By Tyler Durden at ZeroHedge

Two weeks ago, before first the ECB first and then, the Fed, unleashed two massive dovish surprises, we warned – citing JPMorgan – that the most painful part of the short squeeze “may be yet to come.”

As a reminder, this is what JPM said on March 5:

The covering of short equity positions continued over the past week. The short interest in US equity futures declined over the past week. But its level remains very negative suggesting there is room for further short covering. The short interest on SPY, the biggest equity ETF, at 4.75% stands below its recent peak of 5.43% but it remains elevated vs. its level of 3.54% at the start of the year. Equity ETFs have not yet seen any significant inflows, suggesting that ETF investors have done little in actively reversing the almost $30bn of equity ETFs sold over the previous two months. CTAs, which have been partly responsible for this year’s selloff, are still short equities and they have only covered a third of the short position they opened in January. In contrast, Discretionary Macro hedge funds, Equity L/S, risk parity funds and balanced mutual funds, appear to be modestly long equities, so they are currently benefitting from the equity rally.

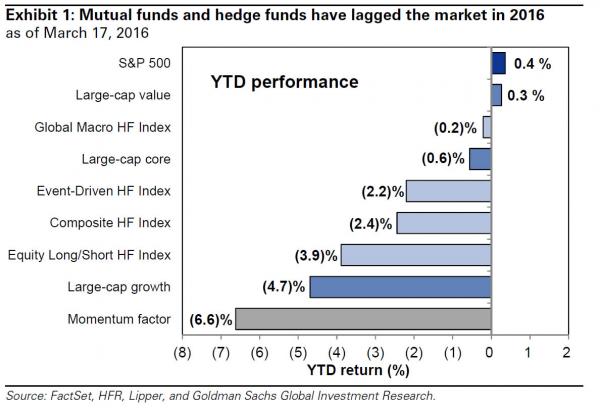

Actually, if one uses the latest Goldman Sachs data, this is not at all true because those long positions which benefited from the market surge were more than offset by pair-trade shorts which soared even more and wiped out all gains.

We won’t cry for hedge funds, however, and instead are much more interested in what current and future flows will look like.

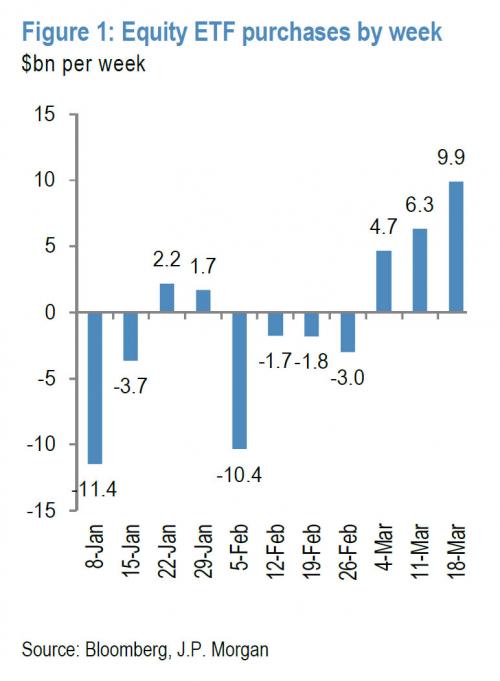

According to the same JPM team which expected a continuation of the short squeeze half a month ago, as a result of central banks once again pandering to stock markets with the Fed shocking even the “Liesmans” of the world by going full dove even as the Fed has already met its labor and inflation mandates, the move has led to a significant “impact on investors’ sentiment and behavior is evident in flows. ETFs, a universe almost equally shared between retail and institutional investors in terms of ownership, saw another big inflow this week meaning that three quarters of the previous selling of equity ETFs during January and February has been reversed over the past three weeks.”

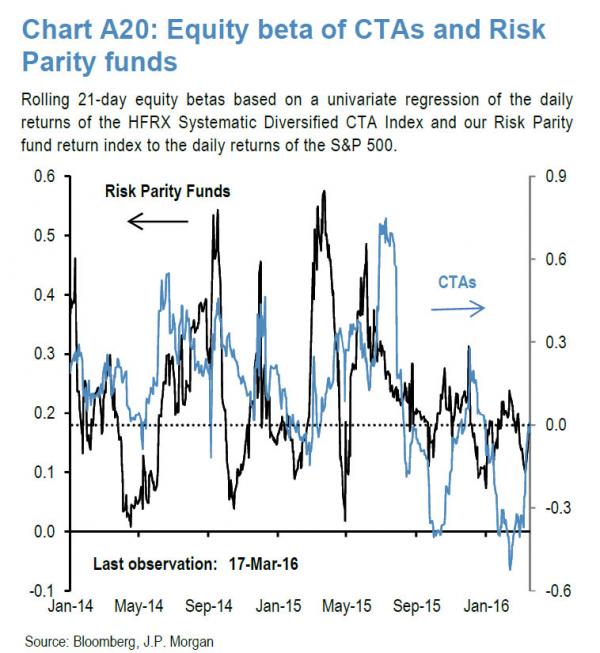

What is more notable from JPM’s note, is that CTAs – one of the most important marginal price setter on the way down when only CTAs were profitable at the expense of all other hedge funds, continued to cover their loss-making short equity exposures. By JPM’s equity beta measure, CTAs appear to have fully covered their shorts as shown below.

But while CTAs may be out, the short base in US equity futures remained elevated as of last Tuesday, March 15th, a day before the FOMC meeting, perhaps held by money managers outside CTAs.

JPM also suggests that there was even more short covering in the post-FOMC period not covered by the chart above, which certainly has collapsed the net short exposure but JPM believes that “given the size of the shorts as of last Tuesday, we doubt that the negative net spec position on US equity futures has been fully covered by this week. In total, by looking at Figure 1 and Chart A16 together, we conclude that the short covering phase that started a month ago is very advanced” but, as JPM hedges “it is not yet fully completed.”

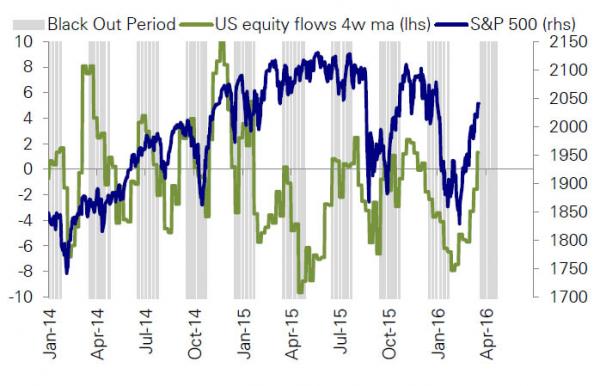

That may be, but a far bigger catalyst for fund flows in the coming days is the end of corporate buybacks for the next 6 weeks as DB warned on Saturday morning:

… a warning which is especially poignant when one considers that BofA’s “smart money” clients have now been selling stocks for 7 consecutive weeks, leading Bank of America to admit the bitter truth that “clients don’t believe the rally, continue to sell US stocks.”

So why would anyone else, unless pressured by a short squeeze, buy… especially when as the central banks explicitly admitted, absent more liquidity support the market is set to tumble. A short squeeze, which as JPM admits, is almost over.

Finally, a major driver of market upside this past week was Quad Witching, the S&P rebal and OpEx, which as JPM’s head quant Marko Kolanovic warned last week, may now catalyze near-term weakness: “in the next week, we could see some downward pressure as the impact of option hedging is reversed.Historically, we have found that the market develops positive momentum during the 3rd week of the month (when there is a call imbalance), and this often reverses during the 4th week of the month.”

But what may ultimately determine the direction of market may also be the most boring one of all: Q1 earnings, which begin in earnest on Momdah, and are expected to be the worst since the financial crisis.