Search Results for: fracking

Stockman’s Contrarian Portfolio

By David Stockman and Dan Amoss, CFA

The following is our basic recommended portfolio designed to survive and thrive through a crash of today’s central bank-fueled bubble, which we fully anticipate. We call it Stockman’s Contrarian Portfolio and it’s meant to be fully invested and turn very slowly.

As we write in July 2017, the portfolio has not performed well on a trailing-twelve-month basis. In short: the bubble has continued to inflate.

But we remain confident that many of the portfolio holdings outlined below will perform well in the months and years ahead.

All it takes for a surge higher in Stockman’s Contrarian Portfolio is a break in the consensus view that central banks can endlessly create wealth, and that governments can allocate resources efficiently. Both sentiments are delusional.

When bubble psychology breaks, the downside in stock and bond markets will be breathtaking. Popular portfolios will be mauled. Many of the portfolio ideas presented below offer ways to mitigate damage to conventional investment portfolios. If you carefully position these shorts and inverse ETFs (and fully understand the risks involved with each) the ideas below could deliver substantial profits while the global financial bubble pops.

The portfolio stated simply:

25% Gold

10% Short S&P 500

15% Short Chinese A-Shares

10% Short Junk Bond Market

20% Select Stock Shorts

10% Short EM Stocks

10% Cash equivalent

Our essential investor modules will help you understand why we recommend each of these components. You can access each of those modules by clicking here and selecting the one you want. For example, you can read the module on why you should own gold if you’re curious why we recommend owning a 25% allocation and in the form we do.

Below, you’ll find the specific recommendation we’ve issued to execute each part of Stockman’s Contrarian Portfolio. At the end, we show screenshots of the permanent portfolio, back-tested the S&P 500’s peak set on 8/15/16. At this point, we believe the latter date marked the top of the massive bubble the Fed and other central banks have been inflating since the crisis bottom in March 2009.

We’ve also modeled a bear market scenario, and what it might mean for the portfolio. In preview it shows an excess return that beats the S&P 500 by 92%.

Please read on…

25% Gold

A good choice for any portfolio’s allocation to gold is the Sprott Physical Gold Trust (PHYS). The closest thing to owning physical gold in your brokerage account is holding shares of the Sprott Physical Gold Trust (PHYS: NYSE, TSX). Sprott provides a secure, liquid alternative for investors interested in holding physical gold bullion without the inconvenience of storage.

The Trust’s physical gold bullion is fully allocated and segregated in a secure third party storage location in Canada.

If conditions get bad enough, and there is a run on physical gold, we could see a default in the gold futures markets; futures contracts would get settled in cash U.S. dollars, even as the physical gold price keeps rising.… Login or Join Now To Read More

More Bad Economic News From The Oil Patch

The Crude Oil Price Recovery Is Over—–So Take The Money And Run

Why Trump Terrifies The Washington War Party

The candidacy of Donald J. Trump has upended American politics, and, indeed, has changed the political landscape in ways our liberal and conservative elites never expected and clearly abhor. He talks like an ordinary person, for one thing – a rarity in a realm where politicians routinely speak as if they are giving a speech […]

The post The Trump Challenge appeared first on Antiwar.com Original. Login or Join Now To Read More

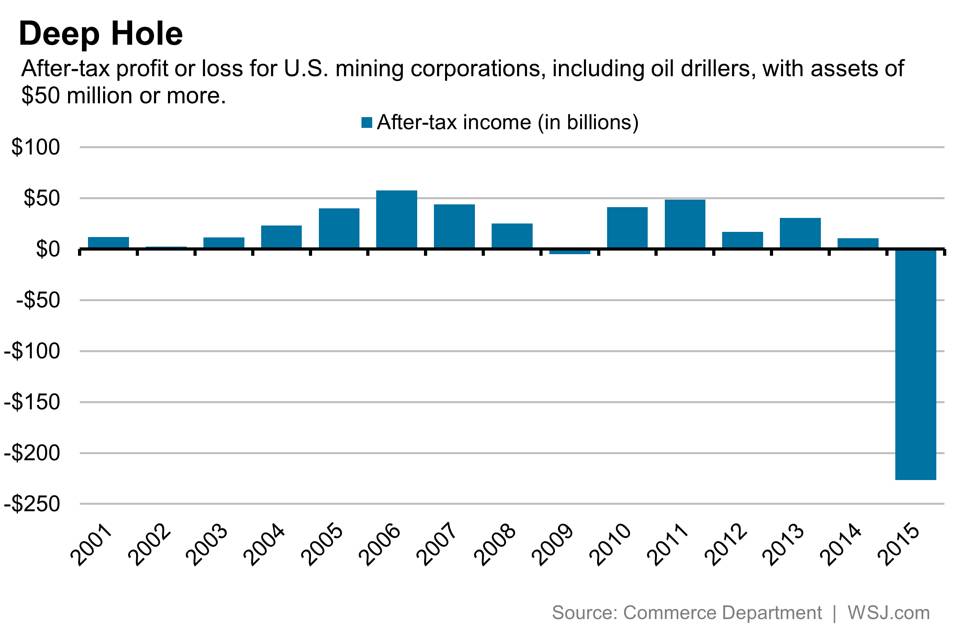

US Energy/Mining Losses In 2015 Wiped Out Eight Years Of Profits

Memo To Obama—–The US Economy Is Not “Pretty Darn Great”

Epic Central Bank Incompetence——-Take Profits, Take Cover

[David Stockman’s Note: This Wednesday, I’m streaming a live video broadcast from my home in Aspen, CO. I believe the most popular investment of the 21st century is about to implode. The collapse of this $3 trillion bubble could be the “final nail: in your retirement if you’re unprepared. But, if you invest in a discreet alternative investment right now your savings could be spared… and you could actually make up to 300% by July. That’s why I’m hosting this live video training from my home. I’ll lay out all of these details and more for you. All you need to do is RSVP right here before your spot is taken. There’s nothing to buy in order to get access — it’s free.]

Investors should not be fooled by the strong performance of stocks last week. Fundamentals have not changed and still present major headwinds to a market recovery.

Oil ended the week at $29.64 per barrel (BTI crude), which is still too low to save struggling fracking companies from the junk heap. The junk bond market backed away from 10% yields but is still a disaster zone. And major hedge funds are still nursing double digit losses.

What we saw was a classic short-covering rally inside a bear market that has further to run. Readers should not let their guards down and let themselves get fooled into diving back into dangerous waters. If they do, they will drown.

The Dow Jones Industrial Average gained 418 points (2.6%) to close at 16,391.39 last week, while the S&P 500 jumped 53 points (2.8%) to 1917.78. The Nasdaq Composite Index, home to the most speculative stocks, jumped by 4% to close at 4504.43. Investors should use rallies like this to lighten their stock exposures before the market takes another leg down.

Stocks were pushed higher by more idiotic comments from European and Japanese central bankers promising to make greater efforts to destroy their currencies and create inflation. Worse, they promise to do so regardless of whether they destabilize the global financial system in the process. Markets were also treated to more remarks from a variety of Federal Reserve officials sending mixed signals about their intentions to raise interest rates further.

The sheer incompetence of central banks is reaching such epic proportions that it is only a matter of time before markets lose whatever scraps of confidence they have left in this confederacy of dunces. Japan’s economy is falling apart again, Europe’s is not behind, and despite reports to the contrary the U.S. is going nowhere. Coming after over 600 interest rate reductions and $12 trillion of QE, it is about time for the world to declare further central bank efforts dead on arrival.

Take Profits – Then Take Cover

Last week, Bank of America confirmed work done over the past couple of years by other firms like Societe Generale and Goldman Sachs, showing that corporate balance sheets are in terrible shape. Corporations are more leveraged today than they were in 2007 before the financial crisis.… Login or Join Now To Read More