shown the dangers of monetary overdrive, but not the relevant lessons taken from central command in instilling that impulse. Instead, economic thought roundly viewed the Great Depression as a systemic flaw of capitalism (socialists taking advantage of the opportunity), and if money wasn’t the answer then government and their treasuries was.

After 1945, Britain nationalized a huge proportion of their industrial base – there were 16 or so car manufacturers in the 1940’s but only one was left by the 1960’s. And so it was that the welfare statement and the ubiquitous if ephemeral drive for “full employment” became the objects of economic policy, not through central banking, but through government Keynesianism. It was mismatched from the start because value imposed restrictions, especially where the pound was supposed to act as a co-reserve to the dollar. The British government wanted heavy fiscal socialism as a means to full employment, but the pound meant that the people outside of that still had influence which they exercised intermittently to keep the utopian ideals restricted to at least less risible budget plans. This transition to fiscal dominance was thus highly irregular and often harrowing.

By the late 1960’s and especially the 1970’s, it was almost all over. The rise of Thatcherism meant the end of nationalizations, the return of private industry and the private economy if not a total repudiation of the welfare state. The fiscal turn in the second age had proved far too unwieldy, and by the end of the 1960’s was once again expecting far more monetary contributions. That was true even in the United States, with vestiges of the New Deal remaining in place but augmented by fiscal experimenting in the 1950’s and especially the 1960’s. The Great Society and the War on Poverty were perfectly consistent with the fiscal focus of the second age, and only by the end was it “necessary” to employ heavy monetarism again – not in restoring value and sense, but in a last ditch to save it all before it became once more unworkable. Value was the great upheaval in the Great Inflation, but instead of listening and seeing that money was never going to be a perfect substitute, at least enough, to allow overcoming the value constraint, theorists simply went still further just as they had in transitioning from the first age to the second.

Part 2 continues here.