When the difference between your rhetoric and your actions is wide, inconsistency is pretty much axiomatic. However, Janet Yellen’s press conference was much more than that. I understand it’s a lot to charge blatant dishonesty, but almost everything she said is cow manure. And I make that assertion not on my own reading of the situation, but on hers.

The FOMC itself decided against exiting ZIRP in September, leaving little room for a policy shift in 2015. Does anyone remember March 2014 and her “six months” remark? In other words, for the FOMC to be so far off track there has to be some reason. Instead, she said this:

You know, I want to emphasize, domestic developments have been strong. We see domestic demand growing at a solid pace, the labor market continuing to improve. Of course, we will watch incoming data to confirm our expectation that that will continue. And we of course will watch global financial and economic developments.

Maybe she means “strong” in the same way she used to talk about the “strong dollar.” In that case, as has been once more proven, she was sorely mistaken. There is no possible way in which the “strong” or even “solid” should accompany her inaction. If the economy were truly that, then the rate hike would have been on schedule within that six-month ideal.

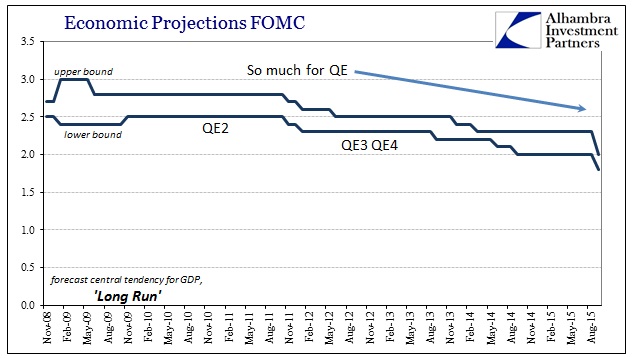

Instead, the FOMC has yet again marked down their view of the long run economic trajectory. There are myriad problems with this statistical presentation, mostly relating to the sophistry of “secular stagnation”, but whatever the root there is no way (NO WAY) a strong economy of any type would lead to such a disgrace. For almost the entire period where the FOMC has published these figures, the long run growth rate was thought near 3% GDP (which would include recessions, meaning that GDP in the recovery and growth stages should be significantly greater than that); as of the September 2015 update, the long run “tendency” is now between 1.8% and 2.0%. You cannot overstate what a massive economic failure that is and so the character of “strong” is not only blatantly misapplied its use here actually and seriously offends.

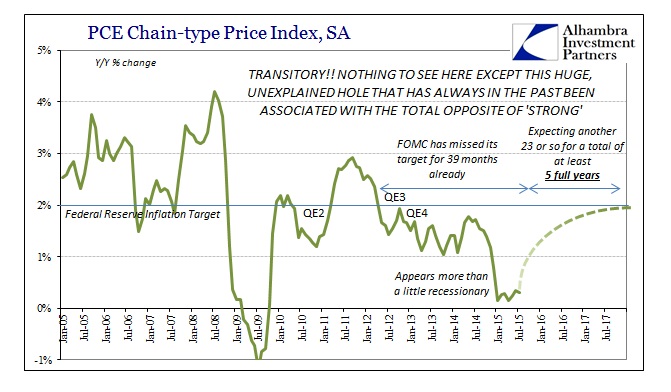

“Part” of that problem relates to “inflation” because it is increasingly clear that the Yellen FOMC doesn’t really know what to make of it. That uncertainty, by itself, is enough to disqualify again “strong.”

Now, we fully expect those further effects, like the earlier moves in the dollar and in oil prices to be transitory. But there is a little bit of downward pressure on inflation. And we would like to see some further developments. And this importantly could include – is likely to include further improvements in the labor market that would bolster our confidence that inflation will move back to 2 percent over the medium term.

The word “transitory”, like strong, loses all meaning in this context which makes it more potential prevarication than actual economic critique or forecast. The FOMC has set a 2% “inflation” target by which they expect their monetary voodoo to produce that figure in their preferred PCE deflator. Despite two additional QE’s, the PCE deflator hasn’t been at 2% since April 2012; 39 consecutive months of futility that directly contradicts “transitory.” Worse, by the Fed’s own updated modeled projections, 2015 is remarkably worse in this respect so that the ferbus and the rest of the GARCH/ARCH statistical conglomerations don’t foresee actual success (2%) until sometime in late 2017 or 2018!

That also flies directly in the face of what they were projecting only last June before the “unexpected” “strong dollar” hit them squarely in the mouth (which, incidentally, makes you wonder yet again just how useful these models truly are in actual, functional interpretation apart from this PR participation). In other words, last June they expected full success this year with 2% inflation, but now 2% has been put off until 2017 or really 2018. That alone would suggest “something” serious has occurred, to which the FOMC will give no answer:

Inflation has continued to run below our 2 percent objective, partly reflecting declines in energy and import prices.

My colleagues and I continue to expect that the effects of these factors on inflation will be transitory.

However, the recent additional decline in oil prices and further appreciation of the dollar mean that it will take a bit more time for these effects to fully dissipate. [emphasis added]

Again, provocative misdirection which is allowed to go unanswered. Yellen will talk all day long about oil prices and the dollar but right here she lets out the truth: “partly.” What she doesn’t say, and what is really the issue here, is what might that other “part” be? If oil prices form only one piece of the pressure suddenly and “unexpectedly” taking the economy so far off course, that means there is something else at least equally as intensive and delineating. The fact that she, nor anyone of the FOMC, will answer to that is all you need to know (and forms the true basis for why they won’t act).

Instead, they pretend as if there is nothing to it (notice, also, the almost exact repetition of the language; the rote hyperbole for the theater of the mainstream):

Inflation however has continued to run below our longer-run objective, partly reflecting declines in energy and import prices. While we still expect the downward pressure on inflation from these factors will fade over time, recent global economic and financial developments are likely to put further downward pressure on inflation in the near term. These developments may also restrain U.S. activity somewhat, but have not led at this point to a significant change in the committee’s outlook for the U.S. economy. [emphasis added]

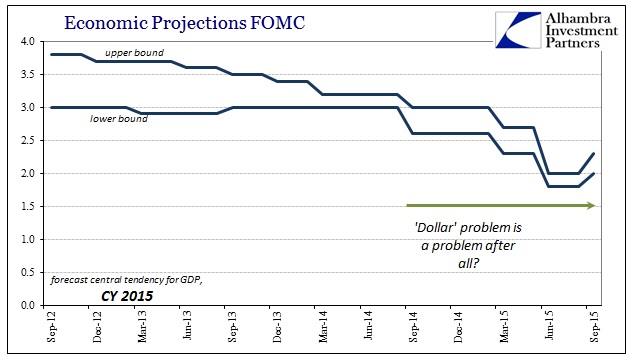

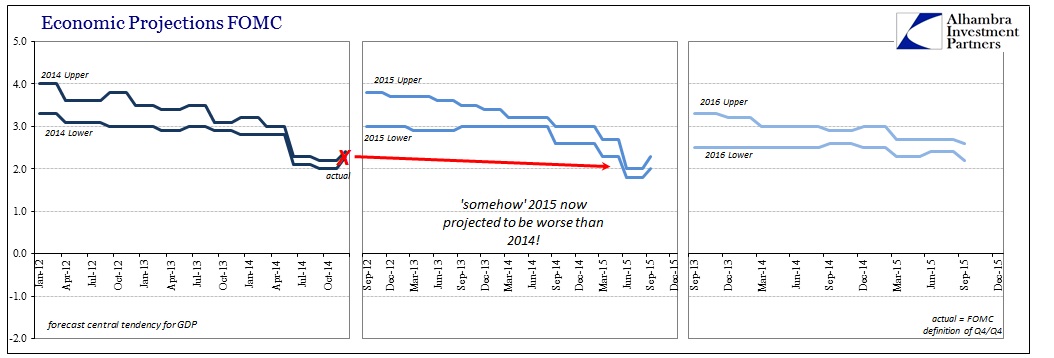

Though the Fed just raised its GDP outlook slightly for this year, there is no rational way to suggest that the events, including “transitory” oil prices and the dollar, have not significantly altered the FOMC’s own projections. By virtue of their own history, we should not expect them to incorporate such changes until long after their effects are known (so much for forecasts). In other words, despite the “dollar” and oil and all that, it wasn’t until earlier this year that they changed their modeled results after it became clear they were wrong last time in likewise ignoring them; so are we supposed to simply accept that they will be correct this time with renewed “dollar” turmoil? As late as last June, the models were still looking at 3% GDP or better for this year. Now, 2% will be a struggle as it has been year after year and the FOMC never saw that coming.

That includes even next year, as per usual the updates erode more distant future projections little by little each time with each new and nonconforming breakout of reality.

That leaves the FOMC even doubting its own rhetoric, as again the fact that they won’t act has had the effect of reducing the forecast probability of them getting there even in the near future.

In what is apparently a new addition to the published model updates, the Fed has run simulations on even the federal funds rate, concluding in June that the upper bound for the central tendency was almost 1% this year. I think what that shows, more than anything expedient, is that their models at least incorporate how much these economists think the “market” really believes their combined gibberish. To think that the recovery fantasy these past few years has largely been based on all this is simply revolting. Janet Yellen sat there yesterday and told the world that there was no economic problem while describing in intentional vagueness a serious economic problem. Does it really matter that they won’t call a spade a spade?