It should not have come as a surprise to convention that the PCE component of GDP was not going to be leading economic gains. The monthly PCE series has been “better” in later 2014 than the winter, but that is far too narrow a context in which to draw any conclusions. No matter how you measure, American consumers continue to be unwilling or, more likely, unable to spend at levels consistent with policy reflections (clogged transmissions and all that).

There has been an curious stability in the spending rate that belies much of the deeper problems that are revealed quite easily by historical comparison.

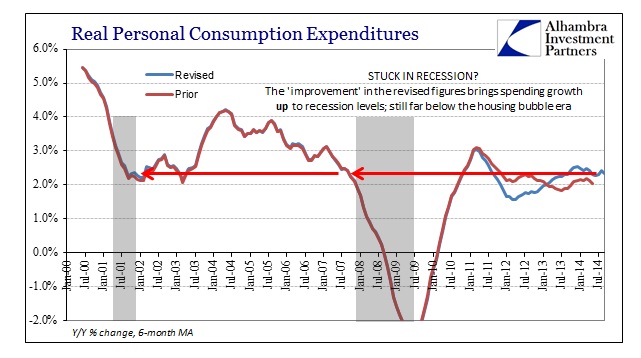

Even with July’s new benchmark, Real PCE continues to be stuck at levels that were consistent with the dot-com recession (and elongated cycle into housing bubble “recovery”). I think that reflection is quite revealing in the lengths at which the consumer remained disengaged and that it was only the last phase of the housing bubble, ultimate mania, that finally “pushed” consumers to increase spending. But even then consumers with the housing bubble as a “tailwind” were only spending at rates previously considered unsatisfactory.

So it took the better part of a few years to move away from the recessionary doldrums and due in almost full part to a bubble of epic proportions. The current elongated cycle has no such bubble, especially as the latest mini-bubble attempt via resident “fixed investment” has seemingly fizzled.

Given the domestic economy’s dependence on investment (including residential and business) and consumption, driving the world economy, the lack of “efficient” bubbles is a tremendous hindrance to monetary “transmission”; and the economy is actually fortunate for that (bigger bubbles means bigger crashes, what we have now will likely be bad enough).

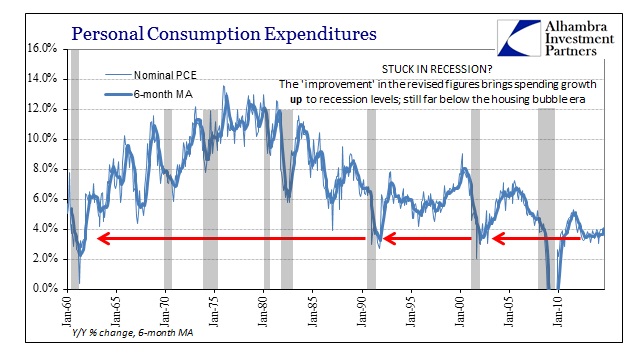

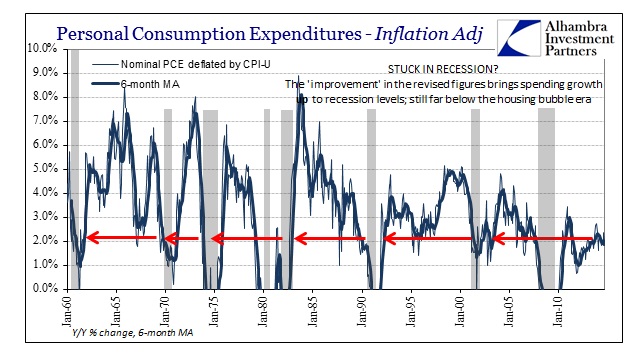

It really is that simple, in that without a debt-fueled substitute of requisite “strength” (the student loan bubble and auto loan bubbles, for example, are not nearly of “sufficient” magnitude nor, it appears, intensity to fully replicate the homes-as-ATM’s effect) there is nothing to drive spending above simple earned income. That is a huge problem given that income continues to follow upon a much lower trajectory than anything seen in the post-war era.

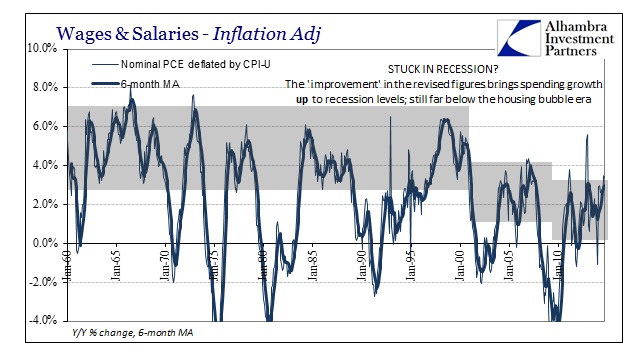

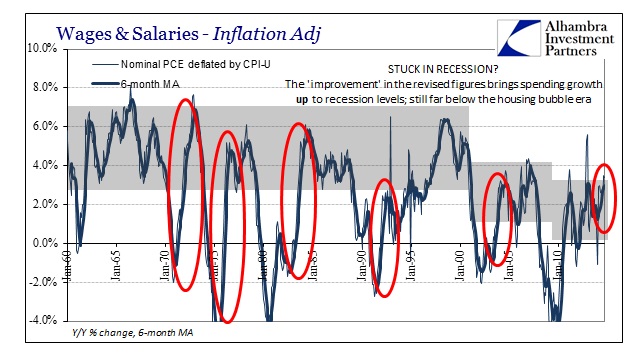

Even the “best jobs market in decades” has only managed a minor improvement in wages and salaries from even earlier this year. It is certainly nothing of the strength and intensity in earned income that marked true recoveries past (and not even favorable in comparison to the relatively lackluster housing bubble mania).

In fact, the latest “improvement” in wages and salaries looks far more like late cycle behavior than anything of a sustainable and accelerating, full recovery.

The effect overall on the cyclical intrusion upon the lack of bubble sustenance is obvious.

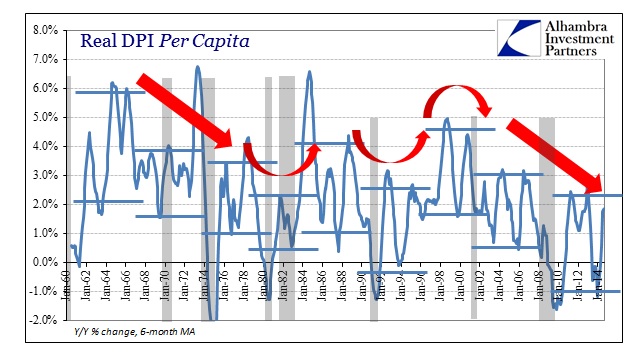

The range of sustained income growth has diminished in each cycle going back to the dot-com bubble era. Again, the housing bubble was “necessary” in that the economy would have likely remained in the 2000’s as it is now – deficient. That would more than suggest monetary experimentation with all these bubbles has been a total failure, as it did nothing to turn the US economy onto a sustainable path, instead only conjuring a short and artificial burst that contributed mightily to the current structural dysfunction. If the bubble “theory” worked, each successive bubble “cycle” would actually leave us better off; that hasn’t happened, in fact the exact opposite. Bubbles do not lead to growth, or even a “nudge” toward potential, but rather consist of permanent alterations amounting to anti-growth over the long run.

The last time we saw successive cycles diminish in actual and sustained income was the Great Inflation, “coincidentally” a period that was perhaps closest in monetary mismanagement to anything seen right now.

Therefore, the spending “problem” is an income problem that goes back to the age of asset bubble formation. Without one, the economy is stuck; which seems to confirm the Krugman/Summers/Yellen thesis of secular stagnation whereby the economy “needs” bubbles to actually grow. The problem of that is as I suggested above, in that bubbles themselves are not economic agents of growth, but anti-growth corrosion.